Pillar 3 data hub

The Pillar 3 data hub (P3DH) will facilitate centralised access by all stakeholders to prudential data from all EEA institutions, promote transparency and market discipline in the EU banking sector, further contributing to the soundness of the European financial system.

The P3DH is also part of the overall EU strategy to promote transparency and market discipline. P3DH will be a source of data for the development of EU strategic projects such as the European Single Access Point (ESAP), an EU project aimed at centralizing the disclosure of public information in the EU single market.

The P3DH information will be available to the public from January 2026.

Pillar 3 data hub main objectives

Building the P3DH

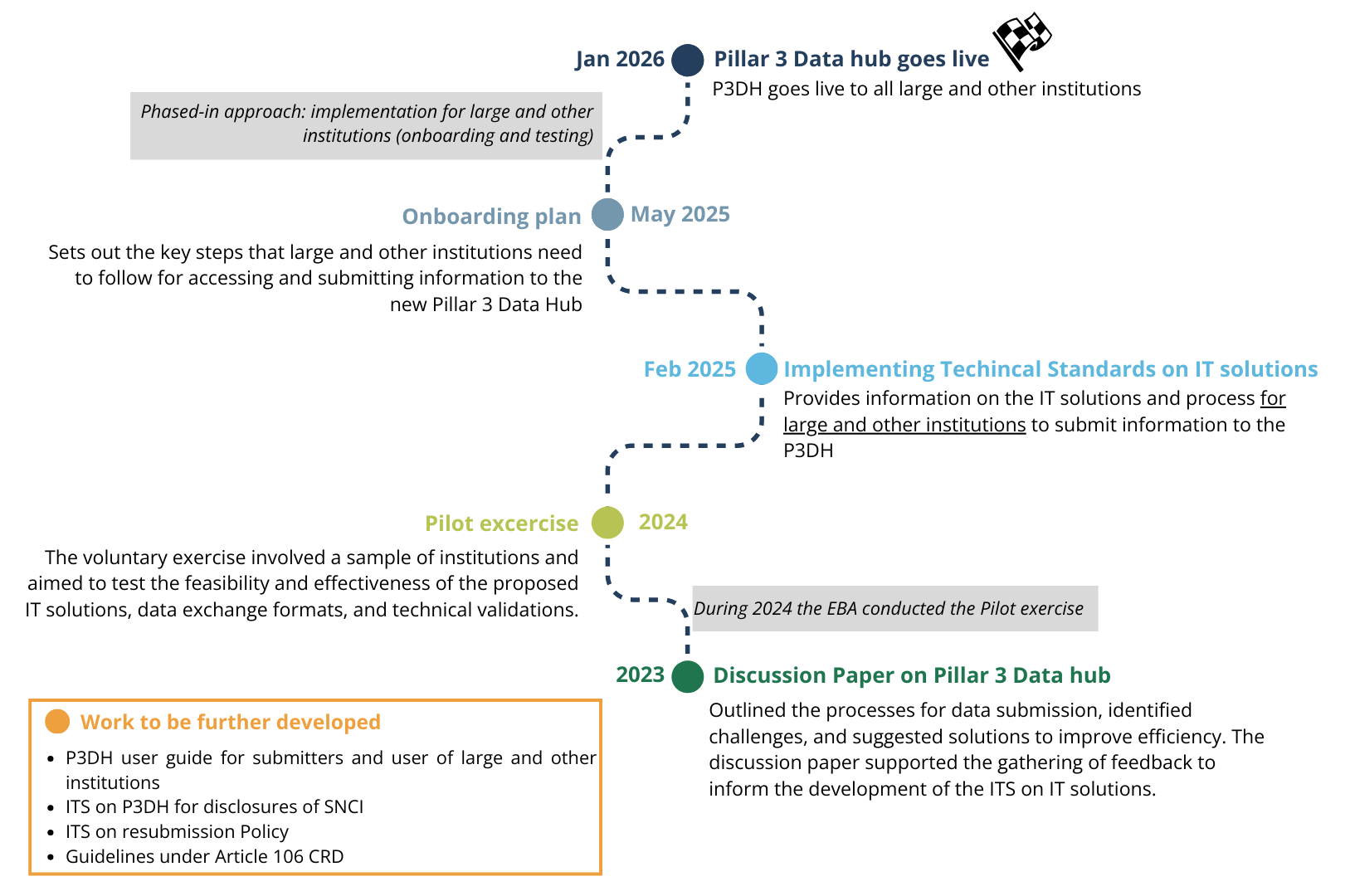

The figure below summarises the roadmap towards the implementation of the P3DH:

FAQS

A. First implementation of P3DH

The following institutions are in scope of the first implementation of the P3DH:

- Large institutions at the highest level of consolidation in the EEA (including stand-alone institutions and including financial holding companies and mixed financial holding companies supervised under Directive 2013/36/EU);

- Large subsidiaries, subject to the reduced number of Pillar 3 requirements as established under Article 13;

- Other institutions at the highest level of consolidation in the EEA (including stand-alone institutions).

