Introduction

Chair’s introduction

JOSÉ MANUEL CAMPA

Another challenging year reinforced the urgency to act collectively in a more decisive and timely manner. In 2022, we operated in a rather challenging and uncertain environment with many disruptive factors to grapple with. First and foremost, we were confronted with the Russian invasion of Ukraine, which not only fuelled unprecedented humanitarian needs around the globe, but it was also a major blow to the global economy, hurting growth and raising prices. We also had to deal with the lingering effects of the Covid-19 pandemic, the inflationary pressures and increasing supply chain concerns, the interest rate volatility, and the fallout from Brexit. The war also rekindled and even galvanised the debate on several long-standing European Union (EU) initiatives, including the EU climate strategy, and the digital finance strategy, and reinforced the collective urgency to act more decisively and more quickly. We cannot afford to wait until it is too late.

The Russian war against Ukraine has dented the economic recovery and heightened uncertainty. Besides the heavy human toll and subsequent humanitarian crisis, the ongoing war in Ukraine had and is still having significant economic knock-on effects throughout Europe ranging from direct costs from sanctions and trade disruptions, rising inflation due to higher energy and commodity prices. In addition, the mounting uncertainty about the end of the war and its aftermath has deteriorated consumers and investors’ confidence. As I write this foreword, we are witnessing the effects of such a confidence crisis rippling throughout the global financial system. The recent bank failures in the US and in Switzerland indeed unfolded at times of heightened uncertainty, geopolitical risks and major societal transformation in response to the energy crisis and climate change.

More attention is needed to measure, monitor and actively manage interest rate risk, in the new high interest rate environment. While a low-interest-rate environment dominated the last decade, we are now confronted with a gradual increase in rates, which has impacted valuation of financial assets and expectations of potential deterioration of credit quality and made bank deposits more sensitive and susceptible to be moved at short notice. Inflation in the euro area has reached heights not witnessed since the 1970s and it is important to remember how it directly affects banks’ balance sheets through multiple channels. It is crucial that all banks, regardless of their size or complexity, properly manage this new environment. From our side, we already published technical standards on the management of interest rate risk in the banking book and increased our scrutiny of the way banks are managing such risk by launching a quantitative impact study late last year. We will also be publishing the results of our 2023 EU-wide stress test at the end of July. Given the rather uncertain economic environment, this exercise will be crucial to assess the robustness of the EU banking sector.

A full, faithful, and timely implementation of the Basel 3 framework is crucial to ensure resilience in the banking sector. A faithful and timely implementation of the EU banking package matters now more than ever. In the past few days, as I already recalled, we have been reminded that strong rules lead to strong banks, and strong banks are better able to serve firms, citizens and the economy at large. More than a decade of regulatory work has put us in a better position, with EU banks holding more and better capital and liquidity positions. The regulatory framework and the Single Rulebook we have developed so far has provided a consistent and robust regulatory framework across EU Member States and added a layer of resilience to the banking sector. That is precisely why I have been, and I am, particularly vocal on the need to speed up a full and faithful implementation of the internationally agreed Basel standards to all banks operating in the EU to further ensures resilience of the financial sector. However, for a successful implementation of these rules, given the interconnectedness of the global financial system, it is crucial that we achieve an international level-playing field through better convergence and transparency of this implementation in all other jurisdictions.

A positive attitude towards the application of innovative technologies is needed but institutions should innovate in a responsible manner, carefully weighing the inherent risks and opportunities. Another important area where we have initiated significant work is related to the digital transformation of the EU banking and payments sector. Here I firmly believe that financial institutions should have a culture that encourages a positive attitude towards the application of innovative technologies, but they should also foresee all possible safeguards to mitigate any associated risk. And for that, I see a crucial need for balanced regulation to facilitate the use of technologies that show a positive impact, whether based on process efficiency, risk management, consumer choice and experience when accessing financial services. Much of our focus this year will be on activities related to the Digital Operational Resilience Act (DORA) and the Markets in Crypto-Assets (MiCA) Regulation. With the DORA-related activities, we aim at making sure that the financial sector in the EU is able to stay resilient through a severe operational disruption. With the MiCA-related activities, we aim at protecting investors and preserving financial stability, while allowing innovation and fostering the attractiveness of the crypto-asset sector. Finally, I would like to mention our important contribution to the future regulation of the European payments industry with the review of the Payment Services Directive (PSD3). I think this review will be a great opportunity to ensure further harmonisation on the payments market and avoid regulatory arbitrage and unlevel playing field.

Our key objective is to contribute to developing a sound regulatory and supervisory framework to support the transition towards a more sustainable economy, while ensuring that the banking sector remains resilient. Financial institutions and capital markets are seen as an important facilitator of the change needed to tackle climate change and encourage sustainability in all its aspects. Banks and other financial institutions have a key role to play in facilitating the transition to a greener and more sustainable economy, while managing financial risks stemming from environmental, social and governance (ESG) factors. We have been actively supporting the integration of ESG aspects in the EU banking sector, with a focus on risks, and the broader objective of contributing to the stability, resilience and orderly functioning of the financial system. ESG is indeed one of our priorities, and ESG aspects will be increasingly embedded across our products and activities. At the end of last year, we published our roadmap outlining the objectives and timeline for delivering our mandates and tasks in this area. There are many ongoing projects on how to best incorporate ESG risks in the regulatory framework focusing on five key areas, such as risk management, disclosures, supervisory practices, climate stress testing and possible adjustments to the prudential framework, as well as work to avoid greenwashing. Moreover, we are also pushing our agenda to develop not only the environmental component of ESG, but also its social and governance aspects, which are key to a sustainable future.

Executive Director’s interview

2022 was another challenging year for the European Banking Authority (EBA) and for the global economy, more generally. Can you tell us how you managed to deliver on your priorities?

2022 was indeed another intense year. Global challenges have forced us to adjust our core activities while we were already evolving our way of working to create a more sustainable, efficient, and innovative environment. Around this time last year, when we were just recovering from the COVID-induced economic crisis, like everybody else, we were taken aback by the war in Ukraine. It is still raging on and takes a very heavy humanitarian and financial toll across Europe and globally. The economic outlook remains fragile, downside risks predominate, and high uncertainty lingers.

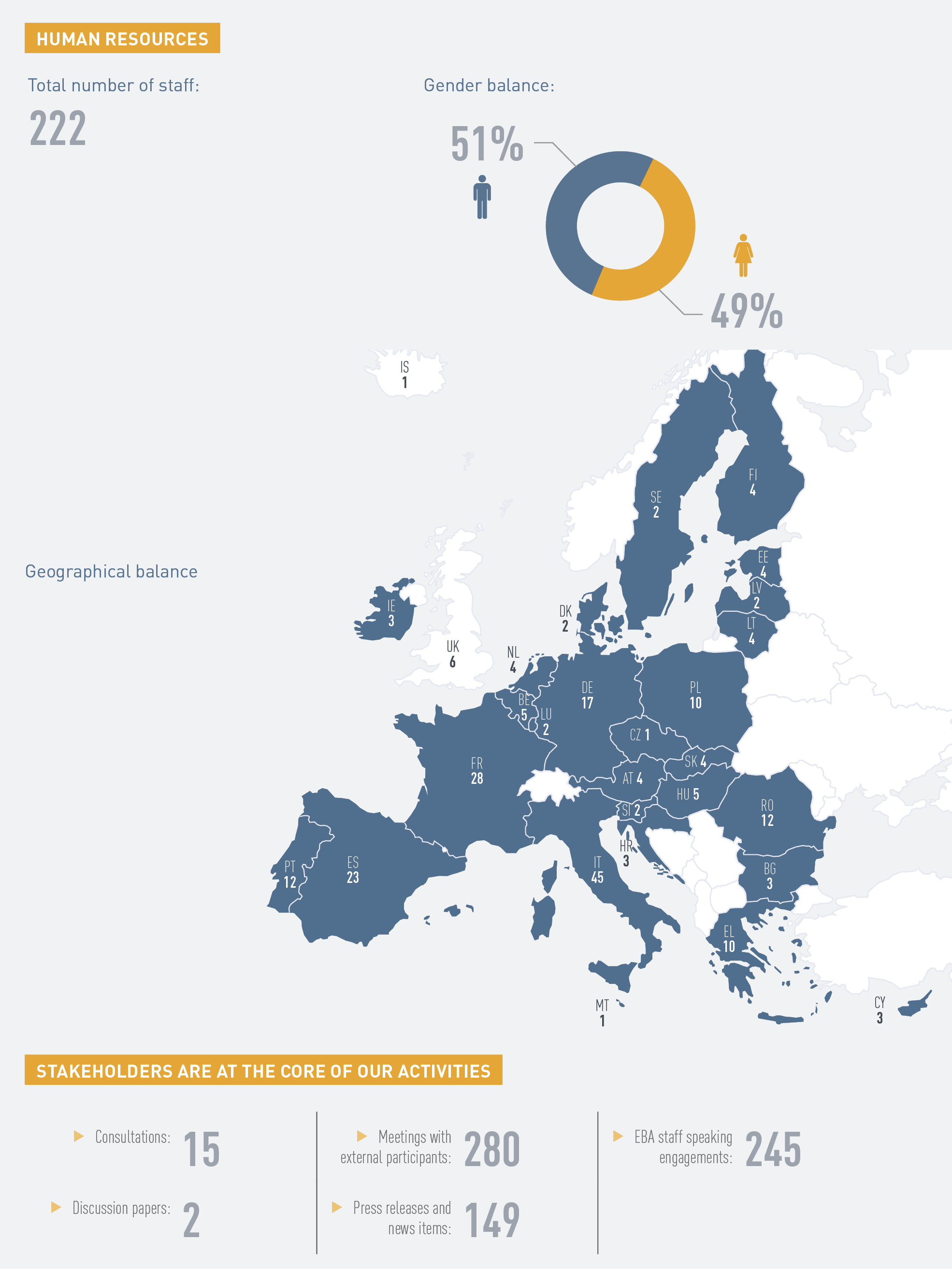

Despite the unexpected circumstances, we managed to execute 95% of the tasks in our 2022 work programme, which is quite an achievement! The motivation, commitment and agility of our staff, the more efficient and streamlined business and operational processes we have put in place in recent years, the new internal mobility policy, are among the key drivers of our ability to deliver to the highest standard on both our planned and unforeseen activities. The latter made up a good 14% of our work.

FRANÇOIS-LOUIS MICHAUD

Let me just single out the progress made in 2022 on one of our key priorities: making the most of banking and financial data. Data plays a crucial role in our activities. We need it to produce an evidence-based rulebook, to perform impact assessments and risk analyses, and to develop a harmonised and proportionate supervisory reporting system for banks and other financial entities. Since our creation, we have been using and receiving a wealth of data, and we came to realise that we needed not only to continue doing this in the most efficient manner, but that we also had a responsibility for making these data available as much as possible to our stakeholders. In order to be a trusted source of data and analytics services – a data hub – we were very busy in 2022 rolling out the multi-year comprehensive data strategy adopted in 2021. This will allow us not only to achieve our mandates more effectively, to enhance our capability to monitor the status of the financial system. It will also facilitate the sharing and use of banking and financial data with and for the entire community. Last year, we expanded the scope of our unique European Centralised Infrastructure for Supervisory Data (EUCLID) platform to investment firms. I am pleased to note that our work in this area is a key building block in the Commission’s data strategy for the whole financial sector and will lead to further synergies and increased consistency benefitting institutions, authorities, and financial entities.

Sustainability has always been at the heart of your actions and work. Can you tell us how you have been contributing to that objective and how the organisation is changing in that respect?

Our commitment to sustainability is indeed at the heart of what we do. Our ESG goals and policies span from our core work to our everyday operations. Supporting the transition to a more resilient and sustainable European banking sector is a key objective for the entire EBA. The banking sector should also play an important role, as a catalyst, in this transition. To that end, the authority has raised its game in this area. It is investigating ESG risks, informing risk assessment and policy making, participating in international discussions on this agenda, and ultimately incorporating such risks into the Rulebook from various angles, including risk management, supervision, and reporting. At the end of last year, we published a comprehensive roadmap outlining the objectives and timeline for delivering our ESG mandates and tasks for the years to come. ESG considerations are now systematically embedded in our products and activities, and we believe we have started providing a significant contribution in this area.

On the organisation front, 2022 has been a breakthrough year for the establishment of our Eco-Management and Audit Scheme (EMAS). We achieved the environmental objectives and targets that we had committed to in our single programming document for 2022. The effectiveness of our EMAS was checked and complimented by independent external auditors, who concluded that environmental matters and concerns are fully taken into account by the EBA at its premises management, in its activities, including its missions. Throughout the year, we have communicated a lot internally to raise awareness within staff and stakeholders. In March 2022, exactly two years since the beginning of EMAS implementation, an internal survey showed that EBA staff does value the management of environmental aspects in our organisation and is very motivated to improve our environmental performance further. This is very encouraging.

Another area where I am particularly happy with the progress made is gender equality. This is also critical to sustainability. Since I started my mandate, with a small internal team, we have been discreetly but consistently very active fostering equal chances for men and women in our organisation as well as through our policy and convergence work for the banking and financial sector. As I often mention, it is indeed the responsibility of a public sector organisation to represent the society it is embedded in. Our systematic and ambitious action over the past two years has allowed us to ensure that gender equality is observed in all our processes. Our workforce is equally distributed between men and women at all levels of the organisation, and we could also swiftly rebalance the situation in our management team. Change is possible in this regard, and one does not have to force the distribution as there is talent. More broadly, we are committed to creating equal opportunities for all staff members. In all this, we work closely with other European agencies to raise awareness, share good practices, and create a positive environment.

Technological innovations are changing the way we live and work. Can you tell us about the innovation projects at the EBA as well as the new ways of working within your organisation?

Staying at the forefront of technological innovation is essential. In particular, new information and communications technologies (ICT) allow us to remain faithful to the inspiration that led to the creation of the European supervisory authorities (ESAs) – that is, we aim to have maximum impact in everything we do, in a most cost-efficient manner.

In 2022, we were massively engaged in further rolling out and enriching our collaboration tools and techniques. This has already significantly transformed our organisation, and we will continue innovating. Our staff can now work seamlessly from anywhere, at any time, using any type of device, in a paper-less mode. It has transformed the way we communicate and collaborate both internally and with our external stakeholders, making us more efficient and effective. We also embarked on a project to evolve our workspaces in the wake of our move to hybrid work last year: it should fully support those tasks that colleagues and teams will need or chose to do at the premises.

Another key objective is our cloudification program. It is expected to be finalised in 2023 and will enable us to take full advantage of the scalability, agility, security, and cost-effectiveness of cloud-based technologies. I am confident that this move will help us deliver better services, while also reducing our environmental footprint.

One word on security and data protection. In 2022 we have also continued raising our setup to the highest standards, including multi-factor authentication, data encryption, and customized access controls to ensure that only authorised users can access sensitive information.

What are the operational priorities for the years to come?

