Deposit Guarantee Schemes data

The level of deposit protection in the EU is harmonised at €100,000 (or equivalent amount in the local currency), and this amount is guaranteed irrespective of the current level of available financial means of any Deposit Guarantee Scheme (DGS). All Member States extend this guarantee to their depositors. The amount of available financial means of a DGS has no impact on the level of this guarantee, and in any case, alternative means of financing the guarantee are available.

Enhanced protection for depositors

Since the last financial crisis, substantial work has been undertaken in the EU and internationally to strengthen the ability to respond to distress in the financial system. A new set of crisis management tools has been made available to the authorities. Such tools include "bank resolution" tools, which allow authorities to resolve failing banks without taxpayers' support.

Another important aspect of managing distress in the financial system is to ensure adequate protection for depositors. Depositors are protected by national DGSs which guarantee that deposits up to a certain level will always be repaid even if the bank holding them fails. The EU system of DGSs has been strengthened in recent years. In particular, the approach to funding the deposit guarantee in the EU has been strengthened and further harmonised. Under this new funding model, banks pay a levy every year into a national DGS fund, and that money remains available in case the DGS needs it to protect depositors if a bank fails.

Publication of DGS data

Every year, starting in 2016, the EBA collects data showing how much money is available in each DGS's fund (their "available financial means"). The EBA also collects information on the level of deposits that are protected by a DGS in each Member State (the level of "covered deposits"). Member States are required to raise available financial means into their DGS funds equal to at least 0.8% of covered deposits (although, exceptionally, the target level may be reduced to no lower than 0.5%). In the interest of transparency, and to further enhance policymaking in the area of deposit protection, the EBA has decided to make this data publicly available on its website.

While the level of deposit protection in the EU is harmonised at €100,000 (or equivalent amount in the local currency), in interpreting this data, it is important to recognise the diversity of Member States' funding mechanisms. The data does not allow a direct comparison of the adequacy of funding of each DGS in the EU, for a number of reasons which include:

(i) Different starting points: Some DGSs had different funding models prior to the new Deposit Guarantee Schemes Directive (DGSD), and are, therefore, in the process of building up their level of funding. Other DGSs already used this funding model, and in a number of cases had already raised funds in excess of the required minimum.

(ii) Different levels of recent DGS use: In recent years, some DGSs have used some or all of their funds. Therefore, in future years, contributions raised from banks to ensure that they meet the target level will increase. Having a lower level of funds available at the point in time when the data is provided does not necessarily mean that a Member State is falling behind in terms of pace of contributions. In case a DGS used more funds than it had available, it may temporarily be indebted to the source that provided bridge funding to the DGS. In addition, the data published by the EBA is point-in-time data as of 31 December, and, therefore, does not reflect any subsequent changes to the amount of covered deposits or available financial means in individual DGSs.

(iii) Different target levels: The target level for these funds can differ between Member States. In most instances, the target level for DGS funds is at least 0.8% of covered deposits, although Member States can also choose to have a higher target level. In addition, in specific cases, based on the DGSD, the adjusted target level may be as low as 0.5%, provided the European Commission has approved a lower target level.

(iv) Different calculation methods of contributions: all DGSs are required to raise risk-based contributions from their member institutions to reach the minimum target level and keep the funds at that level. However, when the amount of covered deposits increases over a year, the fund may temporarily fall below the required minimum level, despite the amount of ex-ante funds remaining at the same level – until the next round of contributions that is being raised from the industry. To address this temporal inconsistency, some DGSs raise funds more frequently than once a year and/or raise funds in excess of the minimum target level, which allows them to take into account a potential increase of covered deposits. Nonetheless, the DGSs may still underestimate such a change in any given year. Potential shortfalls in the size of the fund are small and do not have a significant impact on the protection offered to depositors.

(v) Alternative sources of DGS funding: Besides the funds currently being built up, Member States must ensure that DGSs have adequate alternative funding arrangements in place to enable them to meet any claims against them. These alternative funding arrangements can, for instance, include temporary State financing (which will ultimately be repaid by the DGS). DGSs can also raise extraordinary contributions from those institutions covered by the DGS where they do not have enough money immediately available in their fund. DGSs can also choose to establish borrowing arrangements between themselves, provided the respective national law provisions allow them to do so.

Interaction with bank resolution framework

The enhancements to the framework introduced in the DGSD complement other changes to the crisis management tools available to the authorities. For instance, deposits that enjoy DGS protection have also been given "super preferential" treatment in the bank creditor hierarchy. The same applies to DGSs, which protect these depositors. This means that in case of a bank failure, DGSs will be amongst the first creditors paid out from the estate of the failed institution, thereby limiting the impact of failures on DGS funding levels.

