List of figures

Table of contents / search

Table of contents

List of figures

Macroeconomic environment and market sentiment

Asset side

Liabilities: funding and liquidity

Capital and risk-weighted assets

Profitability

Operational risks and resilience

Special topic – CRE-related risks

Special topic –EU/EEA banks’ interconnections with NBFIs and private credit

Policy implications and measures

Annex I: Samples of banks

Search

List of Figures

Source: IMF, May 2024

Source: IMF, May 2024

Source: Commission Forecasts, May 2024

Source: Bloomberg

Source: Bloomberg

Source: ECB

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA Risk Assessment Questionnaire

Source: EBA supervisory reporting data (funding plan data)

Source: EBA supervisory reporting data (funding plan data)

Source: EBA supervisory reporting data (funding plan data)

Source: EBA supervisory reporting data (funding plan data)

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA Risk Assessment Questionnaire

Source: Dealogic, EBA calculations

Source: IHS Markit*

Source: Reporting on MREL and TLAC

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data (funding plan data)

Source: EBA supervisory reporting data (funding plan data)

Source: EBA supervisory reporting data (funding plan data)

Source: EBA supervisory reporting data (funding plan data)

Source: EBA supervisory reporting data (funding plan data)

Source: EBA supervisory reporting data (funding plan data)

Source: EBA supervisory reporting data (funding plan data)

Source: Dealogic

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA Risk Assessment Questionnaire

Source: EBA Risk Assessment Questionnaire

Source: EBA supervisory reporting data (funding plan data)

Source: EBA supervisory reporting data (funding plan data)

Source: EBA supervisory reporting data (funding plan data)

Source: EBA supervisory reporting data (funding plan data)

Source: EBA supervisory reporting data (funding plan data)

Source: EBA Risk Assessment Questionnaire

Source: EBA Risk Assessment Questionnaire

Source: EuReCA (EBA’s AML/CFT database)

Source: EuReCA (EBA’s AML/CFT database)

Source: EuReCA (EBA’s AML/CFT database)

Source: EuReCA (EBA’s AML/CFT database)

Source: Green Street

Source: Green Street

Source: BIS Data Portal, ECB Statistical Datawarehouse (SDW), EBA calculations

Source: BIS Data Portal, ECB Statistical Datawarehouse (SDW), EBA calculations

Source: S&P Capital IQ

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA Risk Assessment Questionnaire

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA Risk Assessment Questionnaire