We are very fortunate to have a solid list of new frontiers to reach. Life is never boring at the EBA. We will of course continue our work in the traditional areas of prudential regulation, to bring it to the next level, both from a content and from a format perspective. The banking package will in this regard mobilise our policy teams, as will the ESG roadmap. Risk identification tools and techniques, especially in the area of stress-testing will also remain front and centre, not only for the “traditional” EBA stress-test, which we expect to refine further, but also expanding to the area of climate.

On top of this, we are now working at full steam preparing for the application of DORA in 2025, and MiCA, which we also expect to be applicable over the same horizon. This means not only developing a brand new chapter of our Single Rulebook, but also setting oversight and supervisory functions at the EBA, in close liaison with a number of other European and national authorities. This is a new and fascinating task. At the same time, we will be helping our European partners to set up a fully integrated anti-money laundering (AML) authority in the EU, drawing on EBA’s recent experience. This is also very exciting.

Current economic conditions also mean that banks and financial entities will keep navigating difficult waters in 2023 and beyond. With our members, we are of course fully mobilised to monitor the situation, inform policy discussions, and prepare any necessary responses.

The new organisation put in place in 2021 has already served us very well, and together with our ICT modernisation, will continue to help us address all these challenges. We are fortunate at the EBA to have a very talented and motivated team, and we will keep up our efforts to best support and develop them!

2022 key figures

Types and number of institutions under the EBA scope

| How many | Data from | Reporting areas (up to EBA DPM v3.2) | |

|---|---|---|---|

All EU/EEA credit institutions |

>4400 |

Q4 2020 |

COREP (solvency, large exposures, liquidity, leverage ratio, fundamental review of the trading book, supervisory benchmarking of internal models, asset encumbrance), FINREP (IFRS9, national GAAP, Covid-19), Funding Plans, Resolution (Planning, MREL Decisions, MREL/TLAC), Global Systemically Important Institutions, Remunerations (High-Earners, Benchmarking) |

All EU/EEA banking groups |

>500 |

Q4 2020 |

|

Largest credit institutions or banking groups |

>160 |

Q1 2014* |

|

All EU/EEA investment firms |

>2300 |

Q3 2021 |

Investment Firms (CLASS2, CLASS3, GroupTest), COREP (solvency, large exposures, liquidity, leverage ratio, fundamental review of the trading book, supervisory benchmarking of internal models, asset encumbrance), FINREP (IFRS9, national GAAP, Covid-19), Resolution** (Planning, MREL Decisions, MREL/TLAC) |

All EU/EEA Investment firms’ groups |

>200 |

H2 2021 |

|

All EU/EEA payment institutions |

>2400 |

H1 2019 |

Payments, Resolution** (Planning, MREL Decisions, MREL/TLAC) |

All EU/EEA e-money institutions |

>300 |

H1 2019 |

Payments |

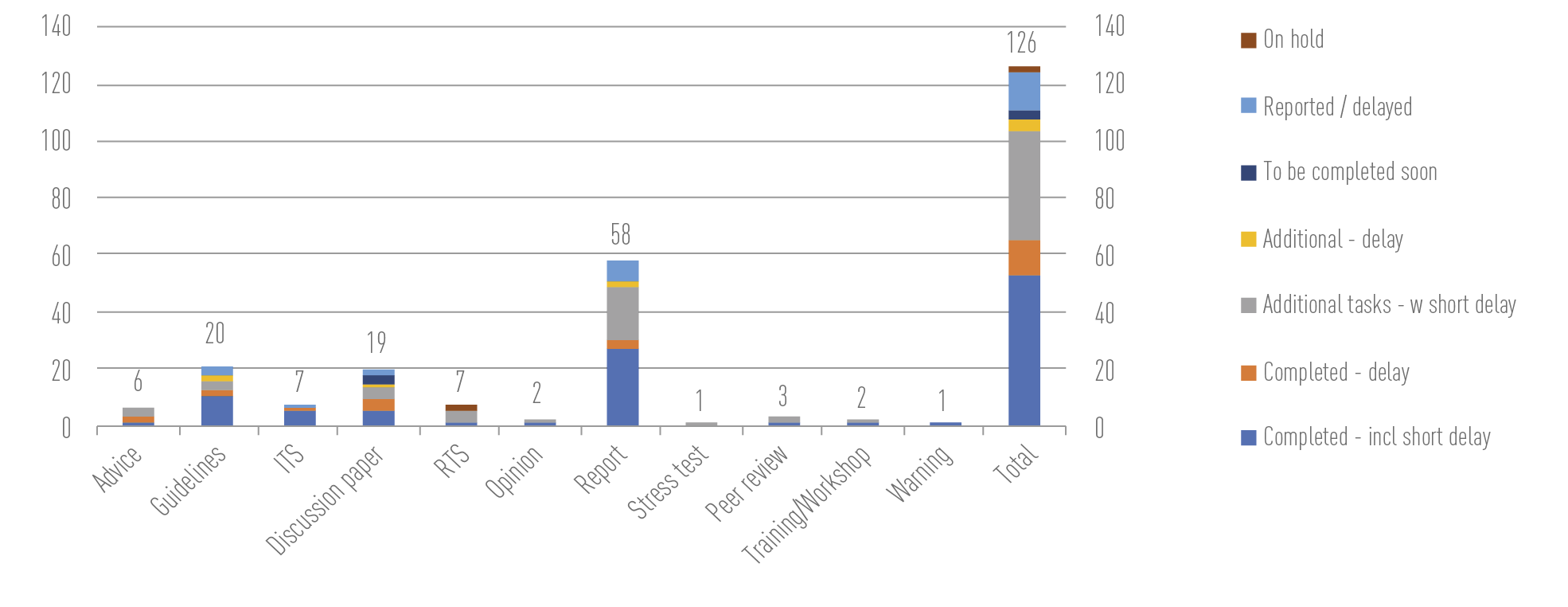

Work programme execution and overview of main deliverables

| Work programme execution | Tasks as set out in WP 2022 | 254 |

|---|---|---|

| Execution rate | 94% | |

| Tasks including additional work | 297 | |

| Execution rate | 95% |

| Deliverables | Reports | 58 |

|---|---|---|

| RTS/ ITS | 26 | |

| Guidelines | 20 | |

| Opinions | 7 | |

| Advice | 6 | |

| Peer reviews | 3 | |

| Stress test | 1 | |

| Other | 5 | |

| Ongoing tasks | 171 |

Breakdown of deliverables

General context

As the world began to recover from the COVID-19 health and economic crisis in the start of 2022, the Russian aggression against Ukraine presented yet another significant humanitarian and financial challenge for Europe and the rest of the world.

The invasion of Ukraine led the EBA to consider challenges and uncertainties arising from that conflict for areas within the EBA’s remit and to address these within the above priorities. This heightened the focus on assessing the risks that derive for banks and the financial sector. Here focus was on the likely adverse financial consequences of the Covid pandemic and the Russian war against Ukraine in the form of higher interest rates due to inflationary pressures and heightened uncertainty due to higher energy prices. The conflict also led the EBA to help with the enforcement of sanctions imposed on Russia but also to help people directly affected by the conflict by providing guidance on how to best facilitate their access to the financial system.

Notwithstanding the challenges presented by geopolitical and economic events during 2022, the EBA continued to adapt its operations and processes to establish a more effective and sustainable workplace.

During 2022 the EBA continued its efforts to strengthen the prudential framework including with respect to supervision and resolution, enhancing the EU-wide stress test, leveraging its platform for banking and financial data (EUCLID), deepening analysis and information-sharing on digital resilience, financial innovation, anti-money laundering and terrorism financing.

The EBA has shown resilience and adaptability not only by adjusting its workload and priorities but also by aligning its organisation with the upcoming challenges to be faced by the EU financial sector - in particular with regards to sustainable finance and financial innovation. New mandates from the Digital Operational Resilience Act (DORA), Markets in Crypto-Assets Regulation (MiCA) and the implementation of the ESG roadmap published by the EBA in December 2022 illustrate the broadened scope of the EBA’s activities as they align with an ever-changing financial sector.

List of figures

| Figure 1: | CET1 (fully loaded) ratio 18 |

| Figure 2: | Funding plan expectations 19 |

| Figure 3: | Outstanding loan growth by segment 21 |

| Figure 4: | Main drivers of operational risk as seen by banks 23 |

| Figure 5: | Tasks and responsibilities of the stress-test exercise 25 |

| Figure 6: | EU banks’ exposures towards commodity derivatives 29 |

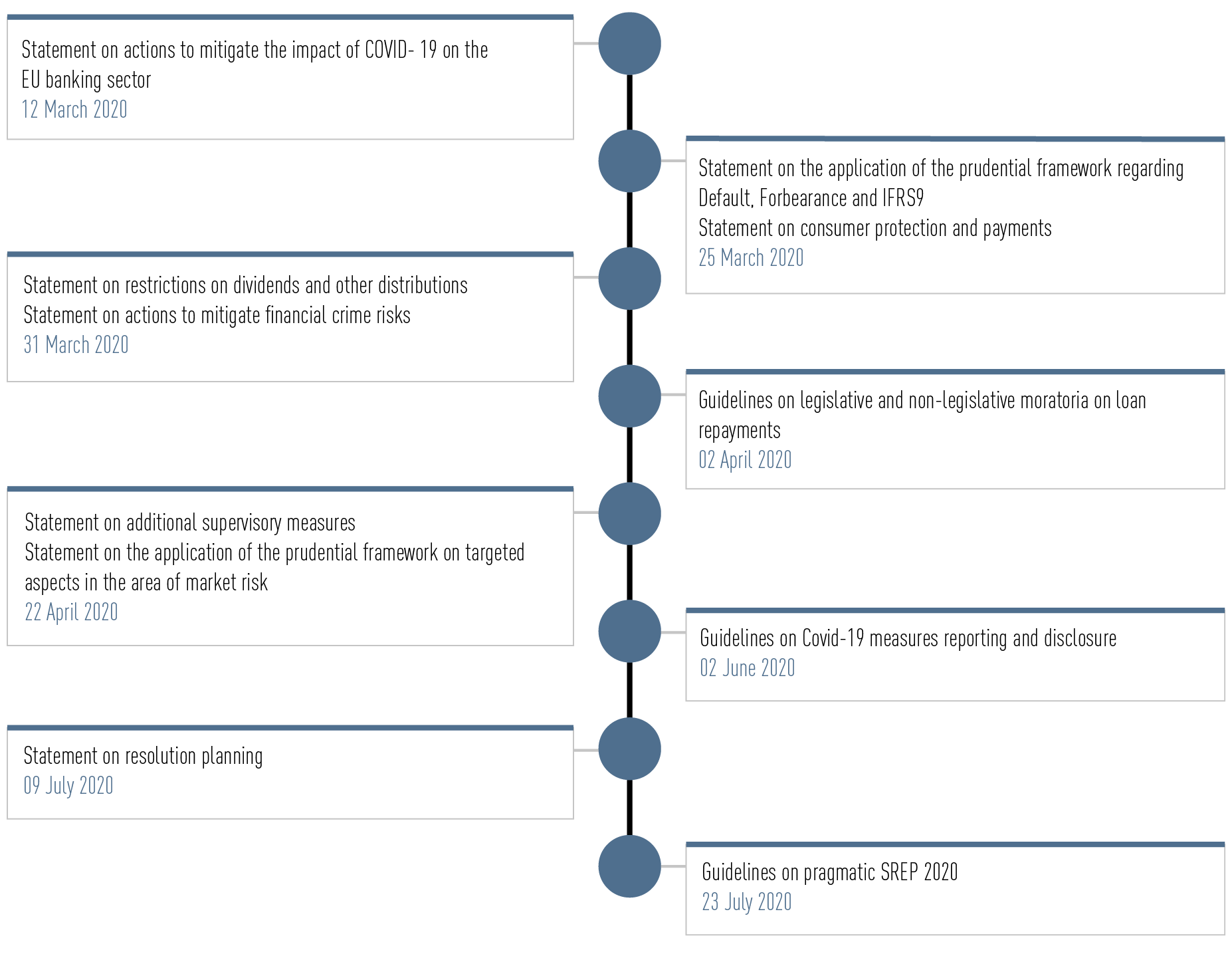

| Figure 7: | Actions in light of COVID-19 36 |

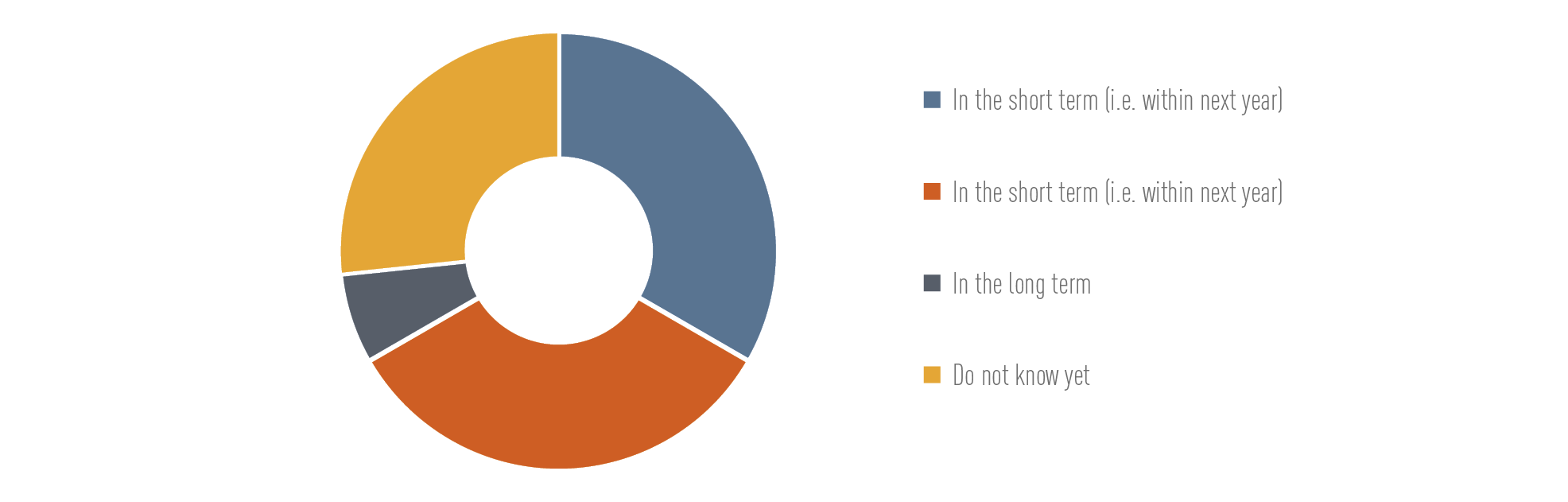

| Figure 8: | EBA market survey responses to “Envisaged timeframe to enter the sustainable securitisation market” 38 |

