Bilateral cooperation and equivalence

The EBA strengthens regulatory and supervisory cooperation with a wide range of non-EU jurisdictions through engagements with their regulators, supervisors and other relevant stakeholders. It performs equivalence assessments of their prudential framework and monitors regulatory developments to assess impacts on the EU's banking sector.

The EBA also fosters cooperation through the negotiation of Memoranda of Understanding and takes part in regulatory dialogues with the EU’s partners, including the USA, the UK, Japan, China, Canada, and Switzerland.

For any questions on international cooperation and equivalence, please reach out to the following contact Equivalence@eba.europa.eu.

Cooperation and equivalence of non-EU jurisdictions

Equivalence aims at facilitating cross-border financial activities by ensuring that non-EU jurisdictions follow standards similar to that of the EU’s. The EBA fosters equivalence in two different areas:

Confidentiality and professional secrecy equivalence

The EBA verifies whether a non-EU authority is subject to a confidentiality and professional secrecy regime in line with the EU. It assesses four principles linked to the use and disclosure of confidential information by the authority, allowing it to participate to supervisory colleges in the EU, amongst other things.

Equivalent authorities are listed in the EBA Guidelines.

For more information on the EBA’s assessment, please consult our handbook on the confidentiality and professional secrecy.

The ESAs are also jointly assessing the confidentiality and professional secrecy regime of non-EU authorities with regards to activities covered by the Digital Operational Resilience Act. Please consult the DORA Oversight page.

Regulatory and supervisory framework equivalence

The EU may deem that a non-EU jurisdiction has a regulatory and supervisory framework equivalent to the EU. An equivalence in that field leads to preferential capital treatment for exposures to non-EU entities, including investment firms and credit institutions.

Prior to adopting an equivalence decision, the Commission may request the opinion and technical assessment from the EBA.

The EBA assessment methodology is built on of two sets of questionnaires. First, the assessed jurisdiction will be invited to reply to the pre-screening questionnaire designed to provide an overview of its prudential framework. After processing the answers, the EBA may invite the jurisdiction to fill out the in-depth questionnaire. This second document covers 16 thematic sections based on CRR/D. It seeks to verify that EU prudential provisions are matched with equivalent rules in the non-EU jurisdiction.

Non-EU jurisdictions deemed equivalent are listed on the European Commission’s website.

Monitoring of regulatory and supervisory equivalence decision

The EBA is mandated to assist the EC in preparing equivalence decisions and to monitor existing equivalence decisions in non-EU jurisdictions by looking at regulatory and supervisory developments and their impact for financial stability, market integrity, investor protection and the functioning of the internal market.

As part of its monitoring role, the EBA oversees relevant regulatory and supervisory developments, enforcement practices and market trends in non-EU jurisdictions that benefit from regulatory equivalence. The findings of the EBA monitoring activities of equivalent jurisdictions are summarised in a confidential report to the European Parliament, the Council, the European Commission and the other European Supervisory Authorities.