The institutions to be onboarded have been identified by the EBA, together with the relevant Competent Authority, based on Articles 6 and 13 of the CRR and the master data available in the EBA system.

Pursuant to Articles 6 and 13 of the CRR, institutions classified as “other” under the CRR that are not at the highest level of consolidation in the EEA are not required to comply with the obligations set out in Part Eight of the CRR, either at individual or consolidated level.

The classification of the different institutions follows the categorization / definitions under Article 4 of the CRR (large institution; small and non-complex institution; other institution for those that do not fall in any of the other categories).

Published on 22/05/2025

In case an institution believes being in scope of the first implementation but has not received the EBA letter launching the onboarding process, it shall contact the EBA via the helpdesk support.

Published on 22/05/2025

The first implementation of the P3DH will solely consider large and other institutions required to disclose Pillar 3 information under the CRR provisions. Institutions disclosing Pillar 3 information on a purely voluntary basis will not be considered at this stage. Following the first implementation, the EBA will reassess how these specific cases could be treated and whether the respective disclosures could be done via the P3DH.

Published on 22/05/2025

Voluntary Pillar 3 disclosures in addition to the minimum requirements under the CRR (i.e., institutions required to disclosure Pillar 3 information) will be accepted in the P3DH. This refers to Pillar 3 quantitative and qualitative information. The submission of Pillar 3 information prepared on a voluntary basis shall follow the general rules for the mandatory submission of information (i.e., quantitative information to be submitted in XBRL-csv format and included in the PDF report; qualitative information to be submitted in the PDF report). In case of additional voluntary rows or columns to the templates developed by the EBA, it would not be possible to include it in the XBRL-csv files. However, this information can still be provided in the PDF report ideally accompanied by an explanation on the reasons justifying the relevance of this information.

Published on 22/05/2025 | Last updated on 25 July 2025

The onboarding timeline is fully aligned with the final draft ITS on IT solutions as transitional provisions[1] were put in place for reference dates June, September and December 2025.

Published on 22/05/2025

[1] Article 9 of the final draft ITS on IT solutions submitted to the European Commission for adoption.

During the transitional period established in the final draft ITS (reference dates June, September and December 2025), institutions should keep complying with their disclosure obligations as they were doing until now without delay. The later submission of the Pillar 3 information corresponding to these reference dates to the P3DH will take place according to the timeline spelled out in this document, and without causing any delay in the compliance with Pillar 3 disclosure obligations during 2025.

Published on 22/05/2025

Under the template included in the final draft ITS submitted to the European Commission, three contact persons are required to be nominated. This template is also being used under step 3 of the onboarding plan. While it is entirely up to the institution to decide who the three contact persons are, the email address to be provided needs to relate to one of the email domains in use by the institution. Email addresses belonging to domains from external providers / companies will not be accepted in the onboarding process.

Published on 25/07/2025

As announced in the P3DH onboarding plan, the onboarding process will be conducted by the EBA in different phases, by groups of institutions (A, B, C and D). In accordance with the presented timeline, the onboarding of groups A and B should occur by the end of September. While this will be case for some institutions, it will not necessarily be valid to all institutions in groups A and B. The login invite will be sent once the accounts are set up by the EBA for new users to access EUCLID. In case the user of an institution included in groups A and B does not receive the respective invite by the end of September, it means that the new user account is still being created by the EBA, and the respective invite will be sent at a later stage. To recall, the phased-in approach followed by the EBA in this process is planned to be concluded by the end of November 2025.

Published on 30/09/2025

B. Submission of Pillar 3 reports by institutions

Once the onboarding process is completed and the institution is under conditions to submit the information to the EBA, the reports for the past reference dates covered by the transitional arrangements shall be submitted to the EBA for publication in the data hub. While no limit date is set for this submission, reports already made public by the institution are expected to be submitted without undue delay and reports not yet published should follow the timeline envisaged for the steady state.

Published on 22/05/2025

The submission dates of information to the EBA shall follow the specifications under Article 4 of the final draft ITS, i.e. required information shall be provided to the EBA on the same day on which institutions publish their financial statements or financial reports for the corresponding period, where applicable, or as soon as possible thereafter. Information required under Article 450 of the CRR shall be submitted separately from the remaining information no later than two months after the date on which institutions publish their financial statements for the corresponding year. Information on contact persons shall be submitted annually, by 31 January.

