Part II – Management

Management Board and Board of Supervisors

Board of Supervisors

The Board of Supervisors is the EBA’s main decision-making body and guides the work of the Authority. In addition to the EBA’s Chairperson, the Board of Supervisors is composed of the heads of banking supervision or their representatives in 30 national EU and EEAEFTA supervisory authorities, who are sometimes accompanied by a representative from the national central bank. It also includes representatives from the European Commission, the European Systemic Risk Board, the European Central Bank, the Single Supervisory Mechanism, the Single Resolution Board, the European Securities and Markets Authority, the European Insurance and Occupational Pensions Authority, and the EFTA Surveillance Authority.

As of 10 July 2023, the Board of Supervisors appointed Mr Helmut Ettl, Executive Director of the Austrian Financial Market Authority, as Vice-Chairperson for a 2.5-year term.

In 2024, the Board of Supervisors met nine times and twice with the EBA’s Banking Stakeholder Group. All the minutes of the Board of Supervisors, Management Board and Banking Stakeholder Group are available on the EBA website under the section Governance structure and decision making | European Banking Authority.

Board of Supervisors’ composition at the end of 2024

Voting members

| Country | Institution | Type of membership | Name |

|---|---|---|---|

| n/a | European Banking Authority | Chairperson | José Manuel Campa |

| Austria | Österreichische Finanzmarktaufsicht | Member | Helmut Ettl |

| Alternate | Michael Hysek | ||

| Belgium | Nationale Bank van België/Banque Nationale de Belgique | Member | Jo Swyngedouw |

| Alternate | Kurt Van Raemdonck | ||

| Bulgaria | Bulgarian National Bank | Member | Radoslav Milenkov |

| Alternate | Stoyan Manolov | ||

| Croatia | Hrvatska Narodna Banka | Member | Tomislav Ćorić |

| Alternate | Sanja Petrinić Turković | ||

| Cyprus | Central Bank of Cyprus | Member | Constantinos Trikoupis |

| Alternate | Kleanthis loannides | ||

| Czechia | Česká Národní Banka | Member | Zuzana Silberová |

| Alternate | Marcela Gronychová | ||

| Denmark | Finanstilsynet | Member | Louise Caroline Mogensen |

| Alternate | Thomas Worm Andersen | ||

| Estonia | Finantsinspektsioon | Member | Andres Kurgpold |

| Alternate | Kilvar Kessler | ||

| Finland | Finanssivalvonta | Member | Marko Myller |

| Alternate | Jyri Helenius | ||

| France | Autorité de Contrôle Prudentiel et de Résolution | Member | Nathalie Aufauvre |

| Alternate | François Haas | ||

| Germany | Bundesanstalt für Finanzdienstleistungsaufsicht | Member | Raimund Roeseler |

| Alternate | Adam Ketessidis | ||

| Greece | Bank of Greece | Member | Heather Gibson |

| Alternate | Maria Katsaki | ||

| Hungary | Magyar Nemzeti Bank | Member | Csaba Kandrács |

| Alternate | László Vastag | ||

| Ireland | Central Bank of Ireland | Member | Gerry Cross |

| Alternate | Mary-Elizabeth McMunn | ||

| Italy | Banca d’Italia | Member | Andrea Pilati |

| Alternate | Francesco Cannata | ||

| Latvia | Latvijas Banka | Member | Kristīne Černaja-Mežmale |

| Alternate | Ludmila Vojevoda | ||

| Lithuania | Lietuvos Bankas | Member | Simonas Krėpšta |

| Alternate | Renata Bagdonienė | ||

| Luxembourg | Commission de Surveillance du Secteur Financier | Member | Claude Wampach |

| Alternate | Nele Mayer | ||

| Malta | Malta Financial Services Authority | Member | Christopher P. Buttigieg |

| Alternate | Anabel Armeni Cauchi | ||

| Poland | Komisja Nadzoru Finansowego | Member | Artur Ratasiewicz |

| Alternate | |||

| Portugal | Banco de Portugal | Member | Rui Pinto |

| Alternate | Jose Rosas | ||

| Romania | Banca Naţională a României | Member | Adrian Cosmescu |

| Alternate | Cătălin Davidescu | ||

| Slovakia | Národná Banka Slovenska | Member | Tatiana Dubinová |

| Alternate | Linda Šimkovičová | ||

| Slovenija | Banka Slovenije | Member | Primož Dolenc |

| Alternate | Damjana iglič | ||

| Spain | Banco de España | Member | Ángel Estrada |

| Alternate | Agustín Pérez Gasco | ||

| Sweden | Finansinspektionen | Member | Henrik Braconier |

| Alternate | Magnus Eriksson | ||

| Netherlands | De Nederlandsche Bank | Member | Steven Maijoor |

| Alternate | Willemieke van Gorkum |

EEA and EFTA members

| Country | Institution | Type of membership | Name |

|---|---|---|---|

| Iceland | Fjármálaeftirlitið | Member | Björk Sigurgísladóttir |

| Alternate | Gísli Óttarsson | ||

| Liechtenstein | Finanzmarktaufsicht Liechtenstein (FMA) | Member | Markus Meier |

| Alternate | Elena Seiser | ||

| Norway | Finanstilsynet | Member | Per Mathis Kongsrud |

| Alternate | Anders Sanderlien Hole | ||

| – | EFTA Surveillance Authority | Member | Frank Büchel |

| Alternate | Jonina Sigrun Larusdottir |

Observers

| Institution | Name |

|---|---|

| SRB | Karen Braun - Munzinger |

Other non-voting members

| Institution | Name |

|---|---|

| ECB | Katrin Assenmacher |

| ECB Supervisory Board | Thijs van Woerden |

| EIOPA | Fausto Parente |

| ESMA | Natasha Cazenave |

| ESRB | Francesco Mazzaferro |

| European Commission | Ugo Bassi |

Management Board

In accordance with the EBA’s Founding Regulation, the Management Board ensures that the EBA carries out its mission and performs the tasks assigned to it. It is composed of the EBA Chairperson and six other members of the Board of Supervisors elected by and from its voting members. The Executive Director, the EBA Vice-Chairperson and a representative from the Commission also participate in its meetings.

The Management Board met five times in 2023, of which two meetings were held at the EBA’s premises, and the remaining meetings were held as videoconferences. The Management Board steers the preparation and revisions of the EBA’s Annual Work Programme and the development of the Draft Single Programming Document, which were approved in 2024 before their submission for final approval by the Board of Supervisors. The Management Board monitors the execution of the EBA’s tasks and activities, the budget planning process and the allocation of human and financial resources. To guarantee the transparency of its decision-making, minutes of the Management Board’s meetings are published on the EBA website.

