Transparency and Pillar 3

This page presents the policy work undertaken by the EBA to promote transparency and enhanced public disclosures by financial institutions in order to reinforce market discipline.

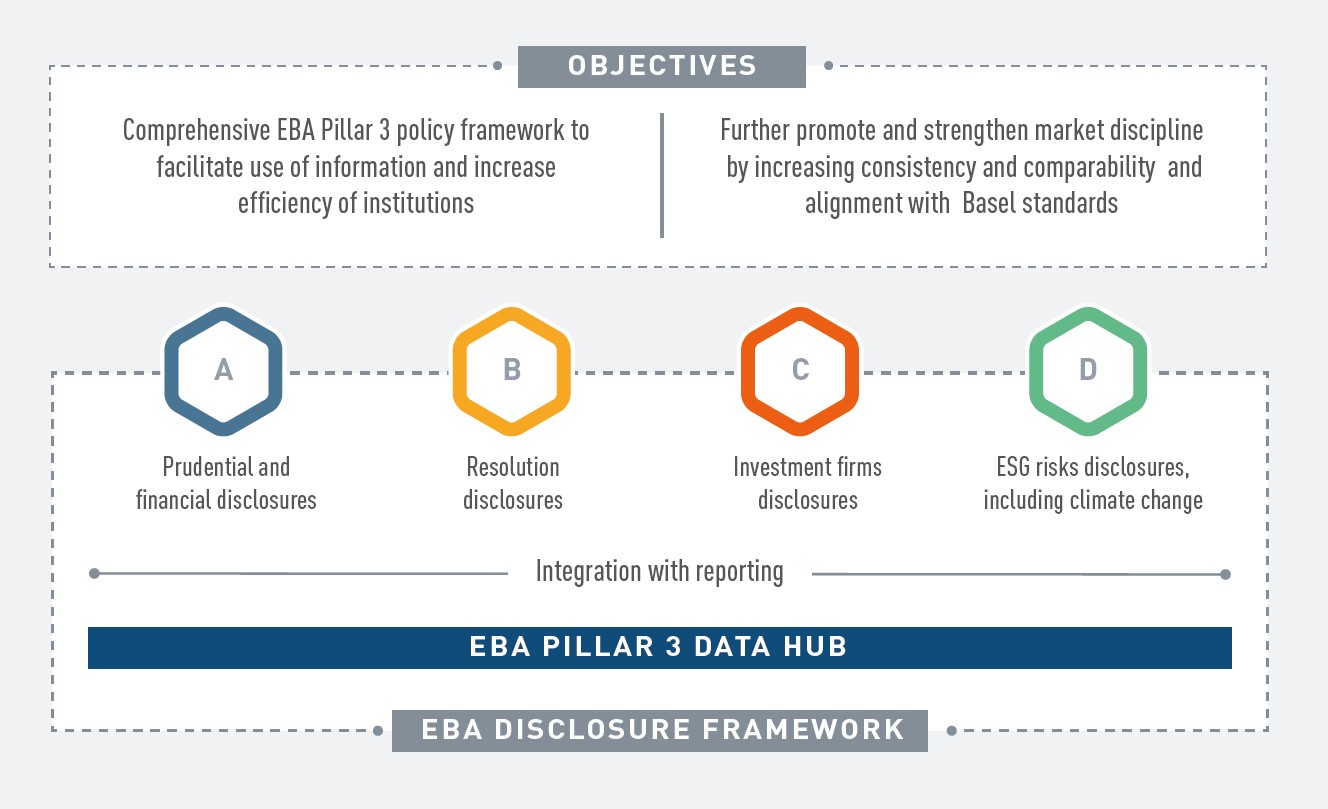

Following the recent updates to the regulatory frameworks for credit institutions and investment firms, and the publication in 2018 of the European Commission’s action plan on sustainable finance, the EBA is implementing a new policy strategy on institutions’ Pillar 3 disclosures that seeks to increase efficiency of institutions’ disclosures and reinforce market discipline by developing a comprehensive framework with consistent and comparable disclosures. In addition, the EBA aims to promote transparency on Environmental, Social or Governance (ESG) risks, encouraging institutions to strengthen their management of these risks and promoting awareness of their key role in the transition to a green economy.

- Overview of P3 templates and related-IT solutions (instructions) after ITS adoption |IT solutions| ITS adopted including P3 templates in all EU languages | IT solutions (instructions) after ITS adoption in all EU languages

- Pillar 3 data hub

- Roadmap on the implementation of the EU Banking Package

- BCBS Pillar 3 framework

- EBA risk reduction package roadmaps

- EBA supervisory reporting framework

- EBA Transparency exercise

- EBA action plan on sustainable finance

- EBA roadmap on investment firms

- Mapping tool | Version with track changes (version 4.2 – published on 4 November 2025)

- Mapping tool | Version with track changes (version 4.1 – published on 22 May 2025)

- Mapping tool (version 3.0 -changes from May 2022)

- Signposting tool

- Factsheet - ESG disclosures | Infographic - ESG disclosures for financial institutions | Infographic - Summary of ESG disclosures Pillar 3