Implementing Technical Standards on reporting and disclosures for investment firms

- Status: Final draft RTS/ITS adopted by the EBA and submitted to the European Commission

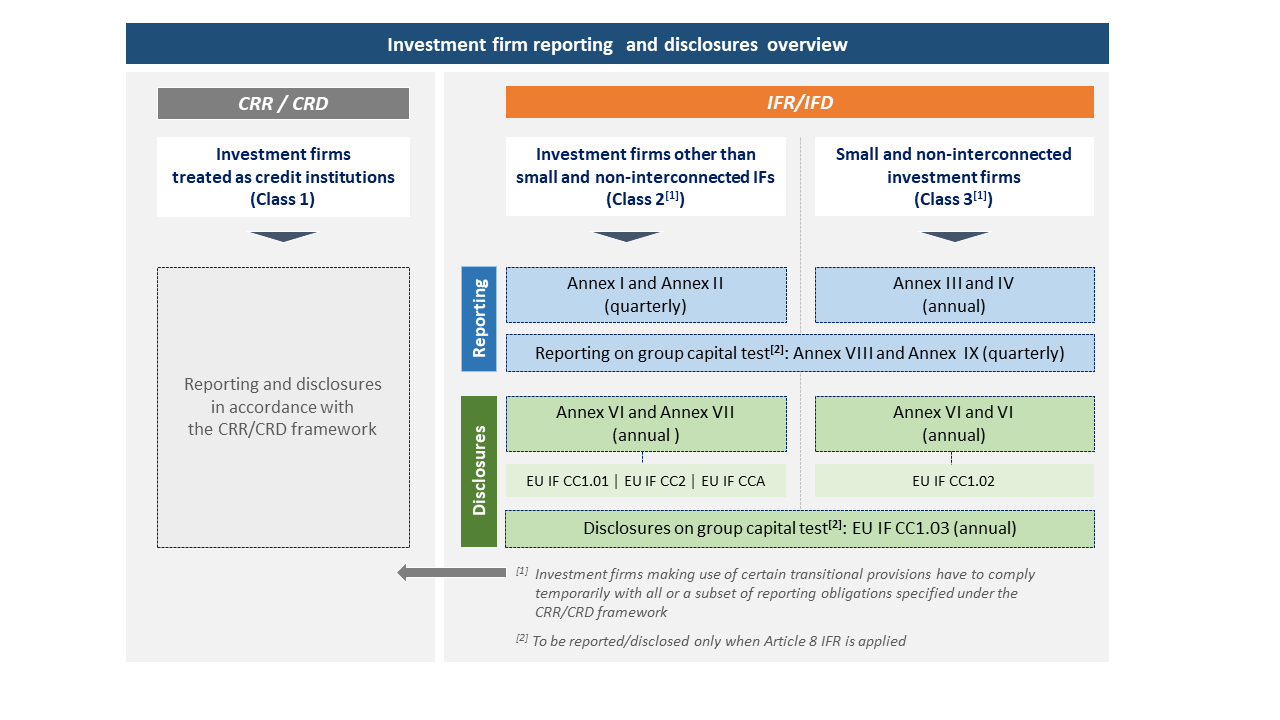

These draft Technical Standards on reporting requirements and disclosures include draft Implementing Technical Standards (ITS) on the levels of capital, concentration risk, liquidity, the level of activities as well as disclosure of own funds; and draft Regulatory Technical Standards (RTS) specifying the information that investment firms have to provide in order to enable the monitoring of the thresholds that determine whether an investment firm has to apply for authorisation as credit institution.