Management Board composition at the end of 2024

| Country | Institution | Type of membership | Name |

|---|---|---|---|

| Germany | Bundesanstalt für Finanzdienstleistungsaufsicht | Member | Raimund Roeseler |

| Alternate | Adam Ketessidis | ||

| Greece | Bank of Greece | Member | Heather Gibson |

| Alternate | Ekatrini Korbi | ||

| Hungary | Magyar Nemzeti Bank | Member | Csaba Kandrács |

| Alternate | László Vastag | ||

| Latvia | Latvijas Banka | Member | Kristīne Černaja-Mežmale |

| Alternate | |||

| Spain | Banco de España | Member | Ángel Estrada |

| Alternate | Agustín Pérez Gasco | ||

| European Banking Authority | José Manuel Campa |

Major developments

Establishing the ESAs DORA Joint Oversight Venture

The EBA, together with the ESMA and EIOPA, are embarking on their new responsibility of overseeing critical third-party providers (CTPPs) providing information, communication and technology (ICT) services to EU financial entities. To ensure efficiency, synergies and consistency in carrying out the oversight activities, the ESAs have set-up a Joint Oversight Venture (JOV) organised as a common ESA department.

The JOV pools the ESAs’ staff resources, together with contributions from CAs, into a single team. This will ensure maximum consistency in the approach towards CTPPs, optimise the use of limited resources by avoiding redundancies, ensure easier allocation of resources among the ESAs over time and a sector-neutral approach, as well as facilitating internal coordination and the development of a common oversight culture in largely uncharted territory.

The JOV is headed by a ‘DORA Joint Oversight Director’ who reports directly to the three ESA Executive Directors. The department functionally consists of three units, one within each ESA, responsible for different domains of ICT services and groups of Joint Examination Teams (JETs). The JETs are the teams of ESA and CA examiners allocated for each CTPP and they will assess their risks and carry out examination activities.

The novel approach with the JOV is a first between EU agencies.

Launching the Horizon 2024–2029 talent strategy

The world of work, which has fundamentally changed since the 2020 pandemic, has led to a volatile, uncertain, complex and ambiguous environment, putting pressure on the shape of talent management. The global talent shortage in some areas, the digital transformation with AI, the rise of diversity, equity and inclusion (DEI), the importance of mental health and wellbeing, and the green deal, all require new thinking to reimagine Human Resources Management.

The Horizon 2024–2029 talent strategy is a pragmatic response to the EBA’s DNA of having first-class experts delivering first-class expertise. Leveraging talent’s versatility, mobility, career development, and striving for a trust-based, inclusive and values-driven environment are at the heart of this strategy.

The Horizon 2024–2029 talent strategy vision is upheld by an interplay of three strategic pillars and nine cross-cutting objectives, with 90 concrete outputs that drive the implementation roadmap. Through these pillars, the Authority is working to integrate talent management into many facets of its operational activities, moving the EBA towards a future where its talent succeeds together and keeps growing.

Implementing the IT strategy

In alignment with its 2020–2025 ‘Digital Agency’ IT Strategy, the EBA has maintained its dedication to digitalising its infrastructure, business products and services, workplace environments and services, with a fundamental focus on security and privacy. Through business-driven investments, the EBA consolidated its IT infrastructure post-cloudification in 2024, enhanced the team, optimised costs, and continued to deliver on crucial mandates and business initiatives. Furthermore, it introduced new technologies and supported EBA and NCA staff in exploring AI and supervisory technology (SupTech). The EBA also collaborated closely with ESA peers to fortify IT security and prepare for the Cyber Regulation.

In 2024, the EBA successfully adhered to its IT workplan and maintained budgetary discipline. Significant initiatives included the implementation of the Pillar 3 Hub, where a pilot with 13 banks was concluded in 2024, preparation for the Digital Operational Resilience Act (DORA), CTPP designation and oversight, and the kick-off of the implementation of a shared platform for the Markets in Crypto-Assets Regulation (MiCA) collection. Furthermore, the EBA finalised its dissemination portal to enhance service delivery and information dissemination to stakeholders and the public.

The EBA completed the first phase of the migration to the Digital Regulatory Reporting (DRR) tool, DPM Studio, which will support a continuous reporting framework development process, including DPM releases, a full validation rules lifecycle, support for data calculations and creation of eXtensible Business Reporting Language (XBRL) taxonomy packages.

Significant advancements have been achieved in workplace and collaboration solutions. Noteworthy developments include the launch of a redesigned EBA website in early 2024, implementation of a second-generation EBA extranet featuring an improved collaboration platform toolset, and continued advancement in the implementation of the internal EBA records management system.

Furthermore, additional initiatives to advance the digitalisation of its suite of applications and services have been initiated and are currently underway. These include the introduction of a new Enterprise Identity and Access Management system, new business digital products and services, and new corporate solutions (SYSPER2, MIPS, ServiceNow, SUMMA) for which it also counts on the support of the Commission when they are providing/enabling these services.

Living the EBA values

The Living the EBA Values campaign is an opportunity to reflect on and reinforce the core principles that guide the EBA’s work and relationships: Public Service, Excellence, Trust, Creativity, and Collaboration. The campaign’s main objectives were to raise awareness of these values and further embed them into the EBA’s daily operations.

The Living the EBA Values campaign is an opportunity to reflect on and reinforce the core principles that guide the EBA’s work and relationships: Public Service, Excellence, Trust, Creativity, and Collaboration. The campaign’s main objectives were to raise awareness of these values and further embed them into the EBA’s daily operations.

Developed with input from all staff last year, this initiative builds on an already strong foundation, helping the EBA amplify its impact – for the organisation, its partners, and the EU citizens who benefit from its work.

In August 2024, staff participated in a benchmarking survey to assess their familiarity with the EBA values and how well these principles were integrated into daily activities. The results were reviewed by senior management and a dedicated task force to help shape the campaign’s direction.

Running until March 2025, the six-month campaign featured a monthly spotlight on each value, with an EBA Director introducing it through the weekly staff newsletter and intranet. A multi-channel communication strategy was also implemented, including:

- short video testimonials from staff;

- new intranet features;

- regular staff newsletter updates, highlighting teams and individuals who exemplify the values; and

- a range of visual aids, such as roll-up banners for each value, posters across all floors, and a new careers brochure showcasing the EBA’s values.

To measure the campaign’s impact, Senior Management will launch a final benchmarking survey in Q2 2025 with the support of the EBA’s task force.

Gender, diversity and inclusion (D&I)

The EBA actively pursued its commitment to fostering an open and inclusive workplace culture by ensuring equal treatment and opportunities to everyone, irrespective of who they are, where they come from and what they believe in.