Source: EBA supervisory reporting data

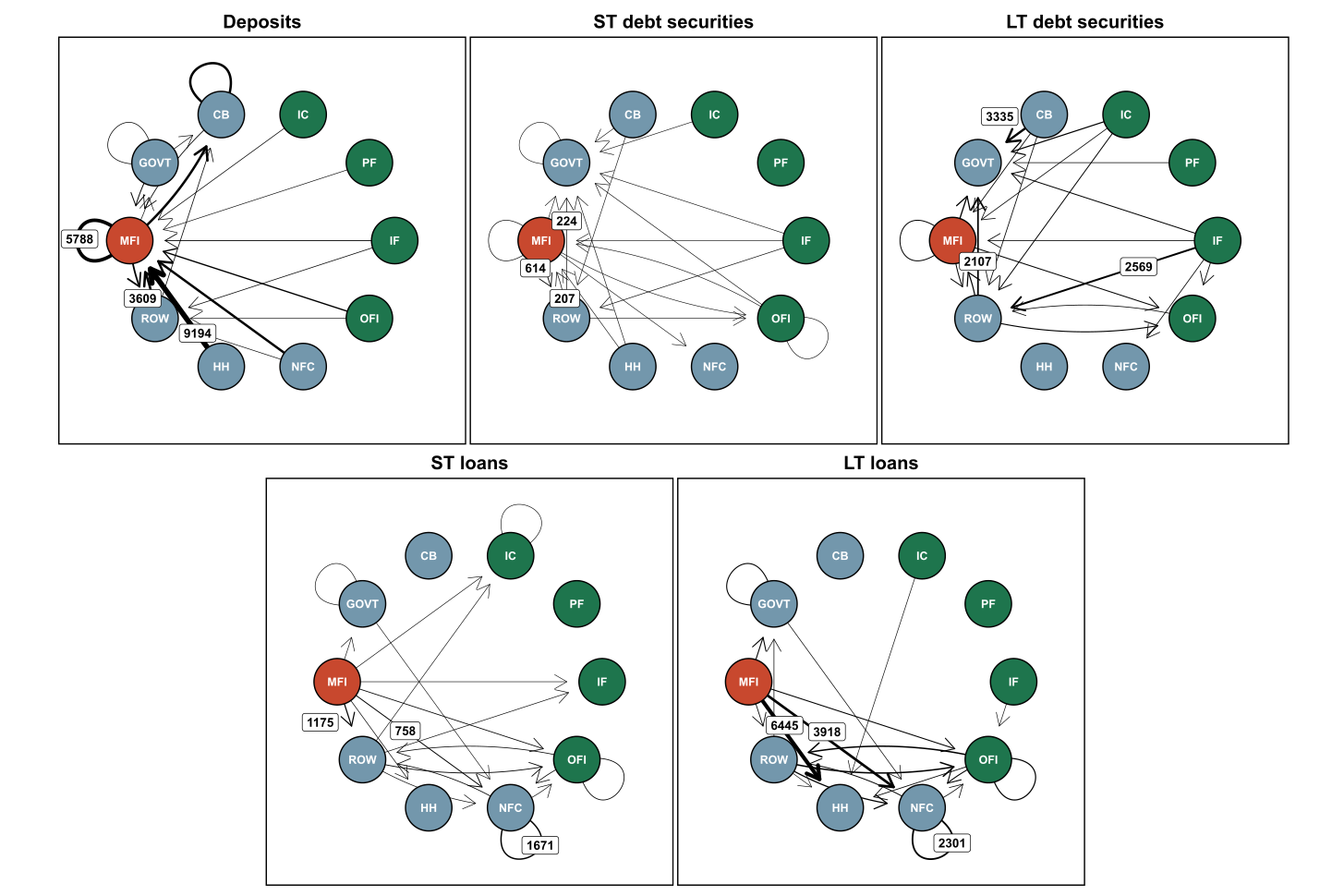

Figure 65: Network of the EA financial system comprising links between the banking sector and other sectors of the economy, December 2023 (the values of the three largest exposures are shown next to the respective arrow in each of the charts) (EUR bn)

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

Source: EBA supervisory reporting data

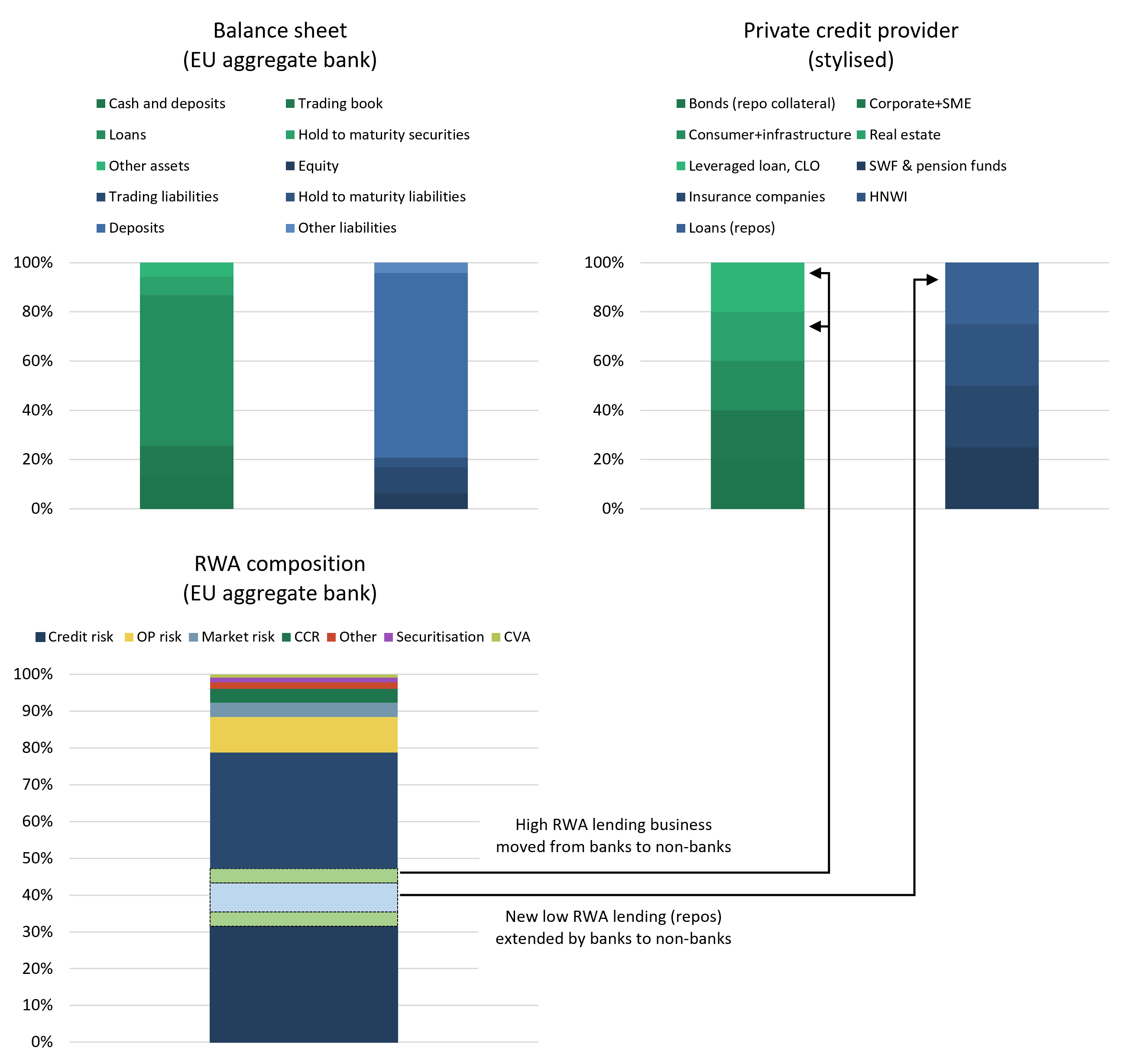

Figure 71: Illustrative examples of a bank’s and a private credit provider’s business and how they are linked

Source: EBA, using, for instance, anecdotal evidence, EBA Transparency Exercise data and further market research/analysis