The EBA's supervisory role under MiCA

Under the EU Markets in Crypto-Assets Regulation (MiCA, Regulation 2023/1114), the European Banking Authority (EBA) regularly assesses issuers of asset-referenced tokens (ARTs) and electronic money tokens (EMTs) to determine whether they meet the criteria for “significance”.

When an ART or EMT is classified as significant, the EBA assumes direct supervisory responsibilities and tasks. Specific additional requirements apply to significant ARTs and EMTs to address the greater risks they may pose.

The Crypto Asset Standing Committee (CASC) supports the EBA in line with its MiCA mandate.

How significance is assessed

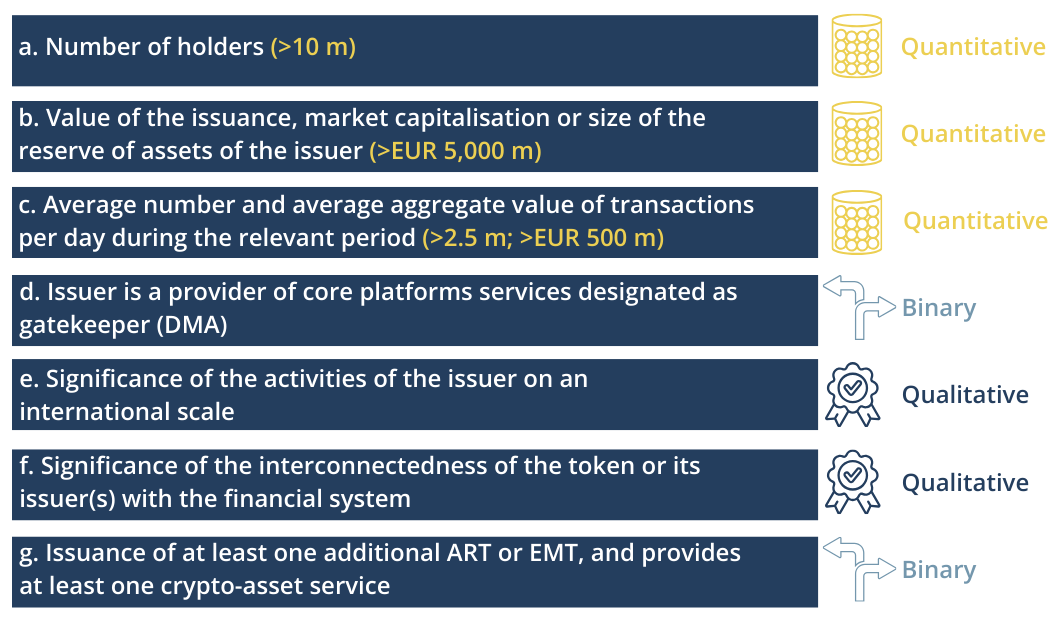

An ART or EMT is deemed significant if at least three of the following criteria are met:

MiCA establishes specific thresholds for the three quantitative criteria and Commission Delegated Regulation (EU) 2024/1506 (link) specifies the indicators to be considered for the two qualitative criteria.

What happens when an ART or EMT is classified as significant?