In line with the EU gender equality strategy adopted in 2020, the EBA has achieved, within only a few years, a gender-equal working environment (50 %) with also increased representation of women in leadership positions (e.g.: 60 % female directors).

The EBA continued to engage in proactive cross-cutting actions aimed at strengthening good practices around D&I, by:

- Including a gender mainstreaming perspective in all areas, adopting intersectionality as guiding principle.

- Fostering D&I as a corporate culture throughout the employee lifecycle (e.g.: D&I-enhanced job vacancies, specific mention of D&I in newcomers’ induction sessions,mitigating bias training, D&I toolkit for managers, etc.).

- Communicating and raising awareness by bringing the topic to the forefront with: the third ESAs’ high-level conference on financial services and gender held on 15 November 2024 with Nadia Calviño, President of the European Investment Bank as keynote speaker; the EBA D&I talks/podcasts providing valuable insights, expert perspectives and inspiring discussions to promote D&I within the organisation.

- Promoting awareness and developing supportive measures for persons with disabilities (e.g.: accessibility of EBA premises, inclusive meetings and missions, materials accessible for assistive technology, dietary requirements, socially responsible procurement, specific accommodations in recruitment procedures, etc.).

- Conducting data collection, benchmarking and developing a dashboard supporting track progress in D&I efforts, ensuring transparency, accountability and continuous improvement.

Budgetary and financial management

Budget overview

The EBA achieved an execution level of 99.9% – its highest ever – on its final budget for 2024.

The level of commitment appropriations carried forward from 2024 to 2025 was within the ECA’s recommended thresholds for each title (being 10%, 20% and 30% for titles I, II and III, respectively) and for the total budget appropriations (threshold of 15% of the final adopted budget).

2024 budget amendments and transfers

The initial budget adopted by the EBA Board of Supervisors (BoS) on 21 December 2023 for a total amount of EUR 56 633 074 was amended twice over the course of the year:

- In July, it was increased by EUR 286 354 to reflect:

- An ad hoc EU subsidy, matched by NCA contributions, to cover staff costs for DORA preparations.

- Estimated increased pension costs arising from salary indexation above budget and from an increase in the pensions contribution rate to 12.1%.

- In December 2024, the budget was decreased by EUR 13 227 to align the NCA pension contributions to actual pension cost.

The final amended budget was EUR 56 906 201, adopted by the BoS on 17 December 2024.

In addition to the budget amendments mentioned above, 32 budget transfers were authorised in 2024 in accordance with Article 26 (paragraph 1) of the EBA Financial Regulations. The Management Board was not required to authorise any transfers.

Consumption of 2024 internally assigned revenue (C4)

In addition to its voted budget, the EBA had EUR 235 115 in appropriations arising from internally assigned revenue received during the year. These are the funds paid to the EBA by other EU agencies for services rendered or contracts entered into by the EBA on behalf of the other agencies, and include a small amount of cost repayments by staff.

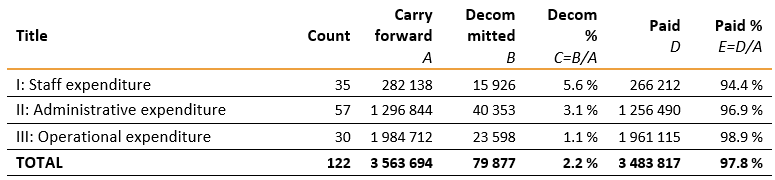

Budgetary execution on 2023 carry forward

In 2024, the EBA executed 97.8% of the EUR 3 563 694 in commitment appropriations carried over from 2023.

Procurement

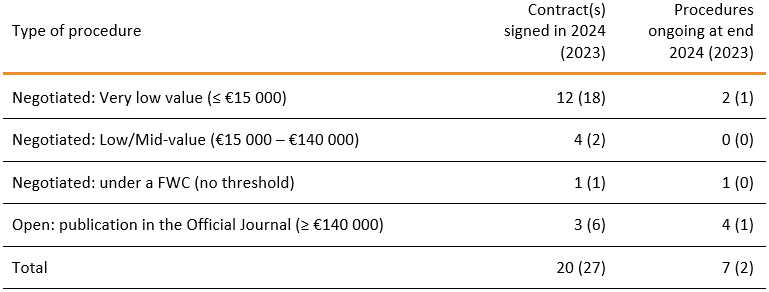

The EBA achieved 95% execution of its 2024 procurement plan.

Procurement statistics – procedures resulting in a signed contract

The fall in activity compared to 2023 results from the fact that most FWC are signed for a duration of four years, so most of the FWC signed in 2019 when the EBA moved to Paris were up for renewal in 2023.

Some procedures were unsuccessful in 2024:

- Two open procedures had to be cancelled and relaunched due to internal errors, one resulting in the signing of a contract (refurbishment) and no negative impact on EBA operations, the other being ongoing at year-end (proofreading) resulting in better participation but a period of two months during which the EBA did not have a contractor to which it could send requests for proofreading and editing services.

- One exceptionally negotiated procedure had to be cancelled because the contractor (Dealogic) refused to follow the procurement rules.

- One exceptionally negotiated procedure was removed from the planning as the EBA was able to obtain it under a newly signed Commission framework contract, ultimately resulting in more efficiencies.

Other highlights:

- New framework contracts for mobile telephony and for cleaning services resulted in average monthly cost savings of 43% and 41%, respectively.

- For competitive procurement procedures (i.e. open procedures or procedures where more than one candidate was invited to tender), the EBA received:

- an average of 3.1 tenders per procedure (median of 3, range 1–6);

- an average of 13.3 requests for clarification, for a range from zero to 36;

- zero complaints;

- zero legal challenges.

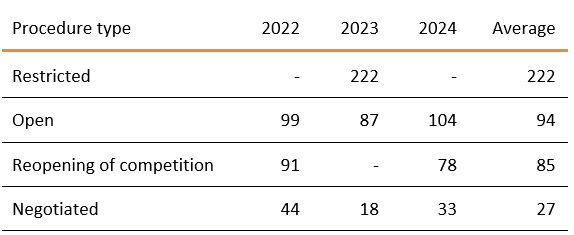

- EBA monitors average time-to-award, being the number of days between the launch of a procedure and the signing of the award decision by the Authorising Officer (or non-award decision in the case of a cancellation). The table below presents the statistics for the past three years:

Procurement procedures – average days to award

- The Procurement team gave three training courses to EBA colleagues.

Grant, contribution and service level agreements

In 2022, the three ESAs (EBA, EIOPA and ESMA) each signed a service level agreement (SLA) with DG REFORM, whereby the ESAs provide training services to the EU Supervisory Digital Finance Academy (EU SDFA) and DG REFORM provides funding to the ESAs for staff, missions and sundry other costs. In 2024, the EBA received EUR 356 119 from DG REFORM under this SLA. The SLA will run for three academic years from September 2022; however, given the success of the SDFA, the possibility of an extension is being discussed.