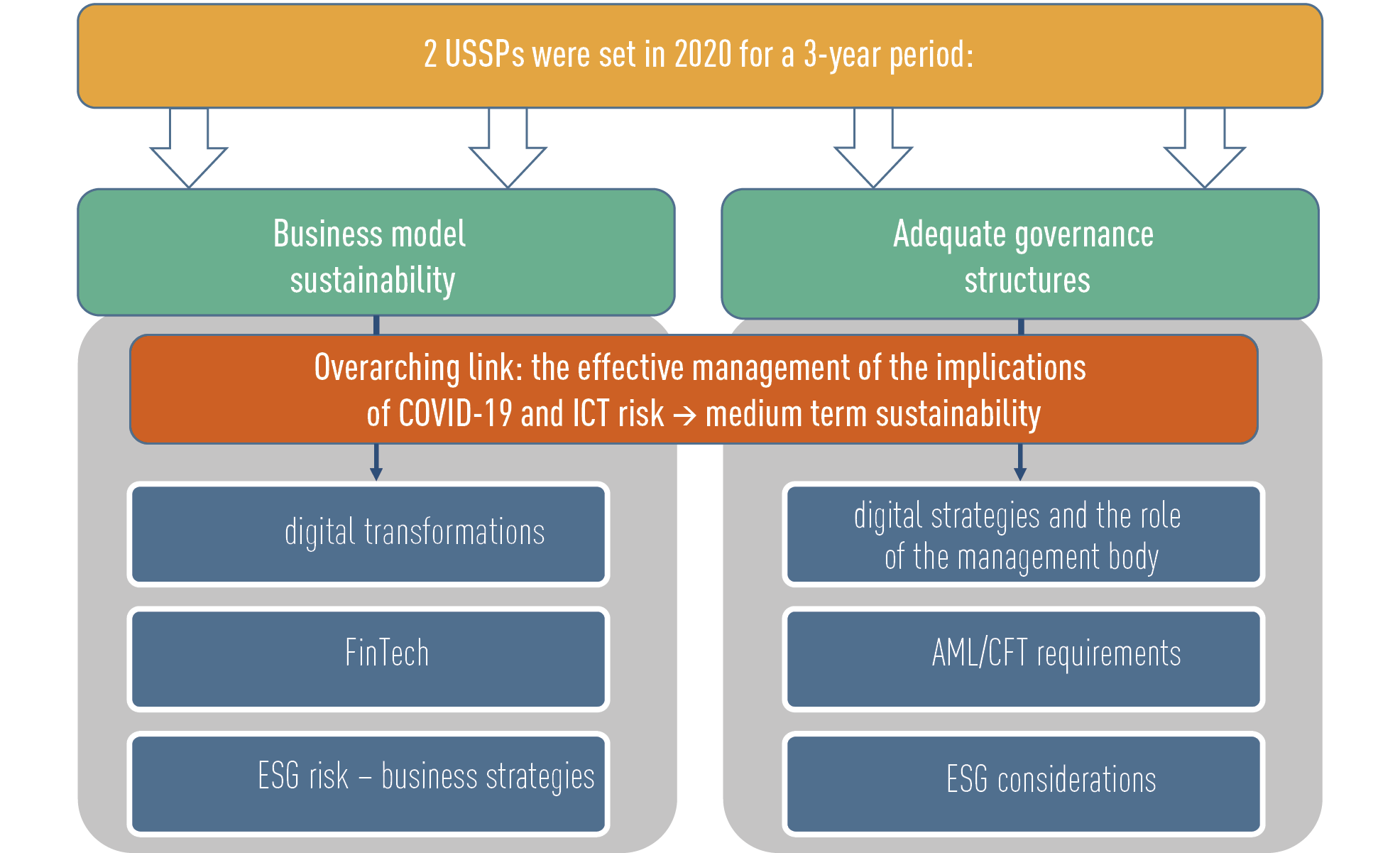

| Figure 9: | USSPs 2020-2022 and the key priorities in the ESEP 2022 39 |

| Figure 10: | Key topics incorporated into CAs’ supervisory priorities in 2022 40 |

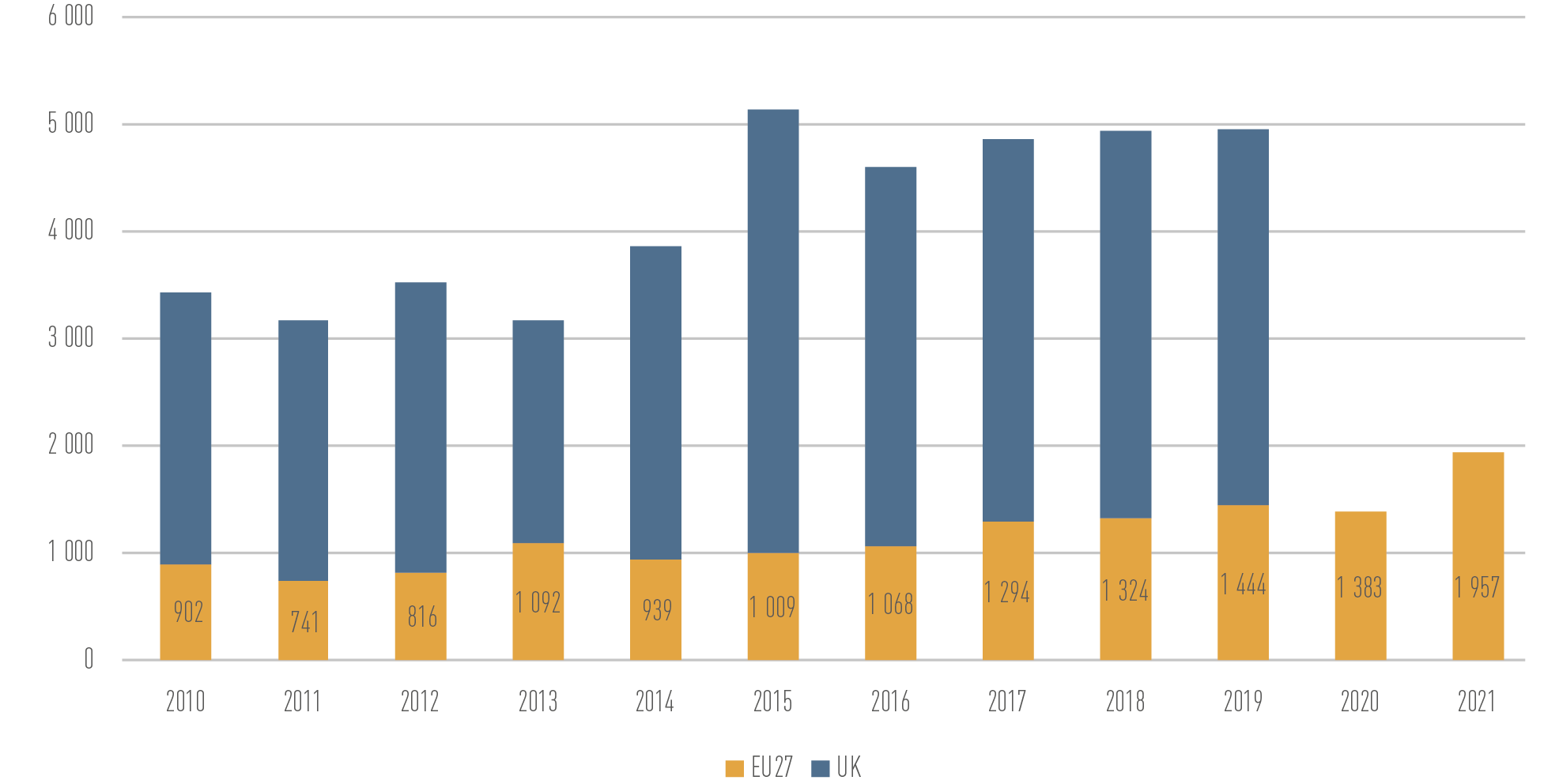

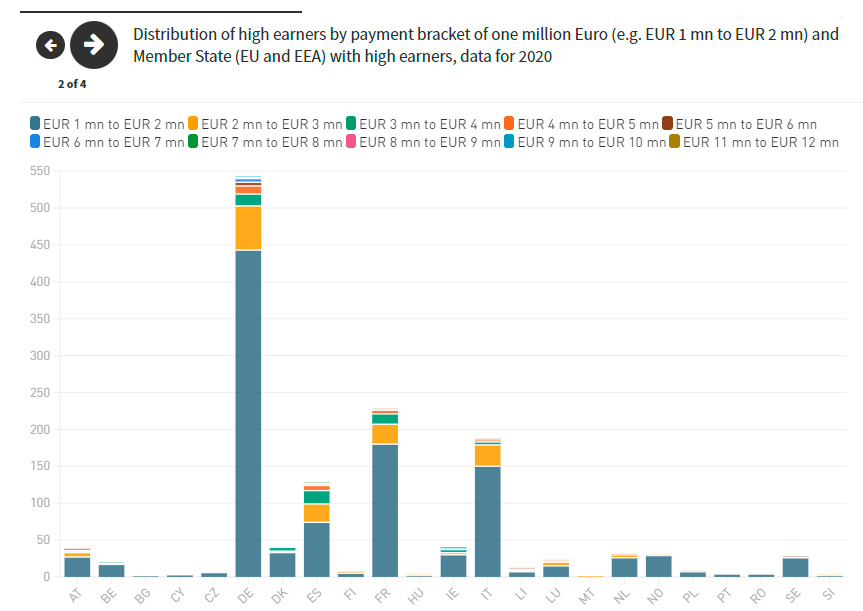

| Figure 11: | Development of the number of high earners 42 |

| Figure 12: | Distribution of high earners by payment bracket of EUR 1 million and Member State 42 |