In addition, the bank resolution regime provides the authorities with an alternative mechanism to deal with a failing bank, called "bank resolution". The likelihood that a DGS is used has been reduced because of the existence of bank resolution tools. The existence of "bank resolution" means that some banks are likely to be dealt with using these new mechanisms, and thus limiting the need for DGS support. The existence of the bank resolution regime means that (i) DGSs are less likely to be used; and (ii) even if used, are likely to recover more of the money spent than it would have been the case in the past.

Illustrative funding path under DGSD

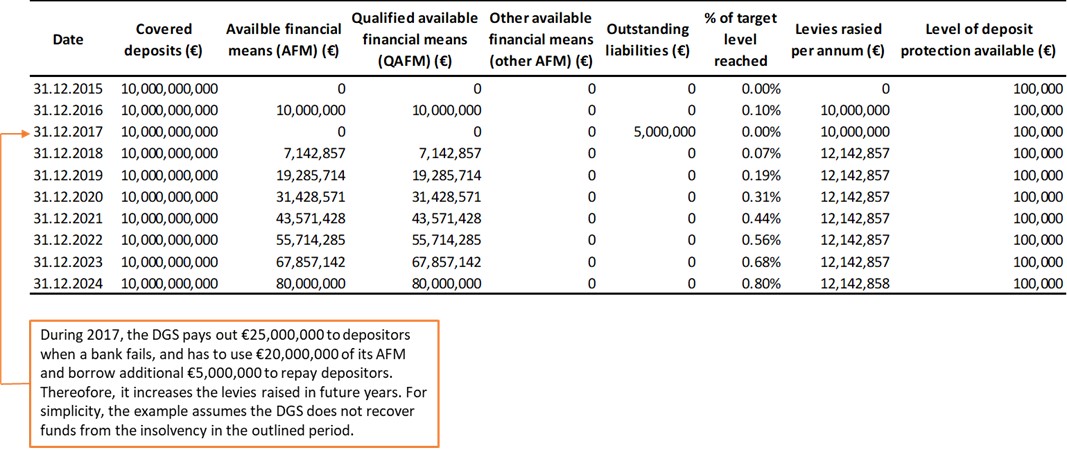

The DGSD requires Member States to raise funds into their DGSs equivalent to at least 0.8% (or in certain cases down to 0.5%) of covered deposits in that Member State. The DGSD, which was enacted in 2014, gives Member States until 3 July 2024 to raise this target level amount. This means that Member States which relied on a different funding model in the past will gradually increase the level of available financial means of their DGSs by raising levies from banks each year. In 2015, many Member States raised these levies for the first time, but others only began raising them in 2016.

In order to provide an illustrative example of how this build-up of DGS funding might work in practice, below is a worked example using a fictional Euro area Member State. This Member State has a single public DGS of which all of its banks are members. It had a different funding scheme for its DGS prior to 2014, and is currently in the process of transitioning to the new funding model. Therefore, its DGS is starting with available financial means of €0. It has a target level of 0.8% of covered deposits. The example also assumes that, following a bank failure in 2017, there is a significant depositor payout which reduces the available financial means of the DGS temporarily. This requires the Member State to increase the levies raised from its institutions in order to reach the target level of 0.8% of covered deposits. Finally, the example assumes that the level of covered deposits in the Member State remains stable for the duration of the transitional period.

It should also be noted that in all circumstances, and regardless of the current level of available financial means of the DGS, the level of deposit protection available to depositors remains €100,000.

AT

Name of DGS (English): Uniform Deposit Guarantee Schemes of Austria

Name of DGS (National Language(s)): Einlagensicherung Austria GmbH

Link to website of DGS: https://www.einlagensicherung.at/

Current target level for DGS: 0.8%

Name of DGS (English): Deposit Guarantee Scheme for the savings bank sector

Name of DGS (National Language(s)): Sparkassen-Haftungs GmbH

Link to website of DGS: www.s-haftung.at/

Current target level for DGS: 0.8%

Name of DGS (English): Deposit Guarantee Scheme for the Raiffeisen sector (started their activity on 29 November 2021)

Name of DGS (National Language(s)):Österreichische Raiffeisen-Sicherungseinrichtung eGen (ÖRS) (started their activity on 29 November 2021)

Link to website of DGS: www.raiffeisen-einlagensicherung.at

Current target level for DGS: 0.8%