Control results

Throughout the year, the Agency carried out various control activities and assessments, and the results support the assurance of the achievement of the internal control objectives[1] stipulated under Article 30(2) of the EBA’s Financial Regulation. The Executive Director and the Management Board are informed of the results of the control activities and assessments, which comprise the following:

- annual internal control self-assessment of the EBA’s Internal Control Framework, checking if all the components and principles are present and functioning;

- status of the implementation of open actions resulting from the control activities and assessments;

- analysis of exceptions reporting;

- results and analysis of ex post controls on financial transactions;

- status of implementation of audit recommendations and observations issued by the EBA’s internal and external auditors;

- status of implementation of actions resulting from the comments and requests issued by the Discharge Authority;

- verification of access rights for the financial system;

- sensitive functions assessment and monitoring of the inventory.

Effectiveness of controls

(i) Legality and regularity of transactions

The EBA uses internal control processes to ensure sound management of risks relating to the legality and regularity of the underlying transactions for which it is responsible, taking into account the nature of the receipts and payments concerned.

(ii) Control objective

The legality and regularity of transactions is ensured by the ex ante and ex post controls undertaken by the EBA. These controls cover procurement, revenue and expenditure. They are targeted to the specific risks related to each type of action/transaction.

(iii)Assessment of the control results

The ex ante controls carried out by the EBA led to quantitative and qualitative benefits in its procurement processes (see Section 2.3.1 and Annex II for details).

The ex ante controls on procurement procedures are intended to ensure that the budget is well used, focused on actual needs and that the tender specifications are fit for purpose. Contracts are managed to ensure that contractors deliver the services requested as planned and that deviations are proportionately addressed.

Efficiency of controls

The EBA can report excellent results in 2024, having met the target for all major financial performance indicators (see Annex II). This reflects the efforts made to plan and monitor budget execution, to ensure the timely payment of invoices, and to ensure the quality of accounting.

(i) Time-to-pay

As in the previous year, more than 99% of invoices were paid on time, with just seven of 893 invoices paid after the deadline (seven days late, on average). Importantly, no late interest was paid. The average time-to-pay was 16.6 days.

(ii) Time-to-register

99.6% of invoices were registered on time (i.e. within seven days of reception), with four invoices registered late.

(iii) Time-to-award

For the three open procurement procedures awarded in 2024, average time-to-award was 104 days from invitation to tender to the award decision, compared to 87 days in 2023 and 99 days in 2022. The increase in 2024 may be attributed to an increase in the number of tenders received. On the one hand, such an increase tends to result in better value for money, but it can also lengthen the time-to-award due to the resulting increase in workload.

Cost and benefits of controls

Control activities ensure that risks related to the achievement of the organisation’s objectives are mitigated at all levels. Consequently, they include a variety of checks and approaches to mitigate risks, through manual and automated controls, both preventive and detective. To be cost-effective, the EBA’s controls are designed to achieve the right balance between effectiveness, efficiency and economy.

The calculation method is inspired by the approach used by the European Commission, and it also incorporates elements from the guidelines provided by the Performance Network of EU agencies.

In 2024, the EBA allocated 6.7 FTEs for control activities (A) in the areas of audit, anti-fraud, data protection, ethics, risk management, financial verification and self-assessment, which together with the direct costs (B) amounts to 2.6% of the 2024 executed budget. This cost estimation includes Chapter 11 costs, meaning pensions and salary weighting, excluding costs arising when staff join/leave (daily subsistence allowance, installation allowance, travel and relocation allowance). Compared to the previous year, where 8.8 FTEs were allocated, the reduction reflects greater efficiency found in the respective areas, leading to a streamlined approach while still ensuring effective control and oversight.

Control activities costs (A)

| Area of activity | TOTAL FTEs |

|---|---|

| Financial Management, including Procurement, Budget & Accounting | 3.6 |

| Governance, risk and compliance | 3.0 |

| Adequate, safe and secure work environment | 0.1 |

| TOTAL | 6.7 (2.4 % of the executed budget) |

The direct costs (B) refer to the costs which are incurred in support of the control activities and include the external audit.

Direct control costs (B)

| Item | Amount in EUR |

|---|---|

| Data protection consultancy | 10 800 |

| Treasury Services, ABAC | 65 000 |

| External audit of provisional and final accounts | 35 854 |

| TOTAL | 111 654 (0.2% of the executed budget) |

In terms of the effectiveness of the controls, the European Court of Auditors has given the EBA an unqualified opinion on the 2024 accounts. In addition, given the overall conclusion on the maturity of the internal control system, the EBA has assessed the effectiveness, efficiency and economy of its control system and reached a positive conclusion on the cost-effectiveness of the controls.

With a special focus on compliance while ensuring performance, the EBA has implemented a set of controls aiming to bring benefits to the Agency. These can be demonstrated by the following elements:

- compliance with regulatory requirements;

- reliable reporting that supports the decision-making process on items related to resources allocation and budget implementation;

- clean accounts, reliable recordkeeping and integrity of data;

- increased efficiency among the functions and processes;

- prevention of conflicts of interest;

- the European Parliament granting annual discharge on the implementation of the budget to the Executive Director;

- continuous unqualified ECA opinion on the accounts;

- a reduced number of audit observations and recommendations, as well as the implementation of the agreed actions within short timelines.

The controls in place are considered adequate and proportionate to the risks they serve to mitigate. They provide reasonable assurance that the budget has been effectively executed in compliance with the regulations. The Agency reviews its internal control procedures and policies on a continuous basis to implement improvements, manage risk and ensure a proportionate balance between the costs and benefits of controls.

Delegation and sub-delegation

As per Article 64(1) of the EBA Founding Regulation (Regulation (EU) No 1093/2010), the Executive Director of the EBA ‘shall act as Authorising Officer and shall implement the Authority’s annual budget’. The Executive Director has delegated Authorising Officer powers to six staff members, via permanent delegations:

- Director of Operations: all budget lines, all transactions, with no monetary limit. This is an indefinite delegation with no time limit.

- Head of Finance & Procurement: all budget lines, all transactions, with no monetary limit on Chapter 11 budget lines and with an EUR 60 000 limit per transaction on all other budget lines.

- Two members of the Finance & Procurement team, all budget lines, payment transactions only, up to EUR 15 000.

- Two corporate support staff members: mission purchase orders only, with no monetary limit.

The delegations are valid for the remaining duration of the employment contracts of the staff members in question, when they are revoked.

In addition, for the month of July, the Executive Director delegated Authorising Officer powers to the Head of Finance & Procurement as follows: all budget lines, all transactions, with no monetary limit.

