Quantitative impact study (QIS)

The EBA conducts regular and ad-hoc quantitative impact studies to assess and monitor the impact of various regulations on the EU banking sector.

In the past, one of the main objectives of the EBA QIS was to assess the impact of the final Basel III framework on a sample of EU banks. In addition, the EBA QIS carried out targeted complementary data collections to assess the impact of potential EU-specific implementations of Basel III, as well as other data collections that served the production of EBA deliverables, e.g. technical standards, guidelines, etc.

However, since 1 January 2025, the Capital Requirements Regulation 3 (CRR3)/Capital Requirements Directive 6 (CRD6) have been implemented in the EU, and institutions’ supervisory reporting requirements have been updated accordingly. As a result, and in coordination with the Basel Committee on Banking Supervision (BCBS) and in line with other jurisdictions that have implemented the Basel III framework, the EBA has decided to discontinue the EBA Basel III monitoring report and instead start monitoring the implementation of the CRR3/CRD6 in the EU based on the supervisory reporting framework data (i.e. COREP data).

The objectives of the EBA QIS remain:

a) the collection of data to answer CRR3/CRD6 mandates,

b) the collection of data for monitoring and analysis purposes,

c) an intermediary role with respect to the BCBS QIS, and

d) the collection of data to respond to future BCBS supervisory initiatives.

For the QIS, which is based on December-2024 data, the sample of banks covered and their classifications have been submitted and confirmed by the National Competent Authorities (NCAs). The list of institutions that are expected to participate mandatorily in each round of the QIS may however differ slightly from the list of banks that actually participate in the exercise. This deviation is mainly attributed to:

a) additional institutions may participate in the exercise on a voluntary basis, subject to prior agreement between the NCAs and the EBA;

b) some institutions may have been removed from the mandatory sample after the publication date (1 December). The removal of institutions is primarily due to corporate actions such as mergers and acquisitions, supervisory decisions prohibiting them from carrying out core banking activities, or situations where institutions are not subject to the relevant EU banking regulation (CRR/CRD).

The EBA is making the EU-specific templates as of December 2024 available to the public, which include the core BCBS templates, whose content is not covered by COREP, as well as additional EU-specific templates for the collection of data to answer the CRR3/CRD6 mandates or for analysis or monitoring purposes. This is only a generic version of the EU-specific templates. Participating banks should only use the version provided by their NCAs to ensure that national specificities are taken into account.[1] The EU-specific instructions refer only to the EU-specific templates, embedded in the core BCBS templates.

Documents

- Amending EBA Decision concerning information required for the monitoring of Basel supervisory standards

- Consolidated EBA Decision concerning information required for the monitoring of Basel supervisory standards

- Sample of banks covered by EBA’s QIS

- EU-specific templates

- EU-specific instructions

- Instructions for the core BCBS templates

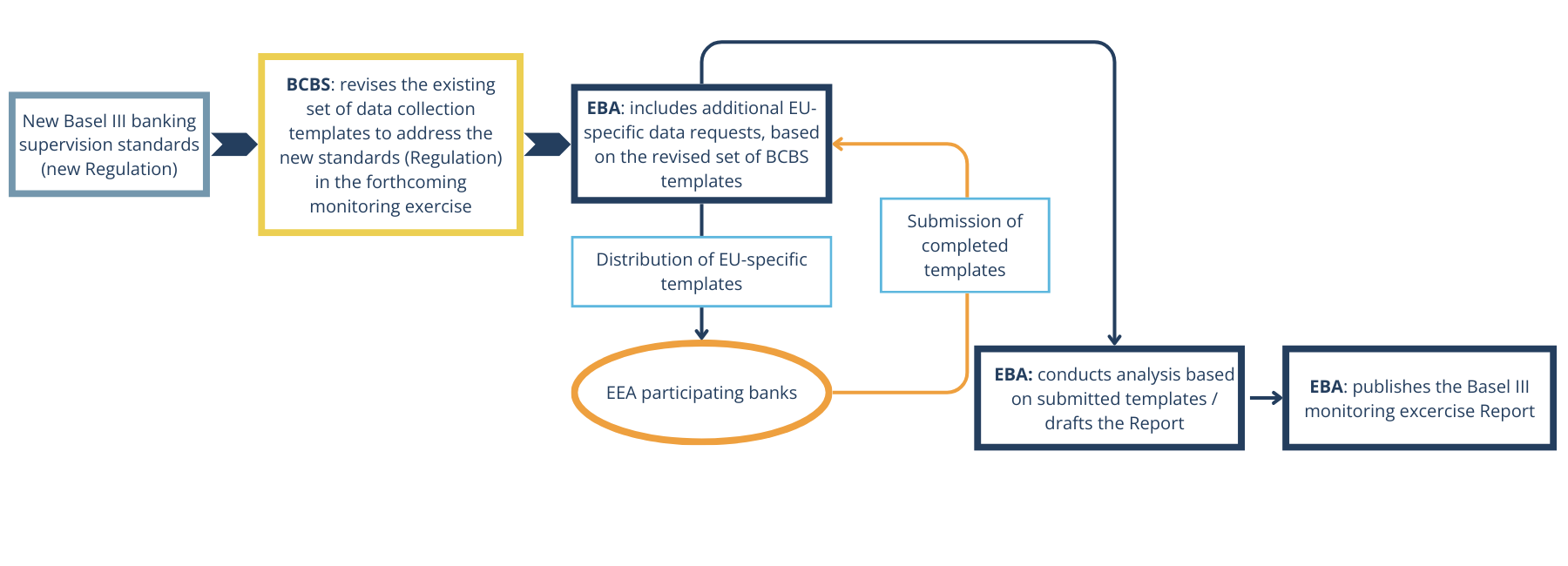

How the monitoring exercise is conducted

Reports on Basel III monitoring

7 October 2024EBA Report on Basel III Monitoring (data as of 31 December 2023) | 26 September 2023EBA Report on Basel III Monitoring (data as of 31 December 2022) | 30 September 2022EBA Report on Basel III Monitoring (data as of 31 December 2021) | 13 January 2023Report on Liquidity Measures under Article 509(1) of the CRR |

Ad-hoc quantitative impact studies

In addition to the monitoring activities, the EBA occasionally publishes ad-hoc impact assessment reports on specific EU or BCBS policy initiatives or revisions to EU or Basel standards. The quantitative impact studies are designed based on specific features and the desired outcomes of the legislation.

List of ad-hoc quantitative impact studies

- EBA report on leverage ratio requirements under Article 511 of the CRR (2016)

- EBA report on SMEs and SME supporting factor (2016)

- Call for Advice of the European Commission on the impact of the final Basel 3 reforms, including the update with the revised FRTB (2019)

- Non-modellable risk factor (NMRF) data collection (2019)

- Call for advice on loan enforcement (ongoing - 2019)

- Investment firms data collection (ongoing - 2020)

[1] Certain BCBS templates are not included in the EBA Decision as they are not requested for the EBA’s QIS exercise but for the BCBS QIS exercise.