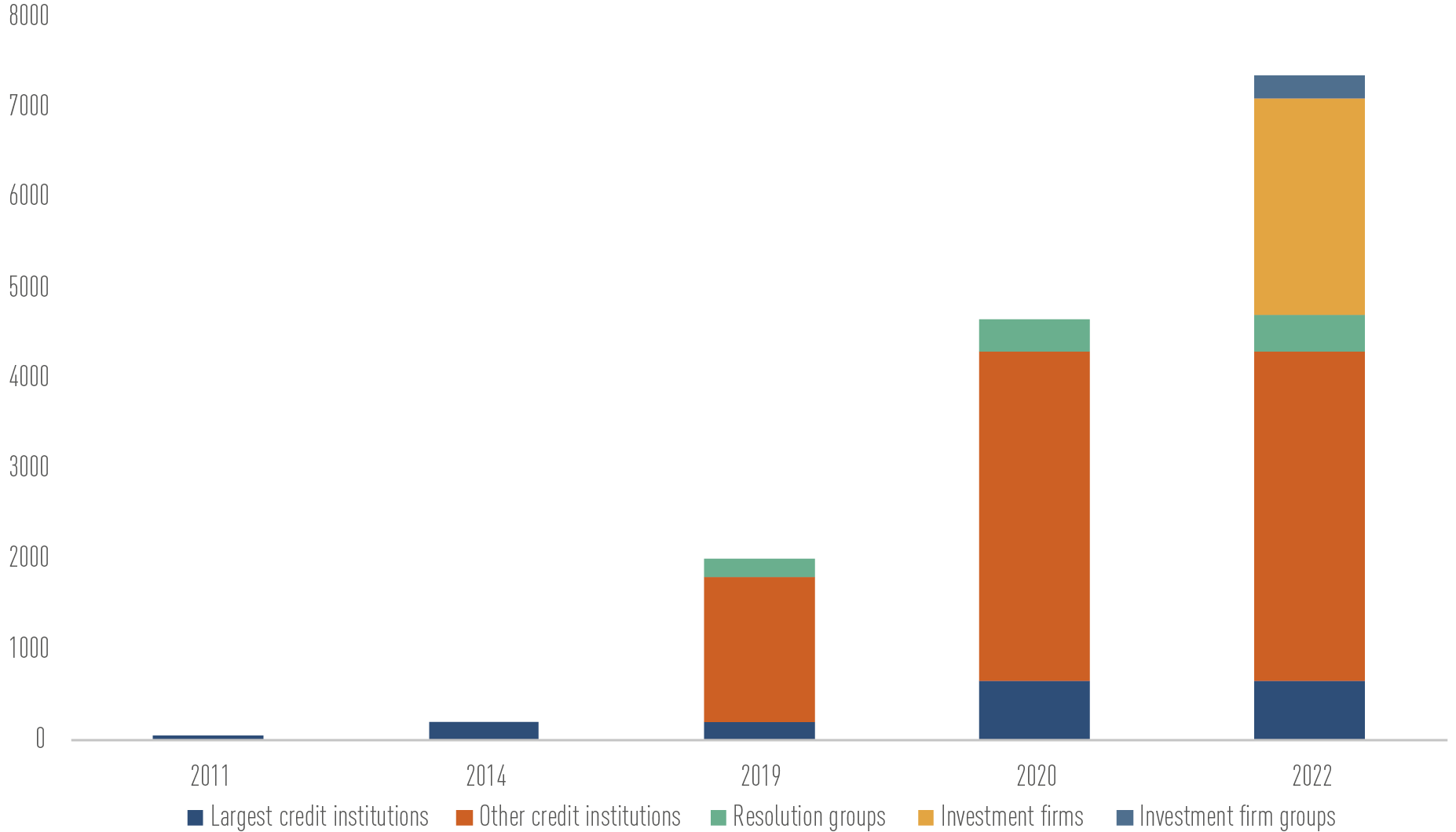

| Figure 13: | scope of entities for whish the EBA collects data 46 |

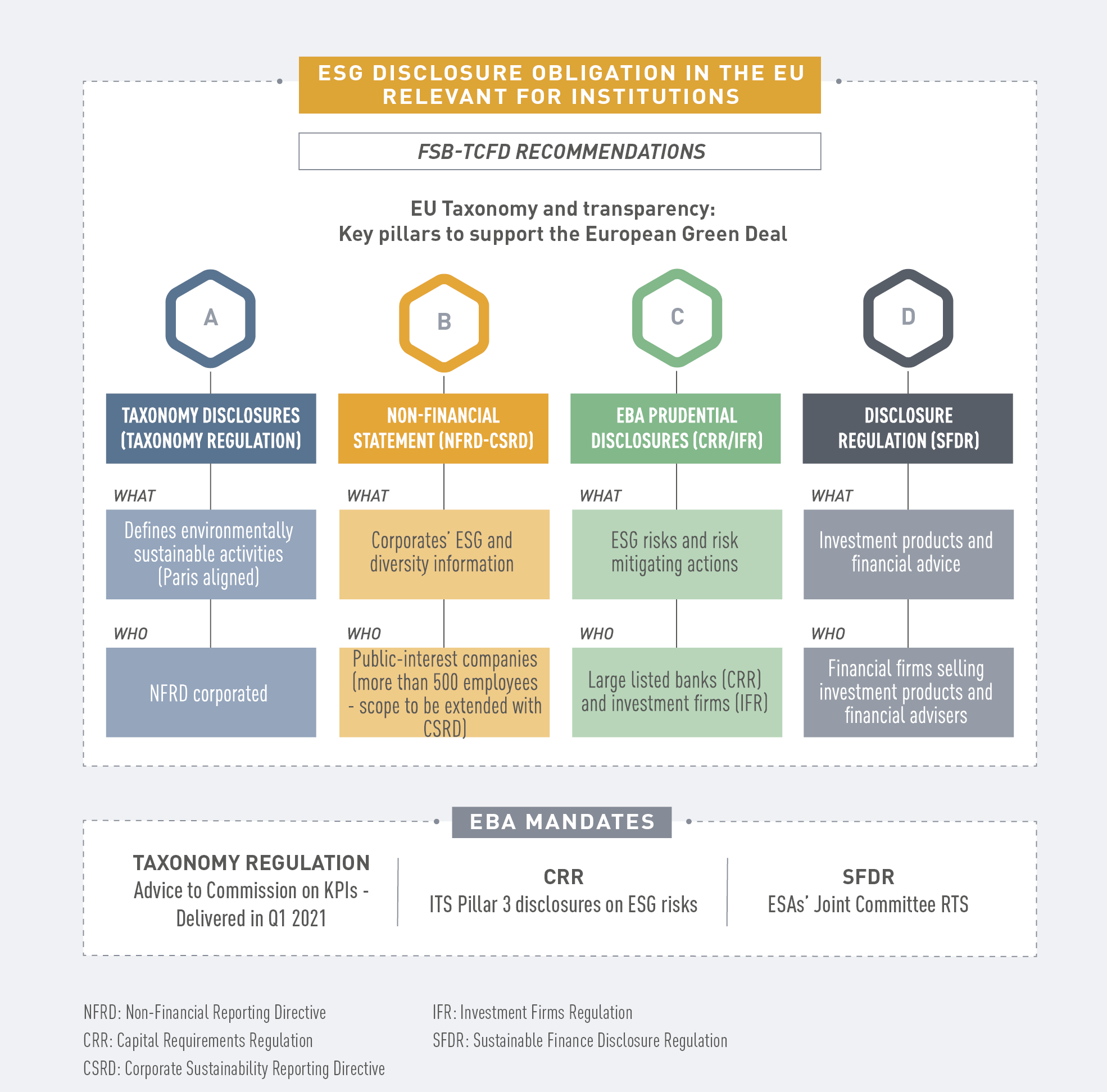

| Figure 14: | ESG disclosure in the EU financial institutions 53 |

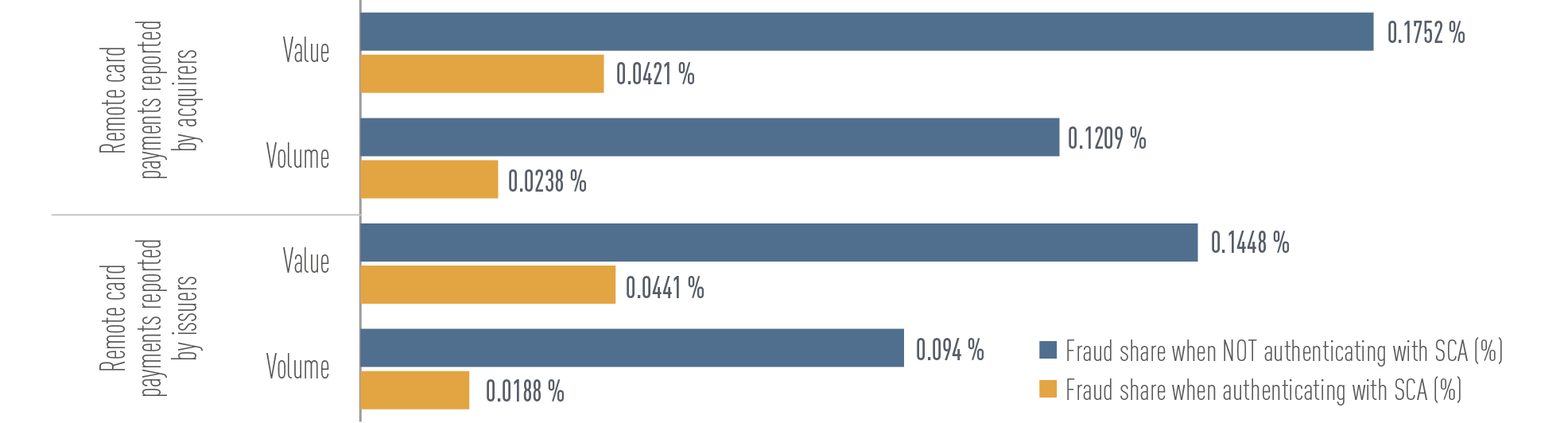

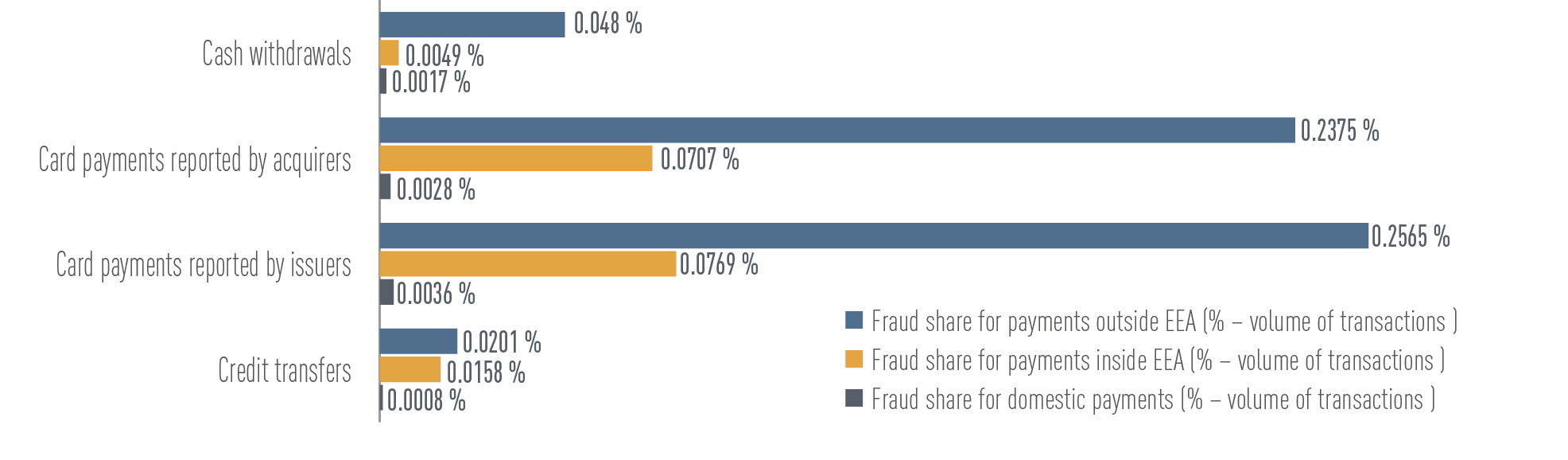

| Figure 16: | Fraud rate for remote card payments reported by issuers and acquirers, with and without SCA 56 |

| Figure 17: | Fraud rate when payments are executed domestically, inside the European Economic Area (EEA) and outside EEA in H2 2020 56 |

| Figure 15: | why is SupTech important? 60 |

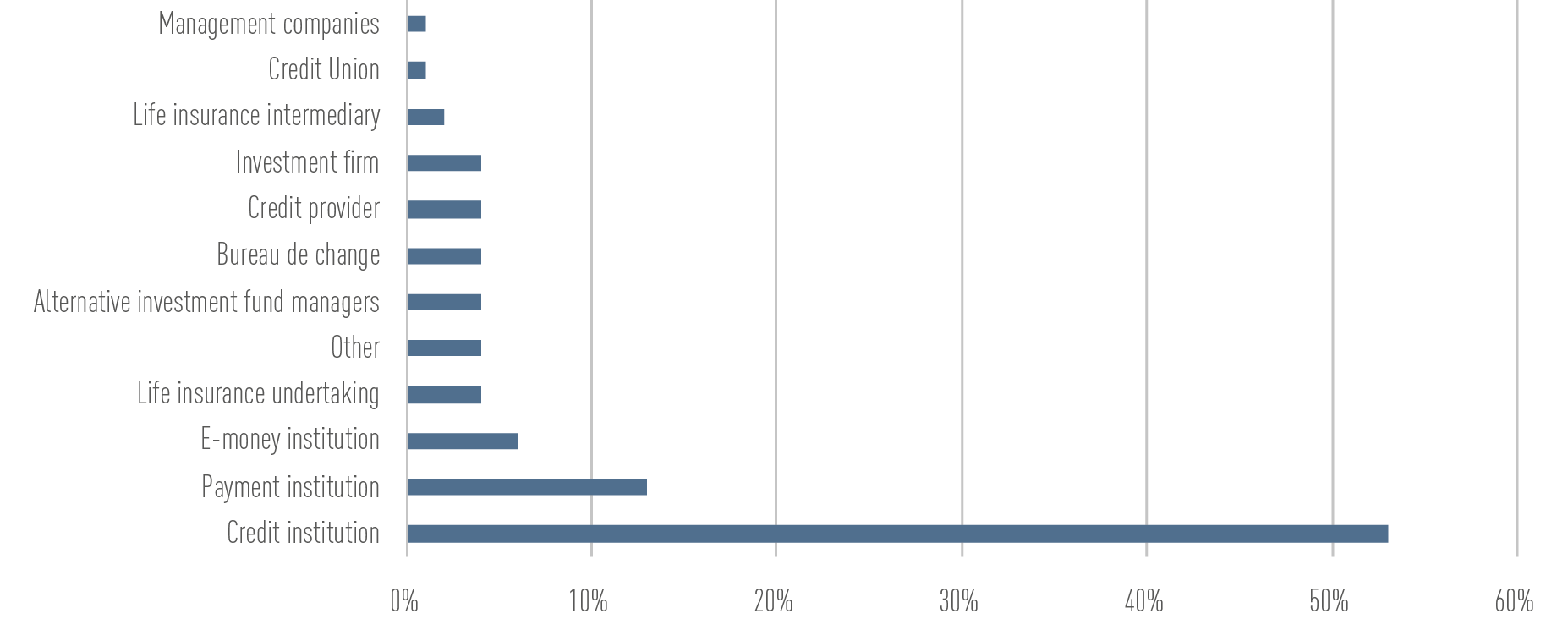

| Figure 18: | Types of entities concerned by the material weaknesses reported up to 31 December 2022 65 |

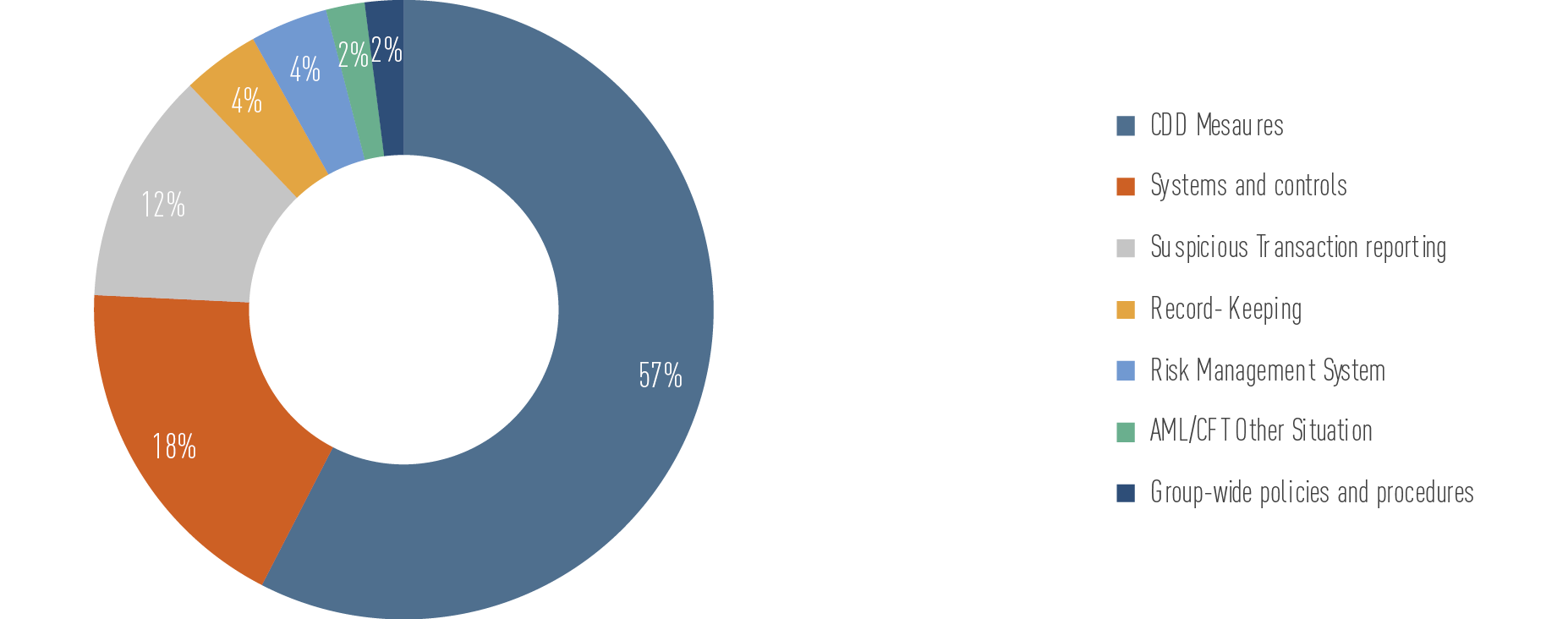

| Figure 19: | Distribution of material weaknesses submitted up to 31 December 2022 by category 65 |