There are no delegations from AOD to other staff.

Controls

Details of all financial circuit delegations are maintained in a SharePoint online list, to which copies of signed delegations are attached. Automated notifications are circulated six weeks prior to the expiration of a delegation.

Annually, the EBA IT security officer carries out a verification exercise on these delegations and on their implementation in the ABAC system, and reports on this exercise in accordance with the instructions received from DG BUDG. Following the last exercise, the finance unit updated the data held in the SharePoint list to ensure that the same codes were used for ABAC roles and profiles as are used in ABAC, to make it easier to compare the data in the list with the ABAC security reports.

The Court of Auditors are provided with the data from the list and with the ABAC security reports. The Court reported no issues in 2024.

Within the finance unit, monthly controls are carried out to compare the ABAC security reports with the data in the list, with the ABAC security reports being generated automatically on the first day of every month.

Human resources management

2024 Key indicators

In 2024, the EBA achieved high HR management results. In particular, its posts are almost all filled, time to recruit is short and staff satisfaction is very high.

| HR area | Indicator | Indicative target | 2024 | 2023 |

|---|---|---|---|---|

| Workforce | Temporary Agents posts filled (a) | > 95% (EUAN benchmark) | 98% (162/166)(b) | 99% (161) |

| Contract Agents posts filled (a) | > 85% (EUAN benchmark) | 100% (52/52)(c) | 98% (49) | |

| Recruitment | Time to hire (from publication to decision) | [3-6] months (EUAN benchmark) | 3.86 months | 3.4 months |

| Staff care | Staff Engagement Survey (SES) satisfaction score | 65% (EUAN benchmark) | 72% | 65% (2022) |

| Diversity & inclusion | Women in management | > 40% (Commission baseline) | 60% Directors, 41% HoUs | 60% Directors, 41% HoUs |

Notes:

(a) Refers to the Establishment Plan for the given year.

- TA: 166 Temporary Agents EU/NCA-funded posts (including 1 SDFA, 2 MiCA and 1 DORA).

- CA: 52 Contract Agents positions (including 2 MiCA). 1 SDFA is not shown above, as per Commission reporting request.

- SNE: 19 positions.

(b) Includes four temporary agent offers made by 31 December 2024.

(c) Includes two contract agent offers made by 31 December 2024.

The above HR KPIs and other indicators (see factsheet below) are all linked to the EBA’s talent strategy, and help monitor the organisation’s HR performance at the different stages of employee life cycle.

HR factsheet

| HR area | Indicator | Target | 2024 | 2023 |

|---|---|---|---|---|

| Workforce | Cost-paid SNE positions filled | As per agency capacity | 79% (15/19) | 74% (14) |

| Cost-free SNEs | As per agency capacity | 9 | 13 | |

| Recruitment | Staff in external mobility | As per agency capacity | 14 | 2 |

| Staff in internal mobility | As per agency capacity | 13 | 6 | |

| Statutory staff (TAs + CAs) turnover rate | < 10% (EUAN benchmark) | 3% | 6% | |

| Outreach | Trainees | As per agency capacity | 24 | 25 |

| Interns (aged 14-19) | None | 34 | 15 | |

| Short-term SNEs/visiting guests | None | 6 | 1 | |

| Staff care | Staff Engagement Survey (SES) participation score | 72% (Commission baseline) | 85% | 71% (2022) |

| Sick / parental leave per staff per month | < 2 days/month (EUAN benchmark) 2024 | 0.28 (3.2 FTE) 0.20 (1.91 FTE) | 0.57 (6.25 FTE) 0.18 (1.80 FTE) | |

| Learning & development | No. of training days per staff per year | > 5 (EUAN, industry benchmark) | 7.91 | 6.15 |

| Harassment awareness sessions | At least 2 sessions / year | 5 | 9 | |

| Staff attending language courses | None | 121 | 140 | |

| Nationalities of staff (TAs+CAs) | 27 EU Member States | 100% | 100% | |

| Women in statutory staff (TAs+CAs) | > 40% (Commission baseline) | 50% | 50% |

Brief description of the results of the screening / benchmarking exercise

In 2024, the EBA continued to apply the benchmarking exercise following the methodology of the European Commission. The table in Annex IV depicts the results of the exercise based on the type of post: Administrative Support and Coordination, Operational and Neutral. Overall, the share of jobs allocated to the three screening types remains relatively stable, with slight variations linked to the decrease in consultants in the IT area.

Strategy for efficiency gains

The EBA’s strategy for efficiency gains relies on three pillars: a flexible organisation, modern tools, and a collaborative approach. This allowed the EBA to achieve its work programme at very high levels in recent years, despite a substantial number of new requests and no additional resources (the share of executed tasks of these respective years’ work programmes was 91% in 2021, 94% in 2022, and 95% in 2023), and is expected – based on provisional results – to reach the self-imposed target of 90% in 2024.

Flexible organisation

Portfolio of activities. To facilitate internal synergies and cross-fertilisation, the EBA is constantly reviewing its portfolio of activities and streamlined the total number of activities from 37 to 25 in 2022, and to 19 as from 2023. As encouraged by the BoS, it will intensify its efforts to better relate inputs and outputs to the complexity and intended outcomes of its tasks (scoping notes for better simplicity and proportionality). The EBA has reduced the relative share of its administrative support and coordination to business resources (11.6% vs 84.6%) and is preparing for onboarding new-fee-funded staff without requesting new HR, IT or Finance resources.

Living organisation. Evolutions in the set-up are regularly introduced to best tackle evolving activities. This included creating, in 2021, a standalone data department and dedicated AML, ESG, and Reporting and Transparency units, to reorganise the set-up for equivalence and for Q&A in 2022. In 2023 and 2024, approximately 25 FTEs were redeployed to DORA and MiCA policy and oversight preparatory work (including 36 mandates for technical standards, guidelines, advice, etc.) which resulted in other tasks being temporarily streamlined or postponed. For cross-cutting tasks, temporary team leaders coordinate internal resources and keep focus. In 2024, the EBA introduced a Joint Oversight Venture (see below).

Planning and controlling. The dynamic allocation of resources is facilitated by an activities-based tool developed in-house with a rolling 3-year horizon: the EBA’s Tool for Handling Operations and Resources (THOR) was piloted in 2022 (in Excel) and rolled out since 2023 (Access Database). Since 2024, an internal Task force on Accountability, Synergies and Consistency (TASC) strives to optimise the cost efficiency and consistency of all EBA documents prepared for purposes of planning and accountability.