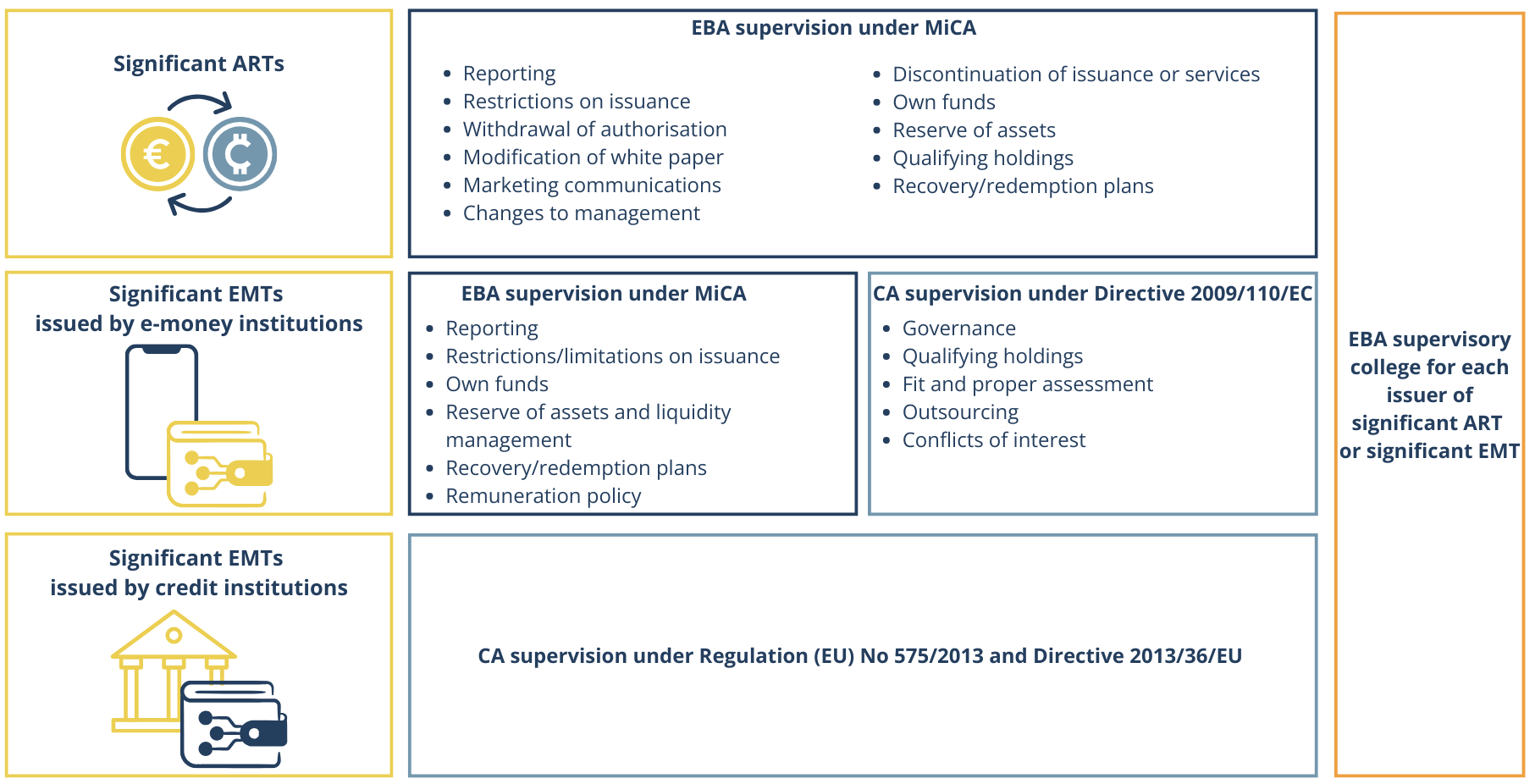

- Significant ARTs: the EBA takes over direct supervision of issuers at the EU level from the home competent authority (CA).

- Significant EMTs (issued by electronic money institutions): the EBA and the CA supervise jointly, with the EBA supervising the compliance by the issuer with the additional requirements to significant EMTs, mainly on liquidity and own funds.

- Supervisory colleges: for each issuer of significant ART and EMT, the EBA establishes, manages and chairs a supervisory college. Supervisory colleges facilitate the cooperation and exchange of information among their members and issue non-binding opinions on specific matters set out in MiCA.

The EBA works closely with the other relevant CAs to ensure coordinated and consistent supervision.

The EBA supervisory responsibilities and tasks

The EBA’s supervisory focus areas

Each year the CASC agrees on priority areas for supervision of ARTs and EMTs. For 2026, the focus is on:

The EBA’s ongoing supervisory activities

Onsite-offsite supervisory activities are planned every year on specific issuers under the EBA supervision.

Off-site supervision refers to ongoing supervisory activities (day-to-day supervision), mainly conducted at the EBA’s premises. It is oriented to proactively identify supervised entities that might not be in compliance with the applicable requirements. It also feeds into the risk analysis of the supervised entities for future supervisory actions.

On-site supervision refers to on-site inspections at issuers’ business premises. This complements off-site supervision and targets specific items or risk areas in depth.

Data reporting obligations by issuers and crypto asset service providers under MiCA

Without affecting the EBA’s ability to request any information it needs to carry out its supervisory tasks, Article 22 of MiCA sets out default reporting obligations, under certain conditions, for issuers and crypto-assets service providers. These obligations support risk monitoring related to issuance activity, the assessment of whether an ART or EMT is significant, and their coordinated supervision. Harmonised templates and instructions are set out in the Commission Implementing Regulation (EU) 2024/2902 and the EBA Guidelines EBA/GL/2024/16. Specific details on relevant methodologies to be used for transactions associated with uses of the tokens as a means of exchange are included in the Commission Delegated Regulation (EU) 2025/298.

These reporting obligations follow fixed quarterly reference and remittance dates. Crypto-asset service providers (CASPs) are required to submit relevant data to issuers and issuers are required to submit their reports directly to the EBA through its shared technical platform. Data are then made available to the relevant CAs, according to their tasks under MiCA.

Quarterly reporting and remittance dates for CASPs and issuers

| Reporting Quarter | Reference Date | Remittance date CASP | Remittance date issuer |

| Q1 (Jan-Mar) | 31 March | 21 April | 12 May |

| Q2 (Apr-Jun) | 30 June | 21 July | 11 August |

| Q3 (Jul-Sep) | 30 September | 21 October | 11 November |

| Q4 (Oct-Dec) | 31 December | 21 January | 11 February |

Daily reporting for CASPS

CASPs report to the issuers data on the tokens held every day by close of business.

Notifications from Competent Authorities under MiCA

CAs have specific obligations to notify the EBA under MiCA. Currently, the EBA receives the following types of notifications from CAs:

| Legal basis | Notification description |

| Art 65 MiCA | Notification of cross-border provision of services |

| Art 93 MiCA | Notification of MiCA competent authorities |

| Art 99 MiCA | Notification of laws, regulations and administrative provisions |

| Art 108 MiCA | Notification of complaints-handling procedures |

| Art 111 MiCA | Notification of rules for administrative penalties |

| Art 2 Commission Implementing Regulation (EU) 2024/2494 | Notification of contact points for the purpose of cooperating and exchanging information under Art 96 MiCA |

For further details on the official notification channel and notification template please refer to the Information regarding notification requirements for Member States under MiCA.