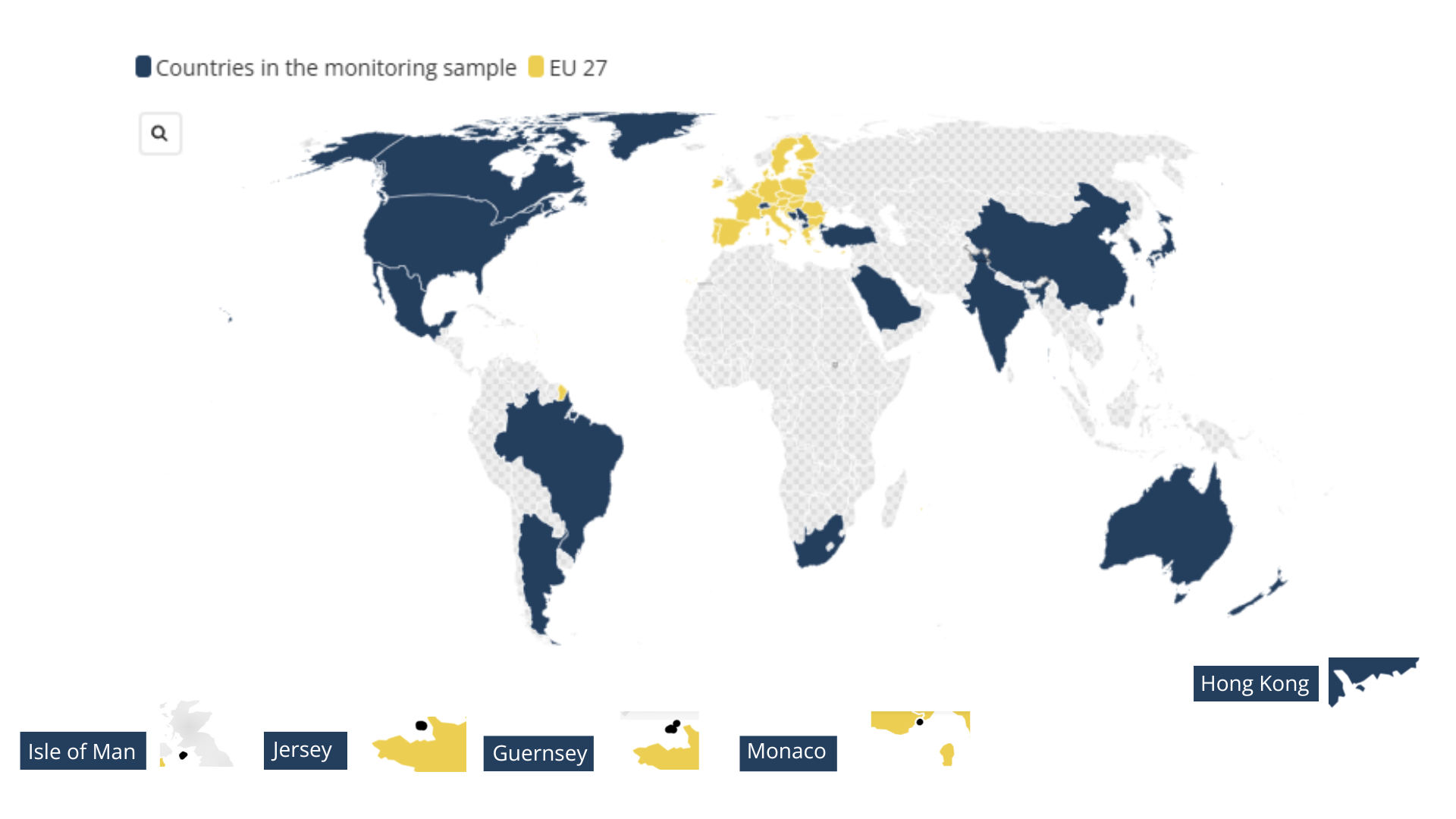

Geographical overview CRR EU equivalence decisions

Memoranda of Understanding

The EBA also relies on Memoranda of Understanding (MoUs) in its relations with relevant stakeholders. MoUs allow for structured and tailored collaboration with non-EU authorities and partners.

The MoUs are published hereafter, subject to consent by the partner authority:

14 January 2026 | MoU with UK Financial Authorities for oversight cooperation under Digital Operational Resilience Act (DORA) and the Critical Third Party (CTP) frameworks MoU accessible here |

27 June 2025 | MoU between the Authority for Anti-Money Laundering and Countering the Financing of Terrorism (AMLA) and the EBA MoU accessible here |

04 June 2024 | MoU between the EBA, the European Insurance and Occupational Pensions Authority (EIOPA), the European Securities and Markets Authority (ESMA), and the European Union Agency on Cybersecurity (ENISA) MoU accessible here |

18 March 2024 | MoU on the establishment of the Joint Bank Reporting Committee between the European Central Bank and the EBA MoU accessible here |

29 October 2021 | MoU on Cooperation and Information Exchange between the EBA and the New York State Department of Financial Service MoU accessible here |

2020 | MoU between the EBA, the Bank of England and the Financial Conduct Authority (FCA) MoU accessible here |

15 September 2017 | Framework Cooperation Arrangement between EBA and the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, the Office of the Comptroller of the Currency, the U.S. Securities and Exchange Commission, and the New York State Department of Financial Services Framework Cooperation Agreement accessible here |

23 October 2015 | Memorandum of Cooperation between the EBA and the Banking Agency of the Federation of Bosnia and Herzegovina, the Banking Agency of the Republic of Srpska, the National Bank of the Republic of Macedonia, the Central Bank of Montenegro, the National Bank of Serbia, and the Bank of Albania MoC accessible here |

23 October 2015 | The Multilateral Memorandum of Understanding (MoU) between the European Supervisory Authorities (ESAs) and EFTA (European Free Trade Association) MoU accessible here |