Working arrangements and sustainability. The EBA has introduced hybrid work, implementing the Commission’s decision by analogy in June 2022. It will continue its efforts towards creating a flexible, digital, sustainable and efficient workplace. In line with its EMAS registration by French authorities in 2022, it has reduced its business travel by half compared with 2019 and only commissions energy from renewable sources. It continuously invests in improving its environmental performance and reducing its carbon footprint (decarbonising operations and implementing circular economy principles: see also Annex VII).

Modern tools

The EBA’s Horizon 2029 Talent strategy. This supports staff engagement, performance and development for the benefit both of staff (to retain a high level of qualification and motivation) and the organisation (to have the right skillsets and reach its objectives). The strategy’s first achievements included internal and external mobility (10 personnel swap arrangements with other authorities in 2025 vs 5 in 2024); induction visits with the Commission; outreach (short-term expert onboarding, alumni network); staff care (e.g. wellbeing, D&I, Mental Health First aiders); the leadership programme. Results look encouraging with staff satisfaction at 72% in the 2024 Staff Engagement Survey and 85% participation (+7 and +14 ppt vs 2022).

The EBA’s 2020–2025 IT strategy. This allowed to embed new technologies, with expected long-lasting gains. A collaboration platform has reduced emails and supports integrated operating models (replacement of the extranet; DORA oversight collaboration space for approximately 30 ESA and 90 external JET members). The move to cloud-based big data technologies has benefited the new stress-test modules (NII), among others. The EBA is exploring AI use cases, which could bring productivity gains to its processes. Virtual-LEIs may ease workload and secure collections from banks (Pillar3 Data Hub) and issuers of crypto assets (MiCA reporting – see below). Key HR processes are being digitalised and a more interactive Single Rulebook is envisaged. An enterprise-level Identity and Access Management capability will provide less labour-intensive role-based access for both internals and externals in over 48 information systems.

Data collection and dissemination. EUCLID (the EBA’s European Centralised Infrastructure of Data) and EDAP (the EBA’s Dissemination platform) enable data flows between diverse endpoints and provide access to high-quality, curated data and insights to internal and external stakeholders. Both platforms will be expanded to MiCA, Pillar 3 disclosures and, from 2026, to PSD3, PSR, FIDA and EMIR datasets.

Collaborative approaches

Competent Authorities (CAs). The EBA collaborates closely with Competent Authorities in the 27 Member States and the EEA: approximately 1 500 of their staff members are involved in its governing bodies and working structures. This provides first-hand expertise and synergies, and allows the EBA and CAs to complement each other, especially in the context of new responsibilities, such as crypto asset supervision, for which a coordination group operated in 2023–2024 to prepare for the new tasks. This was also the case for DORA, including through collaboration with ENISA for the use of their reporting platform (CIRAS) for starting cyber incident reporting.

Reporting. The EBA and EIOPA have developed a common data point model for the insurance, pension fund and banking sectors (DPM 2.0) for more efficient data modelling, use cases, and data types in supervisory reporting. The ECB will also use it for its own next generation data platforms (iREF). In 2024, the EBA, EIOPA and ECB started a DPM Alliance to jointly govern the future use, evolution and support of DPM2.0, for the benefit of Competent Authorities, Vendors and supervised entities. The EBA and EIOPA have jointly developed DPM Studio, a digital regulatory reporting software product that allows them, the ECB and CAs to efficiently model reporting requirements in the insurance, pension fund and banking sectors using the DPM 2.0 standard. The EBA and EIOPA will make the source code of DPM Studio available to interested NCAs for optimising their own reporting activities. Finally, the EBA has started a cost-benefit assessment of least-used harmonised reporting.

DORA Joint Oversight Venture. To tackle their new oversight responsibilities over CTPPs, the EBA will be pooling resources with EIOPA and the EBA in a common department reporting to the three Executive Directors. This approach is a first between EU agencies. It will bring consistency regarding the way the activities are carried out and reap substantial synergies (no duplications, one reporting line, internalised coordination, joint recruitments, easier allocation of resources among the three ESAs over time).

MiCA reporting. In 2025, the EBA and CAs will develop a creative approach to collect reporting from issuers of ARTs and EMTs. Rather than having authorities each develop separate reporting systems, a common platform derived from the EBA’s EUCLID will provide a unique and stable reporting point for issuers, allow authorities to access more timely information on both the issuers’ activities and the market as a whole, creating new synergies and lowering costs.

Procurement. The EBA systematically seeks to include other agencies in its procurement procedures. In 2024, the EBA was lead agency on six interinstitutional procurement procedures, with a total value estimated at EUR 7 401 123 in which a total of 26 other agencies participated. The EBA also participates in many interinstitutional procedures led by other EU entities, predominantly those run by the Commission. Interinstitutional procurement is particularly strong with the ESMA and the other Paris-based EU entities. In 2024, 74% of the EBA’s 172 framework contracts in force (resulting from 77 procurement procedures) were procured by other EU entities – see the table below.

| Procurements Lead: | EBA | COM | Other agencies | Other | Total |

|---|---|---|---|---|---|

| Procurement procedures completed | 6 | 12 | 9 | 1 | 25 |

| Framework contracts | 45 | 73 | 40 | 14 | 172 |

ESAs. The Joint Committee of the EBA, EIOPA and the ESMA with the Commission and the ESRB is a key forum for discussing common regulatory issues and agreeing joint initiatives. It enables these entities to devise common approaches for a number of cross-cutting areas, such as financial risk assessments, ESG and financial conglomerates. A recent achievement was the Fit-for-55 stress-test carried out under its aegis. It will prove instrumental in coming years for tackling topics like ESG again, NBFI, European Savings and Investment Union, oversight of critical ICT third-party providers under DORA, and securitisation, among others. The ESA’s senior management and experts also have ongoing dialogue to align on organisational issues of common interest.

EU agencies. The EBA actively contributes to the two key pillars of the EU Agencies Network’s multi-annual strategy (1) EU Agencies as role models for administrative excellence (2) EUAN as a valued institutional partner, by increasing efficiency through better sharing of services, knowledge, best practices and pooling of tasks (e.g. SLA on providing a procurement resource part-time to the Community Plant Variety Office (CPVO)).

Accounting. The EBA has been sharing an accounting function with the ESMA since 2021 to enhance the synergies between the two Paris-based authorities. The arrangement also includes EIOPA’s Accounting Officer for reciprocal back up.

Public cloud. The EBA and EIOPA jointly migrated to Public Cloud in 2023–2024 using the Commission’s Cloud-2 framework contract. Following the migration (2023/2024), both agencies continue to collaborate daily in the usage of the MC10, sharing ideas and joining forces in optimising costs, security hardening, change orchestration with their common vendor, best practice-sharing.