| Figure 20: | key objectives of the EBA’s roadmap on sustainable finance 71 |

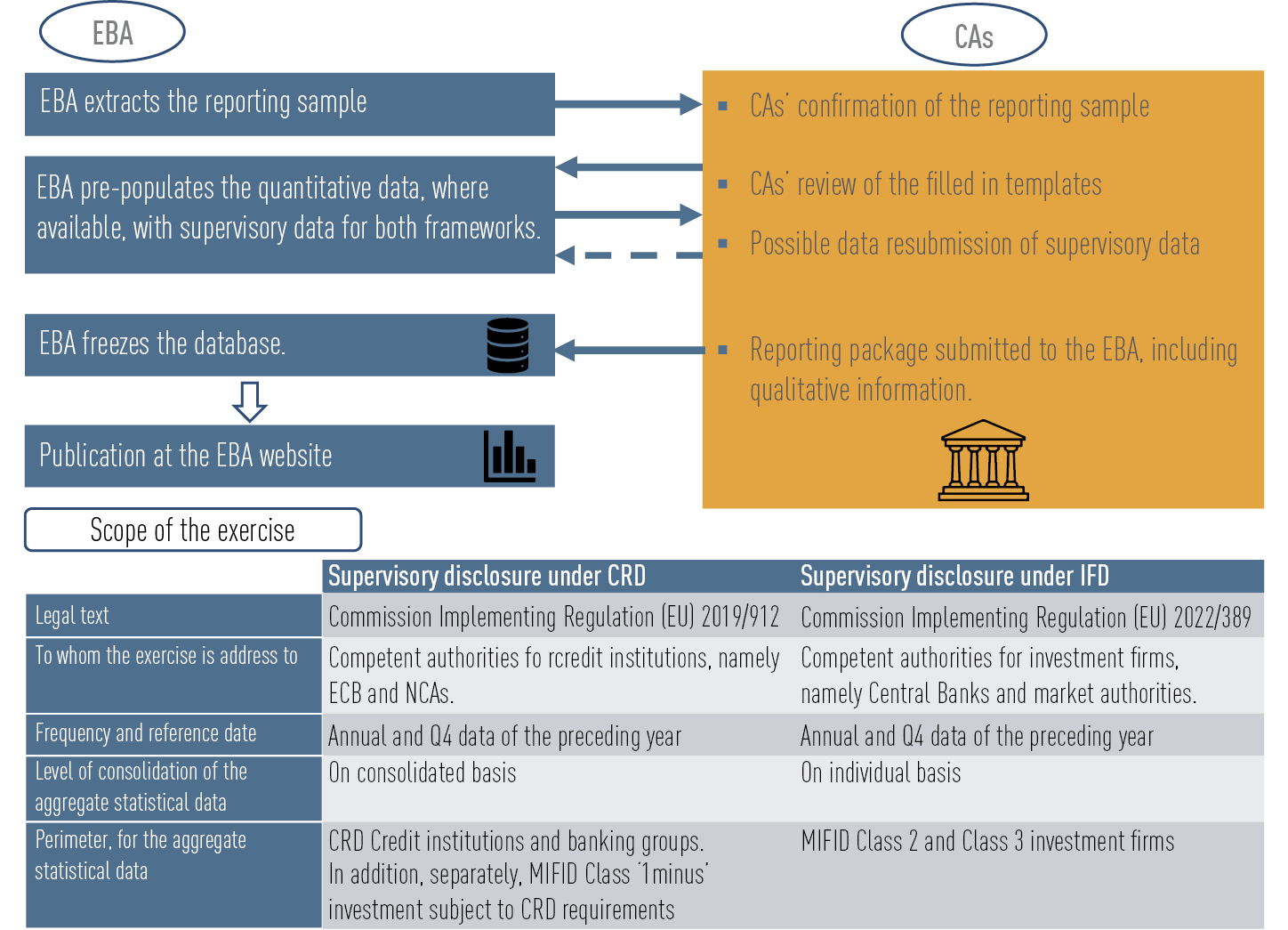

| Figure 21: | Supervisory disclosure process 91 |

Abbreviations

| AI | artificial intelligence | GCC | group of connected clients |

| AISP | account information service provider | GDP | gross domestic product |

| AML/CFT | anti-money laundering and countering the financing of terrorism | GL | guidelines |

| AMLA | Anti-Money Laundering Authority | HDPs | high-default portfolios |

| ARTs | asset-referenced tokens | IFD | Investment Firms Directive |

| BCBS | Basel Committee on Banking Supervision | IPU | intermediate EU parent undertaking |

| BM | Basel III Monitoring | IRRBB | interest rate risk in the banking book |

| BRRD | Bank Recovery and Resolution Directive | IT | information technology |

| CAs | competent authorities | ITS | implementing technical standards |

| CASPs | crypto-asset service providers | JBRC | Joint Bank Reporting Committee |

| CfA | Call for Advice | LCU | Legal and Compliance Unit |

| CRD | Capital Requirements Directive | MCD | Mortgage Credit Directive |

| CRR | Capital Requirements Regulation | MiCA | Markets in Crypto-Assets |

| CSV | comma separated values | ML | machine learning |

| CTR | Consumer Trends Report | ML/TF | money laundering/terrorist financing |

| CVA | credit valuation adjustment | MREL | minimum requirement for own funds and eligible liabilities |

| DeFi | decentralised finance | MS | mystery shopping |

| DGS | Deposit Guarantee Schemes | NCAs | national competent authorities |

| DORA | Digital Operational Resilience Act | NFCI | net fees and commissions income |

| DPM | data point model | NII | net interest income |

| DP | Discussion Paper | NPES | non-performing exposures |

| EBA | European Banking Authority | NPL | non-performing loan |

| EC | European Commission | NSFR | net stable funding ratio |

| ECB | European Central Bank | PSPs/IPSPs | payment service providers / intermediary payment service providers |

| ECJ | European Court of Justice | Q&A | question and answer |

| ECSPR | European Crowdfunding Service Providers | QIS | quantitative impact study |

| EFRAG | European Financial Reporting Advisory Group | RAR | risk assessment report |

| EIOPA | European Insurance and Occupational Pensions Authority | RegTech | regulatory technology |

| EMAS | Eco-Management and Audit Scheme | RoE | Return on Equity |

| EMTs | electronic money tokens | RTS | regulatory technical standards |

| ERM | enterprise risk management | SC | subcommittee |

| ESAP | European single access point | SCA&CSC | strong customer authentication and secure communication |

| ESAs | European supervisory authorities | SME | small and medium-sized enterprises |

| ESG | environmental, social and governance | SNCI | small and non-complex institutions |

| ESMA | European Securities and Markets Authority | SRB | Single Resolution Board |

| ESRB | European Systemic Risk Board | SREP | Supervisory Review and Evaluation Process |

| EU/EEA | European Union / European Economic Area | STS | simple, transparent and standardised |

| EUCLID | European Centralised Infrastructure for Supervisory Data | SupTech | supervisory technology |

| EuReCa | EBA’s central database on anti-money laundering and countering the financing of terrorism | TLAC | total loss-absorbing capacity |

| FRTB | fundamental review of the trading book | TFR | Transfer of Funds Regulation |

| FSB | Financial Stability Board | TPPs | third-party providers |

| FX | foreign exchange | XBRL | eXtensible Business Reporting Language |

| GBP | British pound sterling |

ACHIEVEMENTS IN 2022

Evaluating the robustness of EU banks

Analysing risks and vulnerabilities

One of the key EBA mandates is assessing risks and vulnerabilities in the EU banking sector to ensure the stability, transparency and orderly functioning of the sector.

A vast amount of information needs to be monitored and examined on a regular basis, as the EBA evaluates potential risks arising from EU banking activities. In doing this, the EBA examines quantitative and qualitative information, including supervisory data reported by banks and closely monitors market developments, such as banks’ debt issuances, their equity offerings, pricing and growth of loans and deposits and credit standards.

Several aspects are considered when evaluating banks’ resilience. These include the assessment of banks’ robustness in terms of solvency, liquidity and funding, credit risk, profitability, as well as the viability of banks’ business models. Other risks are also significant. These include market and interest-rate risks, operational risks, as well as ESG considerations. The EBA’s assessment of risks and vulnerabilities in the EU banking sector is discussed regularly at the EBA’s Board of Supervisors.

In 2022 EU banks maintained high capital ratios and average CET1 stood at 15.3%

The annual risk assessment report, which was published in December 2022, brought together these discussions, the analyses performed and the overall assessment of the EU banking sector.

Despite the difficult macroeconomic environment and the challenging conditions during 2022, EU banks maintained high capital ratios while re-starting the distribution of dividends and running share buyback programmes. EU banks reported an average fully loaded Common Equity Tier 1 (CET1) ratio of 15.3% in December 2022, slightly lower than a year earlier (15.8% in December 2021). The capital headroom above regulatory requirements (i.e. overall capital requirements and Pillar 2 Guidance) was almost 500 basis points. The average leverage ratio for EU banks is comfortably above the minimum regulatory requirement (5.5% in December 2022).

In the last few years, European banks have increased their available liquidity to historically high levels. European banks have reported strong liquidity positions above regulatory minimums. Even banks at the lowest end of the distribution have maintained ratios above regulatory requirements, with the lowest quartile at 158% for the liquidity coverage ratio (LCR) and 123% for the net stable funding ratio (NSFR) in December 2022. Yet, this should not lead to complacency. Some banks have recently seen large withdrawals due to a lack of confidence.

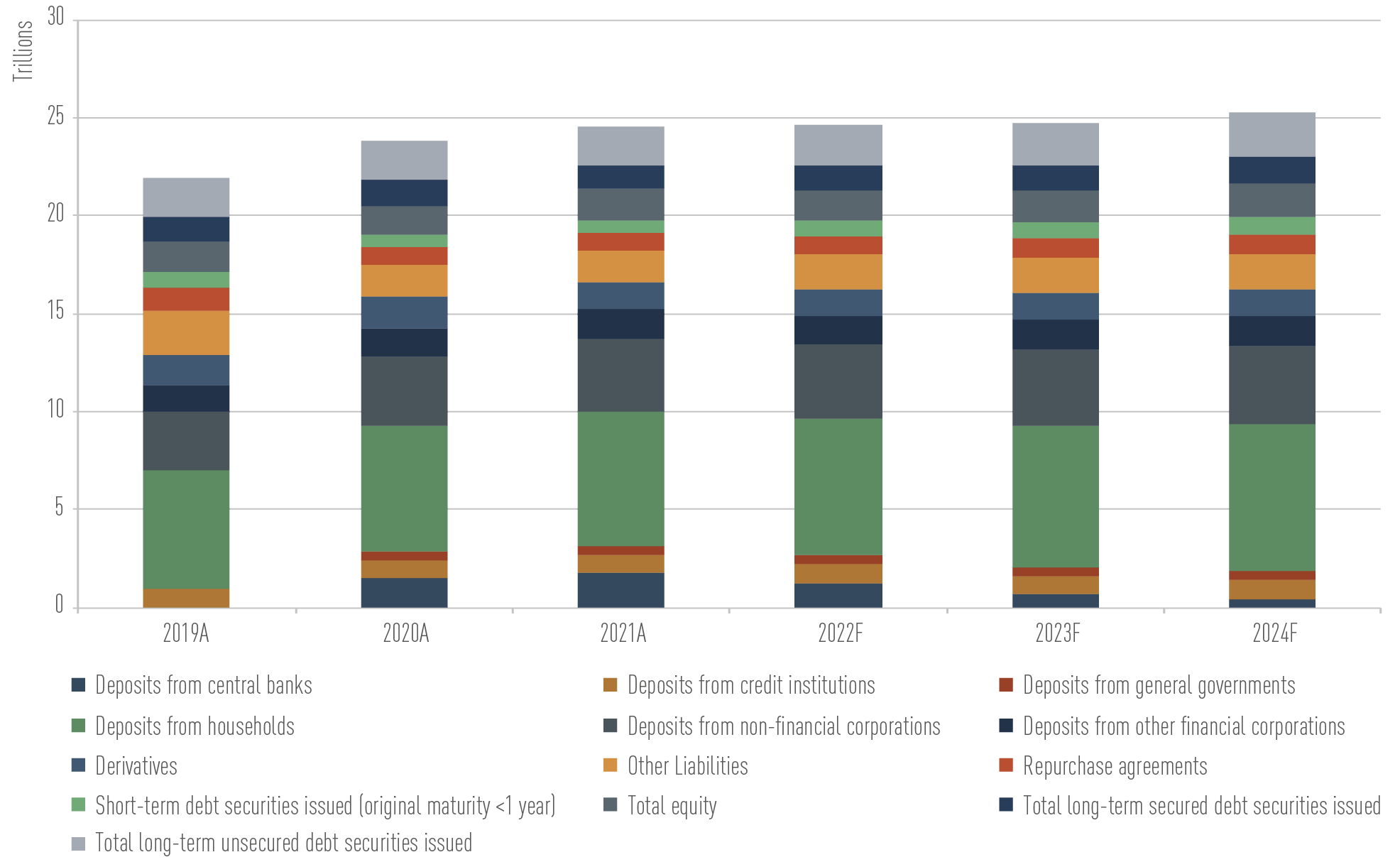

Figure 1: CET1 (fully loaded) ratio

Central banks have tightened their monetary policies at an unprecedented level in response to the rising and persistent inflation across Europe. This has resulted in an increase in banks’ funding costs, albeit from a very low historical base. As monetary tightening policies are deployed, banks will also need to repay substantial amounts of central bank loans by 2024. At the same time, banks also need to meet minimum requirements for own funds and eligible liabilities (MREL). This can increase banks’ funding costs. Banks may be able to rely on existing liquidity buffers – including central bank deposits – to pay back central bank loans. Some banks however may need to issue additional debt or attract new deposits, while volatile markets may continue to challenge banks’ ability to obtain market funding.

Banks’ funding plans reveal intention to increase market-based funding

To further analyse funding and liquidity risks, the EBA publishes a Funding Plans Report annually. In 2022, 159 banks submitted their funding plans for a forecast period from 2022 to 2024. The report highlighted strong deposit growth and an increase in public sector sources of funding in 2021. Banks’ funding plans revealed intentions to increase market-based funding over the forecast period, while the gap between planned debt issuances and maturing targeted longer-term refinancing operations (TLTRO) in the coming two years remains significant. The report also estimated that the shift in economic and monetary developments will reduce banks’ liquidity coverage ratios (LCRs) and net stable funding ratios (NSFR) going forward.

Figure 2: Funding plan expectations

In 2022 asset encumbrance ratio decreased to 25.8 %

In addition to the Funding Plans Report, the EBA published the asset encumbrance report, which also looks into liquidity risks. The report shows that banks continued to make extensive use of central bank funding in 2021. As a result, the overall encumbrance ratio rose by 2.2 percentage points in 2021 to 29.1%. More than 50% of their central bank eligible assets and collateral were encumbered. Increasing encumbrance ratios might lead to adverse feedback loops of higher encumbrance and higher funding costs.

The increasing encumbrance levels reported since the outset of the pandemic have now reversed to their pre-pandemic average levels. According to data at the end of 2022, the asset encumbrance ratio decreased during 2022 to 25.8%. The trend reversal is attributed to the decrease in encumbered assets and collateral received by 7.3% or EUR 640 billion. At the same time total assets and collateral received increased by 4.6% or EUR 1.4 trillion.

Funding risk and EU banks’ reliance on foreign currencies for funding was also one of the key risks identified in the Risk Dashboard in 2022

Given the rising liquidity and funding risks and the importance of these metrics in analysing the resilience of the EU banking sector, during 2022, the EBA expanded the coverage of liquidity ratios in its quarterly EBA Risk Dashboard to provide further information on liquidity metrics, by providing the amount and composition of liquid funds (LCR numerator) as well as for available stable funding (NSFR numerator).

The funding risk and EU banks’ reliance on foreign currencies for funding was one of the key risks identified in a report in 2022. The report on EU dependence on non-EU banks and EU banks’ dependence on funding in foreign currencies shows that a considerable number of EU banks report foreign currency LCR levels below 100% and/or a currency mismatch between buffers and outflows. Many EU banks fund at least some of their assets in a currency different from the one in which the assets are denominated, thus creating a risk of currency mismatch in the overall LCR. Among the significant (foreign) currencies, the US dollar (USD) and the pound sterling (GBP) are those that show the lowest LCR levels for EU banks. Differences were also found when analysing the components of the banks’ LCR in USD relative to the overall LCR. The liquidity buffer in USD relies mainly on Level 1 securities as opposed to cash and central bank reserves, which is the case for the overall LCR. ‘“Other outflows” followed by outflows from “non-operational deposits” are the main component of USD outflows.