While no mandatory or indicative limit dates for submission are put in place, there are some expectations as regards the submission of information to the EBA, as indicated in the final report on the final draft ITS:

- Year-end Pillar 3 reports (reference date December): by end-June, with the exception of the remuneration policies information that would be expected by end-August;

- Year-end Pillar 3 reports (reference date different from December): by “reference date + 6 months”, with the exception of the remuneration policies information that would be expected by the end of “reference date + 8 months”;

- Quarterly Pillar 3 reports: by “reference date + 4 months”;

- Semi-annual Pillar 3 reports: by “reference date + 4 months”.

Published on 22/05/2025

In order to support institutions and users of information to navigate through the list of Pillar 3 disclosure requirements and identify their disclosure obligations, a comprehensive file[1] was published by the EBA last year containing the following information:

- List of templates / tables, with indication of the respective relevant Article under the CRR;

- Disclosure obligations by type of institution, including the templates that they need to disclose and the frequency of required disclosures for: large institutions (listed and G-SII); large institutions (listed and no G-SII); large institutions (not listed); other institutions (listed); other institutions (not listed); SNCIs (listed); and SNCIs (not listed).

In addition to this, the EBA publishes regularly the technical package to facilitate the implementation by the reporting entities. Pillar 3 templates are included in the technical package 4.1. While the final version of this package is expected to be published by end May / beginning June, a draft version can be consulted here.

Published on 22/05/2025

The ITS on IT solutions requires institutions to submit to the EBA the information on contact persons as specified in the template included in the Annex to the ITS. The template includes a functional e-mail aimed at ensuring an effective and efficient communication between the EBA and institutions in scope of P3DH beyond the bilateral communication with the contact persons specified in the same template. Institutions shall provide the information on the functional email once the P3DH is set up, as required in the ITS, but also in the collection of information before the first implementation of the data hub, as explained in step 3 of section B of the onboarding plan. Institutions shall embed in their internal processes regarding the P3DH the use of the functional e-mail, including checking any communications from the EBA received in that email.

Published on 22/05/2025

Article 25(4) of the Commission Implementing Regulation (EU) 2024/3172

Article 25(4) of the ITS on disclosures sets out the following requirements regarding the precision of numerical values in disclosure templates:

‘4. Numeric values shall be presented as follows:

(a) quantitative monetary data shall be disclosed using a minimum precision equivalent to millions of units;

(b) quantitative data disclosed as ‘percentage’ shall be expressed as per unit with a minimum precision equivalent to four decimals.’

These requirements define the accuracy to be applied when interpreting reported values. The precision information is communicated via decimal parameter value. In the csv reporting package (in file parameters.csv), decimalsMonetary = -6 means accuracy to millions; while decimalsMonetary = -3, means accuracy to thousands.

Example:

Where a monetary value is reported as 11,985,000.00 EUR with the attribute decimals = -6, it means that value should be considered with million level precision.

Submission in XBRL formats

Quantitative monetary data must be reported in XBRL-CSV files in units of the relevant currency. Institutions shall report all monetary values in units, not in thousands or millions.

The minimum precision allowed for quantitative monetary data reported under the Pillar 3 ITS is equivalent to millions of units (that is, decimal setting>=-6 as per the filing rules). These means that in general monetary values must not be truncated to millions (or below millions e.g. to thousands) when reporting but may be rounded (i.e. to the nearest value) to millions (or below millions, e.g. to thousands) and be reported in currency units.

Example: where the monetary value is USD 11,985,132.00. It may be reported as follows:

> Report the value with no rounding: USD 11,985,132.00 (correct)

> Report rounding the value to millions: USD 12,000,000.00 (correct)

> Report rounding the value to thousands: USD 11,985,000.00 (correct)

> Never to report: USD 12 million (incorrect!)

Institutions may report monetary amounts in Euros and/or other currency. The example included above is in US dollars (USD) but the same approach would apply for Euros or other currencies. Irrespective of the currency used, monetary amounts included in the XBRL file shall always be reported in units.

Publication on the website

Institutions must submit XBRL data in units.

However, institutions may continue to present values in their accompanying PDF documents using the same units they have been using when preparing their Pillar 3 reports.

For publication in the P3DH, the EBA:

does not perform rounding,

does not recalculate values.

Figures displayed on the P3DH are shown exactly as reported, extracted directly from the XBRL files.

Updated on 16/12/2025