Security Officer. The EBA has close collaboration with EIOPA and the ESMA, which have also migrated to Public Cloud, have required similar Cloud Transformation programmes, and are faced with the same security rules and regulations. While they work together to prepare for upcoming security framework changes such as the Cybersecurity Regulation, sharing current security resources will not be sufficient to meet the number of roles and diligences at agency-level which are required by the new legislation.

Knowledge-sharing. The EBA’s FinTech Knowledge Hub gathers CAs to engage with incumbents, new entrants, FinTech firms, technology providers and other relevant parties. It aims to enhance the monitoring of financial innovation, share knowledge about FinTech, and foster technological neutrality in regulatory and supervisory approaches. In the same vein, the ESAs’ European Forum for Innovation Facilitators (EFIF) provides a platform for supervisors to share insights from engagement with innovation facilitators (regulatory sandboxes and innovation hubs), technological expertise, and to reach common views on the regulatory treatment of innovative products, services and business models, overall benefiting bilateral and multilateral coordination.

Assessment of audit and ex post evaluation results during the reporting year

Internal Audit Service (IAS)

In line with international professional auditing standards, the IAS established a multi-annual audit plan (Strategic Audit Plan 2022–2024), which is being reviewed annually taking into account important organisational and/or external developments that may have impacted the risk profile of the EBA.

IAS audits performed in 2024 for HR Management and Ethics and for IT governance and portfolio management concluded there were adequate set-ups.

| Audits – 2024 | Summary |

|---|---|

| Human Resources Management and Ethics | The objective of the audit was to assess the design, effectiveness and efficiency of the internal control system put in place by the EBA to manage its human resources and the adequacy and effectiveness of its ethics framework. All the recommendations have been accepted by the EBA, none of them being critical or very important, and the action plan prepared was considered adequate by the auditors. |

| Multi-entity audit on coordination between DG FISMA and the decentralised agencies the EBA, EIOPA and ESMA | The objective of the audit is to assess the efficiency and effectiveness of the coordination between DG FISMA and the three European Supervisory Authorities on financial services. The audit is to be finalised in 2025. |

| IT governance and portfolio management | The objective of the audit is to assess the adequacy of the design and the effective and efficient implementation of IT governance and IT portfolio management processes in the EBA. The audit is to be finalised in 2025. |

Internal Audit Capability (IAC)

The EBA’s internal audit function is provided by the Commission’s Internal Audit Service (IAS), which remains the official internal auditor of the Authority.

European Court of Auditors (ECA)

The ECA draft audit report on the 2024 audit identified no observations.

Follow-up of recommendations and action plans for audits and evaluations

Internal Audit Service (IAS)

The EBA had no new or overdue critical or very important recommendations from the IAS.

The EBA continued implementation of audit recommendations stemming from the following audits:

| Audits | Action plan – progress implementation |

|---|---|

| Supervisory Reporting and Data Quality | All recommendations closed (five recommendations issued, of which two remaining were closed in 2024) |

| Internal Control Framework and Risk Management | All of the recommendations closed (four recommendations overall, all closed in 2024) |

| Human Resources Management and Ethics | The audit confirmed that no critical or very important recommendations were identified. The IAS saw opportunities for further enhancement in strategic workforce planning processes, in performance management with the introduction of RACER objectives, and in the recruitment of junior profiles in relation to the years of professional experience of candidates. Of the five recommendations for improvements issued, two are already on track for closure in 2025, while the remaining three are set for implementation by December 2025 in line with the approved action plan. |

The IAS concluded that, overall, the internal control system put in place by the EBA to manage its human resources and its ethics framework are adequately designed and effectively and efficiently implemented to support the achievement of its operational goals.

Internal Audit Capability (IAC)

Not applicable

European Court of Auditors (ECA)

In the Annex to its 2024 draft report, the Court listed one observation that it followed up from previous years. This is shown below, along with the status of corrective action taken by the EBA.

| The ECA’s observation (summary) | Corrective action taken and / or other relevant developments (summary) |

|---|---|

We audited a procurement procedure for ‘blockchain analytics services and crypto assets markets data’, with an estimated value of €360 000, which resulted in multiple framework contracts. We found that three tenderers that did not meet the financial European Banking Authority (EBA) capacity requirements – because they could only provide two years of financial statements instead of three, as required – were nevertheless allowed to participate in the procedure. One of the three was awarded a contract as the second-ranked tenderer in the cascade. This breached Article 167(1) of the Financial Regulation, as well as the principle of transparency and equal treatment. In 2023, the EBA did not make any payments to this contractor, because so far it has only used the services of the first-ranked contractor. | Regarding this particular procurement procedure, in the planned reopening of competition, for the second two of the four years of the framework contract, the EBA will not run the reopening of competition for Lot 1, which is the lot under which a contract was awarded to the second-ranked tenderer referred to by the Court. Hence no payments will ever be made to the contractor subject to the ECA’s observation.

In its procurement checklist developed this year, the EBA has included reference to this issue of procurement in a nascent industry and the adjustment of the financial capacity evidence to young economic operators accordingly. This evidence will be clearly stated in future tender specifications.

|

In its draft audit report on the 2024 audit, ECA marked this observation as closed.

Evaluations

The EBA is subject to regular reviews by the EU institutions, in accordance with Article 81 of the EBA (and other two ESAs’) Regulations. The most recent assessment report on the operation of the European Supervisory Authorities (ESAs) was published on 23 May 2022[2].

The Commission concluded that: ‘Since the last ESA review in 2019, the ESAs have continued to perform their tasks efficiently and effectively, including during the recent challenging circumstances caused by the COVID-19 pandemic’. It also identified ‘some areas where improvements (which) could be implemented with no need for legislative changes, and (it) will cooperate with the ESAs to assess this further’, mainly with the aim ‘to promote supervisory convergence and consistent supervision, which is a key building block in creating a genuine Capital Markets Union’.

In particular, it underlined the increasing number of cross-sectoral tasks and topics that must be dealt with by the ESAs as part of the JC. As a consequence, the Commission invited the ESAs to reflect on desirable changes that could be made to the framework in the future, to ensure sufficient resources and improve the decision-making process. The ESAs made progress in fostering supervisory convergence in the area of enforcement and supervisoryindependence (see joint criteria published on their websites[3]). Partial progress was also made regarding the recommendation to consider ways to ensure sufficient resources and improve decision-making in the JC, although the scope of action is limited given that the legal framework sets clear rules on the JC’s governance and functioning. In the absence of legislative changes, the ESAs have therefore been focusing on enhancing good governance and efficient operations within the JC on aspects under the ESAs’ control that do not require legislative changes.

Further accountability and evaluations are ensured by:

- The European Parliament, in its role as authority responsible for the discharge of the EBA’s financial statements, but also by way of the yearly hearing that the EBA Chairperson attends at the EP’s ECON committee.