Key risks identified in 2022 risk dashboards

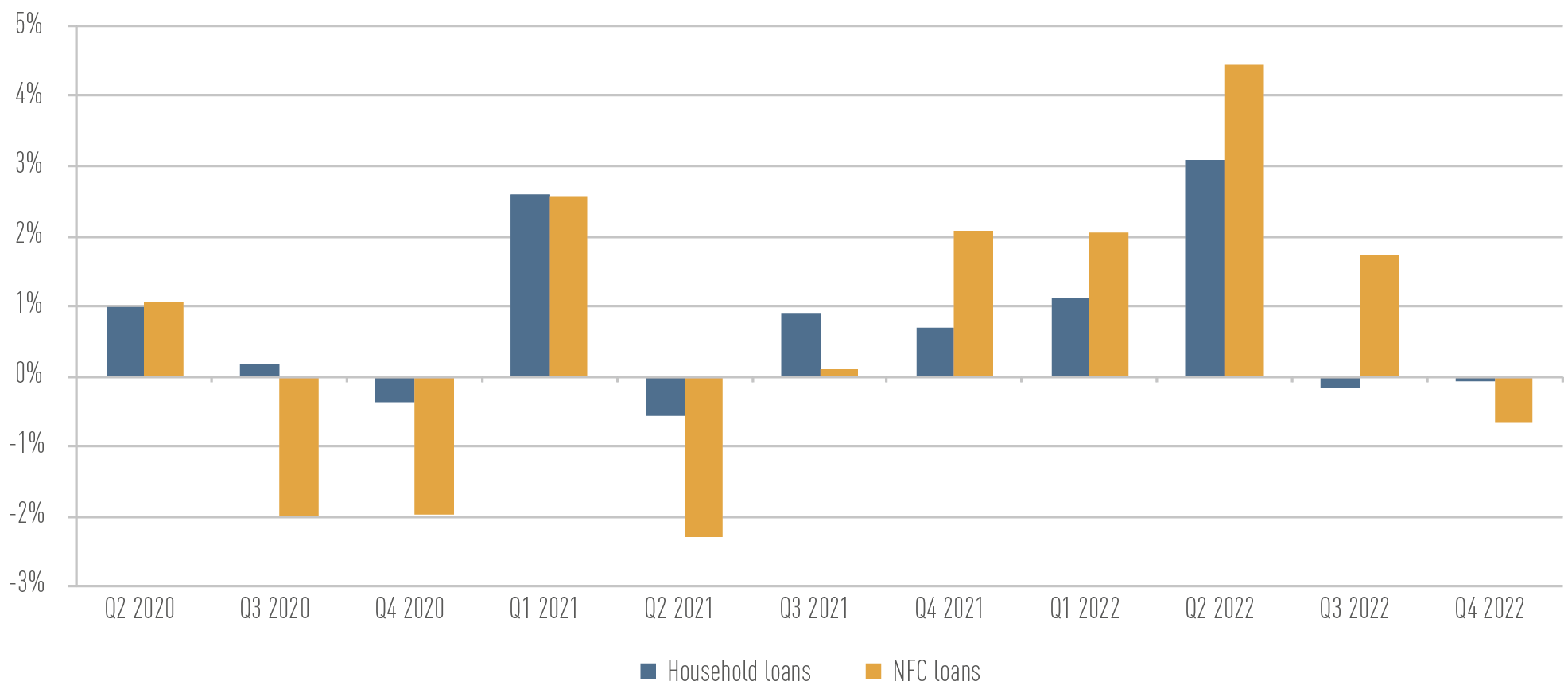

In addition to the solvency and liquidity risks, the quarterly EBA Risk Dashboard also reports trends in asset developments and quality. Overall, EU banks expanded their loan exposures during 2022, but with some differences among segments. While loans to non-financial corporates increased by almost 8% (driven mainly by large corporates), loans to households increased by almost 4% (driven mainly by mortgage loans). In addition, most of the increase took place during the first half of the year. Increasing interest rates, the persistence of inflationary pressures and heightened uncertainty due to the energy crisis during the second half of the year not only limited borrowers’ demand for loans, but resulted in banks significantly tightening their credit standards. This requires monitoring due to the role of banks as lenders in the economy.

Part of the increase in loans to non-financial corporations (NFCs) was due to the increase in banks’ exposures to the energy sector. The increased price volatility of oil and gas markets created unprecedented liquidity needs for energy-related firms in autumn 2022. Banks have been actively engaging with energy companies to provide a wide range of services to manage volatility in derivative energy markets. As a result, banks have substantially increased their overall exposures to the sector, both in terms of loans as well as derivatives. These exposures are concentrated in a small number of banks (please see interview box on this).

The asset quality of EU banks improved in 2022, yet credit risk needs to be closely monitored. The non-performing loan (NPL) ratio continued on a downward trend and its dispersion across banks tightened significantly. Although new NPL inflows remained significant, overall, banks managed to decrease NPL exposures as a solution and outright sales of NPLs (or securitisations) played a significant role. During 2022, the share of stage 2 loans stood at its highest level since implementation as banks recognised an increasing volume of loans in this stage. Banks also substantially increased provisions for performing loans. Nonetheless, the overall cost of risk has fallen below pre-pandemic lows presumably because of current substantial NPL outflows and the release or the reallocation of unused COVID-19 provisioning overlays.

The worsening macroeconomic environment due to the increase in inflation rates, the abrupt increase in interest rates, the consequences of the Russian invasion of Ukraine such as the energy crisis and the heightened geopolitical uncertainty, have amplified downside risks for economic growth and exposed vulnerabilities in several portfolios.

This mix of developments primarily affects vulnerable households that need to allocate an increasing share of their budgets to food, energy and debt repayments. Against this backdrop, debt servicing capacity, especially for highly indebted households and non-financial corporates, could be impaired. In the aftermath of the pandemic, non-financial corporates were the main driver behind the increase in the share of stage 2 loans. However, this changed in the second half of 2022, when banks started increasing the allocation of household loans (both mortgages and consumer credit) in stage 2. In addition, EU banks reported a marginal increase in the volumes of NPLs for consumer credit. These exposures are particularly sensitive to economic growth and especially unemployment rates and they are usually the first to react in economic downturns.

Bank exposures to SMEs remained significant in the current macroeconomic environment. SMEs have not only been challenged by rising interest payments, but also by higher energy costs. The access to capital markets has also been difficult for larger companies which have in response sought funding from banks. This raises the risk of crowding out SMEs as banks tighten their credit standards and limit the expansion of their balance sheets.

The abrupt increase in borrowing costs has also affected real estate markets. EU banks are highly exposed to residential real estate, with EU banks reporting more than EUR 4.2 trillion outstanding loans as of December 2022. The abrupt increase in borrowing costs has also affected real estate markets. EU banks are highly exposed in residential real estate, with EU banks reporting more than EUR 4.2 trillion outstanding loans as of December 2022. This is their biggest portfolio which makes up around 25% of total loans to households and NFCs. To explore the risks of the EU banking sector to residential real estate exposures, the EBA published a thematic note in October 2022. The note identifies that during the pandemic and its aftermath, the demand for housing accelerated rapidly, also propelled by historically low interest rates and the liquidity accumulated during the pandemic, which helped borrowers to meet down payments for mortgage loans. Although exposures to mortgage loans increased rapidly in the post-pandemic period, rising interest rates, heightened uncertainty and the slowdown in economic growth curbed the demand for loans. At the same time, banks started tightening their credit standards. As a result, the growth in outstanding mortgage loans halted during the second half of 2022, while there have already been some indications that house prices began to correct themselves in some areas of the EU. This could impair consumer confidence and their overall expenditure, dampening economic activity further. Although an increasing share of mortgage borrowers have a fixed-rate loan – at least for a predefined period of their loan – those with variable rates will be challenged by higher interest-rate payments. In this regard, their repayment capacity may be impaired, given also the unprecedented inflationary pressures in the cost of living. As a result, banks may be challenged not only with increasing default rates, but as housing prices correct, the collateral valuation is lowered. To some extent banks have taken precautionary measures against such a downturn, as loan-to-value ratios are lower compared to previous years (partly due to rising valuations). This was also a result of stricter credit standards, partly due to guidelines on loan origination and partly because of macroprudential borrower-based measures applied in various jurisdictions.

Figure 3: Outstanding loan growth by segment

Another area of concern has been commercial real estate exposures. Although EU banks’ exposure to this segment is smaller (around EUR 1.4 trillion as of December 2022), it has grown significantly during 2022 (around 9% YoY growth in outstanding volumes). This sector displays procyclical behaviour and has therefore concentrated significant investment in previous years, benefiting from the low-rate environment. The pandemic particularly impacted the sector. In fact, it was one of the segments that made extensive use of COVID-19-related support measures, such as moratoria on loan repayments. Pockets of risks could be exacerbated for the segment as higher interest rates add pressure to these corporates while they tackle rising energy costs and subdued demand due to the post-pandemic impact of lower office demand. Commercial real estate exposures have one of the highest NPL ratios (3.7% at end 2022), as banks still struggle to clean up legacy assets from previous crises. This could deteriorate because of the rise in construction and financing costs and lower demand due to changes in work practices with the increase in working from home.

Banks have raised their provisions against future credit losses due to an increasing credit risk. Thus, the cost of risks has marginally increased during the second half of 2022. However, it remains lower than pandemic levels (43 basis points as of December 2022). The strong profitability tailwinds due to strong lending growth of previous years and higher net interest margins (NIM) helped increase banks’ return on equity (RoE) year on year (YoY) and absorb the increase in provisioning needs. Banks reported the highest level of RoE during 2022 for many years. In December 2022, EU banks’ RoE was reported at 8% (7.3% in December 2021). This creates a first line of defence against rising risks for EU banks. The expected macroeconomic deterioration will likely result in slower lending growth and rising impairments, and higher inflation may increase operating costs. Lower GDP growth and rising rates could also result in lower fee income from asset management and payment services. Finally, banks that are more reliant on wholesale funding may face more rapid increases in funding costs.

As the recent banking crisis has proved, other sources of risks cannot be overlooked. The EBA has been monitoring these either through supervisory data, where available, as well as using qualitative surveys such as the Risk Assessment Questionnaire (RAQ), which surveys banks and bank sector analysts twice per year on a variety of risks, not only in risks such as business model viability, profitability, asset quality and funding risks but also it includes conduct risk, ESG considerations, Fintech and questions for anti-money laundering.

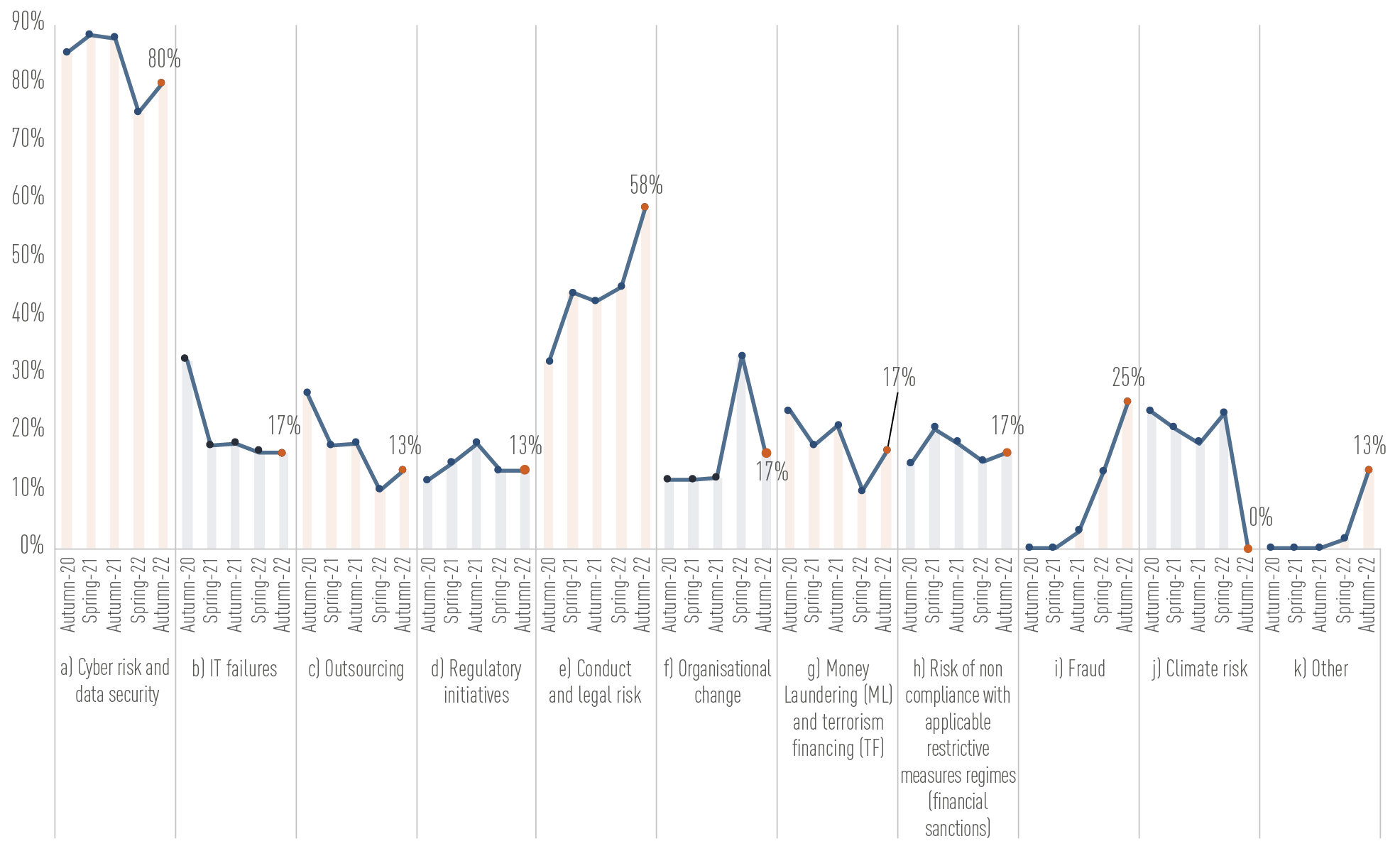

Operational risk has become increasingly relevant in the past years. With the pandemic, digitalisation and the use of ICT by banks and their customers further accelerated and became indispensable. Digital transformation continued unabatedly even after many containment measures related to the pandemic were relaxed. In response to ICT risk, the incoming DORA aims to provide a framework for the mitigation of ICT risks and to enhance operational resilience of financial entities across sectors. According to the Autumn 2022 RAQ, a large majority of retail banking and corporate banking customers are now primarily using digital channels for their daily banking activities.

Reliance of banks on digital and remote solutions to perform their daily operations, to deliver their services to customers, and to conduct business has resulted in an enhanced exposure and vulnerability to increasingly sophisticated cyber-attacks and to fraud. Scope and relevance of operational risk further broadened along with technological advances and underlines the importance of ensuring operational resilience.

Moreover, banks are facing increased operational challenges since geopolitical tensions are playing an increasing role in the technological and digital space, with impacts felt across geographies. The Russian war of aggression against Ukraine has led to further heightened cyber risks, including threats to information security and business continuity.