- The European Court of Auditors, the Commission’s Internal Audit Services, and the yearly external financial audits.

- The publication of the EBA’S Consolidated Annual Activity Report and Annual Report, which provide an overview of the execution of the work programme and more detail on the above external evaluations.

Follow-up of recommendations issued following investigations by OLAF

There were no recommendations issued by OLAF to be followed up in 2024.

Follow-up of observations from the discharge authority

On 11 April 2024 the European Parliament (EP) granted discharge to the Executive Director of the European Banking Authority (EBA) for the 2022 financial year and approved the closure of the accounts for that financial year. In that context, the EP also set out its observations in a resolution.

Equally, the EBA welcomed the feedback received during the discharge process, which is an essential exercise for the evaluation of the Authority’s performance. It provides an external point of view to the actions undertaken by the Authority during the year, as well as current practices.

The 29 observations issued by the discharge authority in the 2022 report represented another improvement compared to the previous year(s) in terms of substance.

The EBA published an Opinion on the European Parliament 2022 discharge report in July 2024, with responses to the observations received in the Parliament’s resolution, in particular on those with a call for follow-up action[4].

Overall, the EBA considered that the large majority of the observations did not require follow-up actions or had already been addressed. A small number of observations are the subject of continuous efforts to ensure good governance, processes and management.

A few specific observations in the area of procurement and the related EBA reactions are set out below.

| Observations of the Discharge Authority | EBA response and measures taken | Status |

|---|---|---|

| [The Discharge Authority] Notes that, according to the Court, the Authority sought to procure services in two open tenders, one for market research for financial services and another for consultation on data protection; notes that in one tender there was an overlap between the selection and award criteria; highlights that such an overlap goes against Article 167 of the Financial Regulation, which stipulates that there must be complete separation between selection and award criteria; states that selection criteria are used to evaluate the capacity of the tenderers and award criteria are used to evaluate the price and quality of the offers; notes with regret that, in both cases, the Authority overestimated the maximum value of the contracts because of shortcomings in the research on market prices it had carried out before launching the tender. | The EBA takes note of the Discharge Authority’s observation in relation to procurement procedures. One section in the EBA’s updated guidance for selection committees relates specifically to the distinction between award and selection criteria. The EBA conducts market research by publishing ‘prior information notices’ in the Official Journal, in which it invites companies to respond to a questionnaire (public consultation) and asks for indicative prices to help it estimate contract value. In its 2023 audit report, the Court indicated that this observation is closed, indicating that the actions taken by the EBA are sufficient to address the observation. | Measures to address observation implemented and accepted by Court. Observation closed. |

| Notes that, according to the Court, the procurement weakness affecting two separate negotiated procedures reported in 2021 have been corrected as the Authority is now using the Commission’s templates, thereby bringing its procedures into line with the Court’s observation. | The EBA takes note of the Discharge Authority’s observation in relation to the use of Commission templates in procurement procedures, thereby bringing them in line with the Court’s observation. | Measures to address observation implemented and accepted by Court. Observation closed. |

| Highlights that, since the 2020 financial year, the Court has raised new procurement-related observations every year for four agencies, including the Authority; recalls that the objective of public procurement rules is to enable procuring entities to obtain the goods and services they need at the best price, while ensuring fair competition between tenderers and compliance with the principles of transparency, proportionality, equal treatment and non-discrimination; calls on the Authority to ensure full compliance with the applicable procurement rules to achieve the best possible value for money. | The EBA takes note of the Discharge Authority’s observation in relation to procurement. The EBA strives to achieve full compliance with the Financial Regulation and applicable procurement rules. The EBA considers the Court’s comments to be a useful input to the EBA’s ongoing work to be fully compliant. Other activities engaged in by the EBA as part of this work include:

| This represents an ongoing effort. |

There are no outstanding or open issues with observations made in previous Discharge Authority reports, and hence no delays in terms of implementation.

Environmental management

In 2024, the EBA maintained its EMAS registration. The 2024 environmental statement (with data from 2023) was positively verified and validated by independent external auditors and is now available on the EBA website here: https://www.eba.europa.eu/about-us/sustainable-eba.

The EBA was invited by the Community Plant Variety Office (CPVO), a European agency in Angers, France, to deliver a presentation on 29 January 2024 about its EMAS journey as well as greening activities and best practices we have put in place in the agency. Organised in collaboration with the CPVO’s management, staff and greening network, the event highlighted the benefits of implementing EMAS and was a testament to the significance of collaboration among European Union agencies.

The EBA continued to actively promote EMAS, environmental management and sustainability within the EU Agencies Network.

The EBA, together with the ESMA and EIOPA, participated for the second time in Interinstitutional EMAS Days. The ESAs’ presentation ‘Sustainable finance: tools for mitigating climate-related risks’ ranked in the top three most frequented sessions of this annual event for EMAS-registered organisations.

The EBA managed to achieve all its 2024 environmental objectives.

Assessment by management

Overall budget implementation rate

In 2024, the EBA reached one of its highest levels of budget execution: 99.9% execution on a total voted 2024 budget (after amendments) of EUR 56 906 201.

Execution of the appropriations carried forward from 2023 was 97.8%.

In both cases, the execution rate was above the ECA’s recommended threshold of 95%.

Legality and regularity

The control activities carried out on 2024 financial transactions and on the 2024 accounts included ex ante and ex post controls conducted by EBA staff, and the annual audit carried out by the ECA and PKF. Overall, these showed that verified transactions were in all material aspects legal and regular. In its 2024 annual report, the ECA made one observation on the legality and regularity of transactions, which is covered in more detail in Section 2.7.3.

Validation of the accounting system

Since June 2011, the EBA has been using the accounting systems provided by the European Commission, which include ABAC Workflow for budgetary accounting, ABAC Accounting for financial reporting and ABAC Assets for the management of fixed assets. The ABAC system is the property of and is regularly validated by the Accounting Officer of the European Commission.

In December 2024, the financial systems of the EBA were validated by the Accounting Officer in compliance with Article 49(e) of the EBA Financial Regulation.

[1] ‘legality and regularity’ of the underlying transactions; 2) sound financial management; 3) prevention/detection/correction and follow-up of irregularities and fraud; 4) reliable reporting and, where applicable, 5) safeguarding of assets and information.

[3] Joint Committee of the ESAs, ‘Joint European Supervisory Authorities’ criteria on the independence of supervisory authorities’ (https://www.eba.europa.eu/sites/default/documents/files/document_library/Publications/Other%20publications/2023/1063223/JC%202023%2017%20Joint%20ESAs%20Supervisory%20Independence%20criteria.pdf), JC 2023 17, 25 October 2023.