Exposure to reputational and operational challenges, including business conduct and organisational change, for example, have neither diminished with the pandemic. To RAQ respondents, conduct and legal risk is the second most relevant driver of operational risk. The Russian war of aggression and sanctions implemented at an EU and global level in response may give rise to further legal and / or reputational risks. Against this backdrop, an enhanced monitoring of sanctions compliance by banks and supervisors is essential.

Figure 4: Main drivers of operational risk as seen by banks

First mandatory QIS exercise

In March 2021, the EBA published a decision to change the Basel III monitoring exercise from voluntary to mandatory with effect from December 2021. Since December 2021, the EBA has required EU banks to regularly assess the potential impact of implementing Basel III banking supervision principles. This allows the EBA to monitor the convergence of a consistent sample of banks over time and to submit its proposals to the European Commission (EC) on items of EU regulation that better address the specificities of the EU banking system and ensure its safe and smooth functioning.

The conduct of the mandatory Basel III monitoring (BM) exercise analyses (i) the impact of the final Basel III rules on European credit institutions’ capital and leverage ratios and (ii) the associated shortfalls that would result from a lack of convergence with the fully implemented Basel III framework. In September 2022, the EBA published its first report on the mandatory Basel III monitoring exercise using data as of December 2021. The report contains a breakdown of the impact on the total minimum required capital arising from credit risk, operational risk, leverage ratio reforms and the output floor.

The first round of the mandatory BM exercise resulted, on average, in the submission of better-quality data, even from the credit institutions that participated in the exercise for the first time. Except for being more reliable, the data provided enables the EBA to analyse a more representative sample amounting to more than 150 banks, i.e. it increased by roughly 50% in relation to the previous reporting dates. In addition, the participants were more informed about the content of reporting, as the EBA held regular seminars and workshops, as well as bilateral explanatory sessions, with the relevant competent authorities (CAs) and the participating banks.

The main factors driving the impact of the Basel III framework results are the implementation of the output floor and the credit risk reform, at 6.3% and 4.4% respectively. The new leverage ratio is partially counterbalancing the impact of the Basel III risk-based reforms by 3.3%.

The accumulation of data from a wider sample enabled the EBA to provide national competent authorities and the Basel Committee on Banking Supervision (BCBS) with more in-depth feedback on issues relevant to data quality issues and the challenges that the analysis in the BM report had to confront. Based on the impact observed from the analysis, the EBA can now provide input to assist the BCBS with the development of supervisory standards. In addition, the EBA continues collaborating closely with the BCBS to develop methodologies that more accurately evaluate the impact of the proposed BCBS supervisory standards and ensure there is alignment between the EBA and the BCBS.

On 1 December 2022, the EBA published the revised sample of banks that would participate in the December 2022 mandatory BM exercise. The resulting sample of banks closely follow the composition of the EU banking sector in a way that takes into account both the risk-weighted-assets coverage (more than 80% overall) and the number of institutions in each jurisdiction.

| BANK CLASSIFICATION: Systemic importance / Business model |

Universal | Retail-oriented |

|---|---|---|

| Global Systemically Important Institutions (G-SII) | 8 | 0 |

| Other Important Institutions (O-SII) | 82 | 5 |

| Other | 12 | 16 |

| TOTAL | 102 | 21 |

To address the principle of proportionality at data submission level, the EBA limits the mandatory fields to those considered necessary for the overall assessment of the Basel III impact and to those that appear to have the highest impact in previous (voluntary) submissions.

EBA stress test activities

Preparing for the 2023 EU-wide stress test

Given the uncertain macroeconomic environment and rising probability of risks materialising for the EU banking sector, the need for stress testing the solvency of banks is even more important. The EU-wide stress test is part of the supervisory toolkit used by CAs to assess the resilience of EU banks to severe shocks, identify residual areas of uncertainties, as well as feed into the supervisory decision-making process to determine appropriate mitigation actions. The stress test also allows CAs to assess if the capital banks have accumulated in recent years, is sufficient to cover losses and support the economy in stressed times. Moreover, the exercise fosters market discipline through the publication of consistent and granular data on a bank-by-bank level, as it shows how balance sheets are affected by common shocks.

The stress-test exercise requires a substantial amount of preparatory work which concluded during 2022 with the publication of the stress-test methodology and templates. Part of the preparatory work consisted of a discussion with the industry (including a workshop and public consultation) where stakeholders were able to discuss their questions on the exercise. By leveraging the discussion with the industry, the methodology was published in November and templates were published in mid-December 2022, allowing time for banks to familiarise themselves with templates and the methodology.

Along with the enhanced sample of banks included in this year’s exercise (70 vs 50 in the previous stress-test exercise), the methodology has also undergone some significant enhancements compared to the one used for past stress-test exercises. These enhancements include the incorporation of lessons learnt from the previous exercise, introducing top-down items for net fee and commission income (NFCI), more detailed sectoral analysis, and an increased sample with larger coverage. The changes are part of the medium-term plan of revising the stress-test framework. The EU-wide stress test remains a predominantly bottom-up exercise with a gradual implementation of top-down items.

Figure 5: Tasks and responsibilities of the stress-test exercise

COVID-19, the war in Ukraine and subsequent consequences created the need for a more targeted sectoral analysis. As part of the more detailed sectoral analysis for credit risk, for the first time, banks will have to provide a breakdown of their exposures to firms and the related impairment by sector of economic activity. The main purpose of the breakdown by sector is to ensure that the results of the stress test reflect banks’ exposures to different sectors, thereby increasing the credibility and realism of the exercise. Furthermore, the reference rate pass-through on sight deposits from households and non-financial corporations (NFCs) has been recalibrated to increase the realism of the exercise.

Further developing and implementing top-down stress-test capacity

Following the EBA decision to move to a hybrid framework in a step-by-step approach, the EBA worked together with the European Central Bank (ECB) and the CAs to design the top-down models. In 2022 the focus was on reviewing and validating existing top-down models for projecting the net interest income (NII) and NFCI in the stress test. It was decided to postpone the implementation of the NII top-down model, while the NFCI model was deemed ready for implementation in the 2023 EU-wide stress test.

The initial NFCI model was developed by the ECB and has been validated by the EBA and National Competent Authorities to ensure its suitability for the purposes of the EU-wide stress test. To reduce model risk, the raw model projections are subject to a model overlay. The overlay takes the form of a “corridor” with a maximum and minimum permissible decrease of cumulative NFCI (cap and floor).

Using this type of model applies a different philosophy for completing the stress-test submissions. During previous stress tests, banks had to use their internal models to project the NFCI amounts over the 3-year horizon for both the baseline and the adverse macroeconomic scenarios subject to some methodological constraints. The 2023 methodology departs from this approach as the NFCI top-down model is used to communicate projections to participating banks.

Introducing top-down items for the projections of NFCI is part of the EBA work on the future changes to the EU-wide stress test. This methodological change aims to reduce banks’ reporting and computational burden during the exercise, minimising the quality assurance for this area and ensuring a level playing field across banks.

The EBA will continue working to improve the current framework and maximise the information value of the results. In addition, and considering the experience gained during the 2023 EU-wide stress test on top-down models (i.e. NFCI), the EBA will further investigate the role of top-down aspects in the EU-wide stress test. More efforts should be made to implement additional aspects for future stress tests and further expand the top-down approach to some other risk areas, such as NII or credit risk.

Work on climate risk stress-testing

Climate risk stress testing is one of the EBA’s top priorities and the EBA is planning to address the new mandates from the Renewed Sustainable Finance Strategy of the EC in the short term. The mandates include running a regular climate change stress-test exercise and developing guidelines for banks and supervisors to assess the impact of ESG risks under adverse conditions. Furthermore, the ESAs, with the support of the ECB and the European Systemic Risk Board (ESRB), have been invited by the European Commission to cooperate on a one-off system-wide climate risk stress test to assess the resilience of the financial sector in line with the Commission’s Fit-for-55 package.

In 2022, the EBA discussed the strategy on climate risk stress testing with the EBA Board of Supervisors. One of the conclusions was to separate, at least in the short term, the climate risk stress test from the EU-wide stress test and perform the climate stress test in a pragmatic way, relying as much as possible on existing synergies.

Furthermore, in 2022 the EBA started internal work on the mandates for the one-off exercise and coordinated with the ESAs, the ECB, the ESRB and the EC on the precise planning of the necessary tasks to perform the exercise. This exercise will require close coordination among all parties.

Moreover, in 2022 the EBA worked on the preparation of a workshop on climate risk stress test to discuss possible practical solutions for adapting or changing the current stress-testing framework to accurately assess the effects of climate-related risks on the banking sector. The insights from the workshop will be key inputs for shaping the EBA regular climate risk stress-test framework in the 2023.

Finally, the EBA is planning to review its Guidelines on institutional stress testing to provide guidance for institutions on how to test their resilience to climate change and the long-term negative impacts of ESG factors. This work will be carried out in accordance with the mandate proposed by the EC in its revision of the Capital Requirements Directive (CRD), draft Article 87a(5)(d). Nevertheless, the timeline for the publication of the consultation paper and final guidelines will depend on the outcome of the legislative process.

The EBA’s response to the Russian invasion of Ukraine

The Russian invasion of Ukraine has taken a heavy toll on the Ukrainian state, society and economy. Following the restrictive measures against Russia and rising energy prices and inflation, the conflict has transformed the macroeconomic landscape creating several challenges for European citizens, the economy and the financial sector. In this context, the EBA has rapidly assessed the potential implications for the banking sector by evaluating the readiness of the regulatory framework to deal with the specific features of the conflict and the relevant disruptions visible in the markets and by deploying the tools available to ensure a coordinated response among prudential supervisors.

Impact of the Russian invasion of Ukraine on the EU banking sector

At the outset of 2022, the European economy was recovering from the effects of the pandemic. However, the Russian invasion of Ukraine posed a new challenge. Tensions in the supply chain due to the pandemic were exacerbated by the war, the subsequent energy crisis and the abrupt inflationary pressures. To tackle inflation, central banks across the world have responded with faster-than-expected interest-rate rises accompanied by monetary tightening of their balance sheets. What was expected to be a rather short-term inflation spike has proven to be more persistent.

At the outset of the Russian invasion, the EBA had to assess its impact on the EU banking sector. According to the assessment done in March 2022, first round effects did not pose a material threat to the financial stability of the EU’s market. Such risks were idiosyncratic and were attributed to the direct exposures of EU banks to Russian and Ukrainian counterparties. As of Q4 2021, banks in the EU and the European Economic Area (EEA) reported exposures (loans, advances and debt securities) of EUR 76 billion and EUR 11 billion to Russian and Ukrainian counterparties, respectively. These exposures are mainly driven by subsidiaries of individual institutions. As European banks exited the Russian market or wound down their operations and exposures, by the end of 2022, their exposures amounted to EUR 49 billion. Austrian, French and Italian banks reported the highest volume of exposures to Russian counterparts.

More important from a financial stability perspective were the second-round effects. The heightened uncertainty about the outcome of the war in Ukraine and the potentially large impact on the wider EU and global economy of this conflict remain uncertain even one year after the start of the war. The supply shock of the war and the disruption in production lines have had a twofold impact. First, the unprecedented high inflation for the Eurozone and many other European countries, as well as the energy crisis that followed in autumn 2022. Economic growth in the EU slowed down substantially towards the end of 2022 yet avoided recessionary pressures. Besides the macroeconomic impact and the possible repercussions on banks’ balance sheets, through the deterioration in asset quality and heightened liquidity risks, EU banks were expected to be affected through other sources of risks, such as increased operational risks, including cyber and conduct risks.

The initial assessment of risks stemming from the conflict in Ukraine was published in a special feature within the quarterly EBA Risk Dashboard in April 2022. To provide market participants with further transparency, the EBA continued reporting at a country level and on a quarterly basis through the EBA’s risk dashboard on the evolution of both on- and off-balance sheet exposures to Russia and Ukraine.

Volatility in energy derivatives market

Achilleas Nicolaou

Bank sector analyst

Andrea Romero

Policy expert

On 13 September, the European Commission sent two letters to the EBA and the European Securities and Markets Authority (ESMA) on possible responses to excessive volatility in energy derivatives markets and unprecedented increasing level of margin requests.

Q1: What triggered the Commission request for an urgent response?

Achilleas: The Russian invasion of Ukraine (please see 1.1 on impact of Russian war on EU banks) prompted a significant increase in all major commodity prices, which skyrocketed for EU energy prices. The use of energy derivatives is essential for energy companies when planning their operations. Trading in EU energy derivatives, normally conducted on regulated markets and centrally cleared, involves the posting of margin (highly liquid collateral) as a performance guarantee. Margin calls at CCPs have risen in line with the sharp rise in energy prices and energy companies needed access to collateral to meet these calls, resulting in fast-growing liquidity problems. Some Member States quickly reacted providing public guarantees to energy firms, while also calling for amendments to the requirements for margin calls to ease stress situation for the energy sector.

Q2: What did the Commission request the EBA to focus on?

Andrea: The Commission asked the EBA to reflect on the role played by banks, assessing their provision of collateral transformation services, whether the provision of guarantees to be posted as collateral by non-financial counterparties could be facilitated and whether other measures would be possible to minimise the liquidity challenges faced by energy companies. In addition, the EBA was asked to cooperate on ESMA’s work on temporary amendments to Commission Delegated Regulation (EU) No 153/2013, to facilitate the provision of collateral by energy firms.

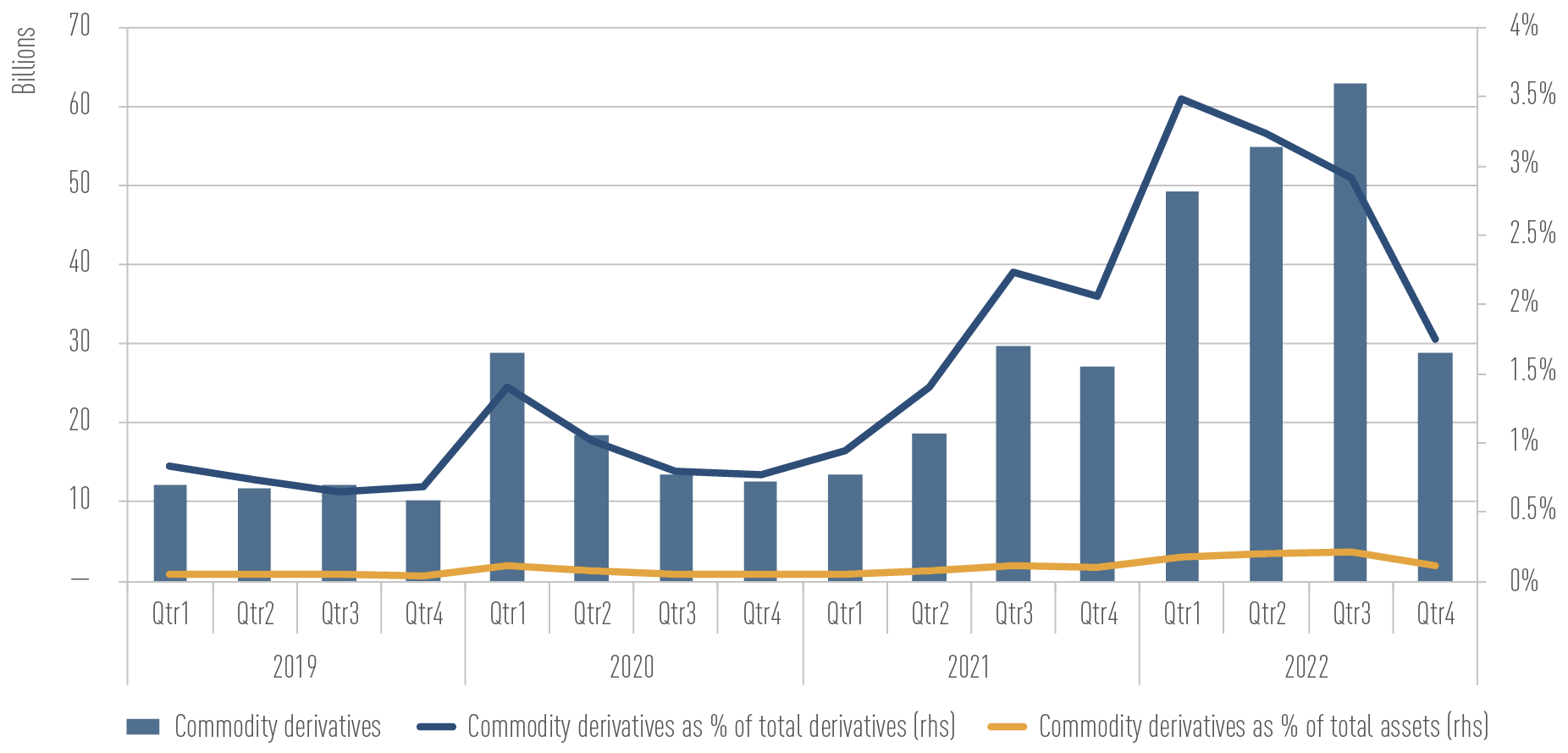

Q3: What was the role played by banks until that point?

Achilleas: Banks have always played a key role for energy firms, not only providing to them clearing services for derivative products, but they also extent short-term credit supporting energy firms to meet their collateral obligations.

Credit towards energy firms has been on the rise since the early signs of the energy crisis. Banks have always been providing significant support to energy firms by facilitating the posting of collateral towards CCPs, including by means of collateral transformation services. During the spike in energy prices, higher usage of existing credit lines was offered to banks’ clients, as well as an expansion of various forms of collateral transformation. Although support from banks to energy firms was growing to meet demand for credit, we saw that as only a handful of banks are active in these markets, their internal risk limits started to constrain banks’ capacity to further support energy firms to their needs.

Q4: Which elements have been considered to bolster banks’ capacity to assist energy firms?

Andrea: Let me start by saying that the increase in the level and volatility of energy prices was driven by the significant disruptions to the EU energy supply markets, therefore reflecting a significant increase in real economic risk. The prudential framework is exactly in place to protect banks from excessive risk undertaking and in turn the overall financial stability, including from possible spill-over effects from the energy to the banking sector. Therefore, its soundness and risk-sensitiveness should not be eroded, also considering that most of the binding constraints for banks to further assist energy firms arose from existing internal risk management limits.

However, the EBA flagged the importance of increasing transparency around margin calls, to facilitate banks’ liquidity management – in fact, sudden significant margin requests can easily exacerbate the liquidity shortage experienced in a crisis.

With respect to banks’ guarantees, the EBA noted their use as collateral for clearing members, rather than as collateral for CCPs. In their uncollateralised form, their use as eligible collateral at CCPs was considered as possible temporary measure to alleviate liquidity strains, subject to certain restrictions as outlined by ESMA.

Q5: What is the latest follow-up on the energy crisis?

Achilleas: EU banks reported in the fourth quarter of 2022 around EUR 340 billion of exposures towards energy firms, slightly lower than in the previous quarter. Towards the end of the year, energy prices had eased considerably from their peak levels. For this reason, exposures towards commodity derivative retreated back to end-2021 levels. Volatility, however, remains elevated in energy markets compared to previous years, warranting close monitoring of the developments in this sector, since commodity prices are closely linked to geopolitical developments and therefore remain highly volatile.

Figure 6: EU banks’ exposures towards commodity derivatives

Source: EBA Supervisory reporting data

Regulatory and supervisory actions taken

Readiness of the regulatory framework and evaluation of the potential impacts

Since the inception of the conflict, the EBA began identifying and listing possible related prudential issues arising from the prudential framework under the mutated circumstances. The framework has proven robust in past crises and equipped to deal with such situations. Nonetheless, a close assessment of specific features of the deteriorating environment and the extraordinary global and EU response was warranted to evaluate any potential loopholes to be potentially addressed from a regulatory perspective. The areas investigated were manifold, ranging from the application of the prudential consolidation requirements to the credit risk and market risk area, as well as some specific accounting requirements potentially impacting the prudential requirements. Even if no immediate actions have been deemed necessary from a regulatory perspective, continuous monitoring of the situation vis-à-vis the prudential and accounting aspects is still ongoing.

Ensuring a consistent supervisory approach to the macroeconomic events that affected the financial situation of banks

All competent authorities, with very few exceptions, undertook supervisory activities to assess the direct and indirect implications of the Russian aggression against Ukraine, the asset concentration in energy sensitive sectors, as well as the consequences of interest-rate rises, inflation risk and related asset price corrections. Banks were required to report regularly to the competent authority the direct exposures to Russia, Ukraine and Belarus, which were further analysed in a proportionate manner. The highest attention to the indirect implications was warranted as CAs undertook vulnerability assessments, monitored second-round effects, conducted walk-away scenarios and examined ICT security implications.

In line with its mandate to foster the efficient, effective and consistent functioning of supervisory colleges, from the onset of the Russian aggression against Ukraine, the EBA has proactively facilitated information sharing on the direct and indirect implications on the banking groups and its subsidiaries/branches and for coordinating supervisory actions. In some cases, the EBA had to initiate interactions and recall the importance of colleges as a forum for coordinating supervisory responses to an adverse event.

The EBA aims to include its experiences from the monitoring of supervisory colleges in 2022 in the update of the regulatory and implementing technical standards on the functioning of supervisory colleges1., In particular it will include its experiences on college interactions in the context of the Russian aggression against Ukraine by strengthening the identification of early warning signs, potential risks and vulnerabilities, and increasing information exchanges if there is an adverse material effect on the risk profile.

Derisking аnd financial inclusion in the context of the war in Ukraine

In April 2022, the EBA published a statement setting out what financial institutions and their supervisors can do to provide refugees from Ukraine with access to the EU’s financial system. The EBA also indicated what financial institutions and supervisors can do to protect vulnerable persons from abuse by criminals, to prevent human trafficking and called on financial institutions to ensure that compliance with the EU’s restrictive measures regime does not lead to unwarranted de-risking.

The outbreak of the war in Ukraine coincided with the EBA’s preparation of new guidelines aimed at tackling the adverse impact of de-risking on vulnerable customers such as refugees and human relief efforts. In December, the EBA consulted on two new sets of guidelines: the guidelines on effective money laundering (ML) and terrorist financing (TF) risk management and access to financial services; and the guidelines on the risk factors to consider to manage risks associated with customers that are not-for-profit organisations. Together, these guidelines foster a common understanding throughout the EU on what institutions should do to tackle ML/TF risks effectively, while taking care not to deny customers access to financial services without good reason. The final guidelines will be published in Q1 2023.

Supporting the implementation of sanctions

To assist the EC and the national authorities in monitoring the deposits under the Russian and Belarusian sanctions, the EBA designed templates for the reporting of deposits falling under the economic sanctions. The templates and associated instructions published in May 2022 were meant for voluntary use by the relevant national authorities responsible for then monitoring the sanctions in the Member States. While leveraging the EBA’s expertise in designing common European supervisory reporting frameworks, these templates do not form part of the EBA reporting framework.

Updating the prudential framework

The Single Rule Book

Ensuring consistency

-

Finalising the framework for the IRRBB

In October 2022, the EBA delivered on its CRD mandates to amend the framework for the interest rate risk in the banking book (IRRBB). The EBA developed an improved set of guidelines and two final draft regulatory technical standards (RTS) specifying technical aspects of the revised framework capturing IRRBB positions. These regulatory products complete the enacting into EU law of the Basel standards on IRRBB and are of crucial importance given the current interest-rate environment.

The Guidelines on IRRBB and credit spread risk arising from non-trading book activities (CSRBB) will provide continuity to the current guidelines published in 2018, which it will replace, while including new aspects, particularly the criteria to identify non-satisfactory internal models for IRRBB management and those to assess and monitor credit spread risk arising from non-trading book activities.

The final draft RTS on the IRRBB standardised approach specify the criteria to evaluate the risks arising from potential changes in interest rates that affect both the economic value of equity (EVE) and the NII of an institution’s non-trading book activities. They will also provide a simplified standardised approach for smaller and non-complex institutions.

The final draft RTS on IRRBB supervisory outlier tests (SOT) specify the modelling and parametric assumptions and the supervisory shock scenarios to identify institutions for which the EVE would decline by more than 15% of Tier 1 capital, as well as to evaluate if there is a large decline in the NII.

The EBA committed to closely monitor their implementation and more generally the impact of the evolving interest rates on the management of IRRBB by EU institutions and on other related prudential aspects.

-

Monitoring work on capital

In 2022 the EBA continued its monitoring work under its mandate as per Article 80 of Regulation (EU) No 575/2013 (Capital Requirements Regulation – CRR)2. In this chapter, three of the main streams of work performed are described: i) monitoring of the implementation of the Opinion on the Legacy Instruments; ii) closing of the pre-CRR CET1 review; and iii) monitoring of total loss-absorbing capacity and minimum requirement for own funds and eligible liabilities (TLAC/MREL) and reinforcement of the consistency of capital and eligible liabilities (TLAC/MREL).

Legacy instruments

In 2020, the EBA issued an opinion to clarify the prudential treatment of legacy instruments after the ending of the CRR1 grandfathering rules in December 20213. Starting from 2021, CAs, in close cooperation with the EBA, worked to identify potential infection risk and discussed the way forward on the basis of the EBA Opinion.

In July 2022, an analysis of how the opinion was implemented4 was published. It showed that many instruments were already resolved through either calling, redeeming or repurchasing, or by amending their terms and conditions. In a few cases, the infection risk was addressed through the transposition of Article 48(7) of the Bank Recovery and Resolution Directive (BRRD), while for a limited number of instruments, actions are still ongoing or under consideration. Finally, a few instruments have been kept in a lower category of own funds, as eligible liabilities or in the balance sheet as non-regulatory capital.

Going forward, the EBA expects institutions and CAs to consistently apply the guidance and principles of the EBA’s opinion for the new generation of legacy instruments stemming from CRR2. In the course of 2023, the EBA together with CAs will scrutinise the remaining legacy instruments.

Closing of pre-CRR CET1 review

In 2017, the Board of Supervisors mandated the review of pre-CRR CET1 instruments. The exercise concluded in 2022 after the EBA, in cooperation with the CAs, assessed almost 70 types of instruments and 240 single issuances. All in all, this exercise resulted in strengthening the collective knowledge of the different instruments in each EU jurisdiction with significant impacts on the quality and loss-absorbing capacity of the CET1 instruments via improved consistency between the CRR/RTS provisions. Finally, this exercise reinforced the EBA’s monitoring role as per Article 80 of the CRR.

The analysis of the pre-CRR instruments built on the CET1 list as published in May 2017, and it has been regularly updated. In December 2022, an updated CET1 list was published. Since the previous list of December 2021, the new version includes instruments issued by institutions from Iceland, Liechtenstein and Norway and a new type of instrument issued by Spanish investment firms. Furthermore, a few instruments no longer used by institutions were deleted and minor amendments were applied to reflect legislative changes or to provide further clarifications.

Monitoring of TLAC/MREL and reinforcement of the consistency of capital and eligible liabilities (TLAC/MREL)

In 2022, the EBA published an updated TLAC/MREL monitoring report5. Overall, the recommendations of the first TLAC-MREL monitoring report were well implemented. However, the EBA identified some new provisions to be recommended and some others to be avoided. In light of the new observations on certain features of the issuances, new parts were included in this report, namely on make-whole clauses (to be disallowed), clean-up calls (to be allowed) and substitution and variation clauses (for which prior approval is needed in certain circumstances).

Furthermore, to ensure consistency, where appropriate, across instruments with similar loss-absorption features, the report contributed to the alignment of the own funds and the eligible liabilities instruments frameworks, in particular on:

- tax gross-up clauses, which can be accepted if they are activated by a decision of the local tax authority of the issuer, and if they relate to interest and not to principal under both frameworks;

- the exercise of substitution and variation clauses in both own funds and eligible liabilities instruments should as a minimum be subject to receiving prior consent from the relevant authority and where these clauses would lead to material changes that would affect the eligibility criteria of the instruments, to the prior approval of the relevant authority;

- the incentives to redeem have been established consistently across the two regimes even though their presence triggers different consequences.

In general, the vast majority of eligibility criteria are fully aligned for own funds and eligible liabilities and only isolated deviations exist. In this context the EBA plans to publish a report that merges the contents of the recent Additional Tier 1 (AT1) monitoring report6 published in June 2021 and the above-mentioned EBA report on the recent monitoring of TLAC-/MREL-eligible liabilities instruments.

Monitoring the high-quality and consistent application of the IFRS 9 expected credit loss frameworks

The EBA continued to work on monitoring and scrutinising the implementation of International Financial Reporting Standards (IFRS) 9, as well as its interaction with prudential requirements following the publication of the EBA report on the IFRS 9 implementation by EU institutions7 published in November 2021.

In line with the staggered approach presented in the IFRS 9 roadmap8 the benchmarking exercise on IFRS 9 gradually extended. In 2022, the EBA worked on the integration of the high default portfolios (HDPs) into the benchmarking exercise to assess relevant drivers of variability and related impacts on the prudential ratios arising from the implementation of the IFRS 9 expected credit losses model.

In June 2022, a third data-collection activity was launched to test new quantitative templates on HDPs. The data analysis is still in progress and will be completed in the first half of 2023. The preliminary findings and data quality checks issues have been considered in the development of the HDPs portfolios IFRS 9 templates of the ITS on supervisory benchmarking 20249, leveraging to the extent possible credit risk benchmarking infrastructure and methodology.

The new ITS seeks to: (i) widen the scope of the IFRS 9 benchmarking analysis to a higher share of financial instruments subject to the IFRS 9 impairment requirements; and (ii) get a broader view of the existing variability of the expected credit loss outcomes and the related impacts on the amount of own funds and regulatory ratios.

Full extension to HDPs is expected to be achieved in the ITS on supervisory benchmarking 2025.

-

Finalising the development of an all-inclusive large exposures regime in the EU